In this conversation, we talk with Michael Sena of uPort, 3Box Labs, and The Ceramic Network about web3.0, decentralized identity, and the various standards that he has been implicit in creating. Additionally, we explore the nuances around data ownership and identity, the journey from founding uPort to now 3Box and the Ceramic network and how the practical implementation of these ideas has changed as the decentralized web has changed from Web2.0 to Web3.0, and conclude on how the metaverse will be composed of decentralized identity and the protocols on which it travels.

Read MoreThis week, we discuss the current state of the NFT markets, and our top 5 trends for NFTs beyond the initial hype:

Incumbent media NFTs and enterprise IP networks

Programmatic and generative art, and the blockchain medium

Digital Museums, DAOs, and the growth of the Metaverse

What it means to own the NFT: IPFS and multi chain support

Integration into DeFi and traditional portfolio management

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

Read MoreThis week, we look at:

TikTok has become a platform with billions of views for investing and stock recommendations to teens. This emotional and persuasive labor can be traced from Jim Cramer to Roaring Kitty.

78% of Millennials (vs. 31% of Boomers) plan to use more digital tools in wealth management and 81% of them think that technology has made investing more efficient (vs. 61% Boomers)

This generational change has implications for investing technology, digital wallets, and the role of people in the financial advice process

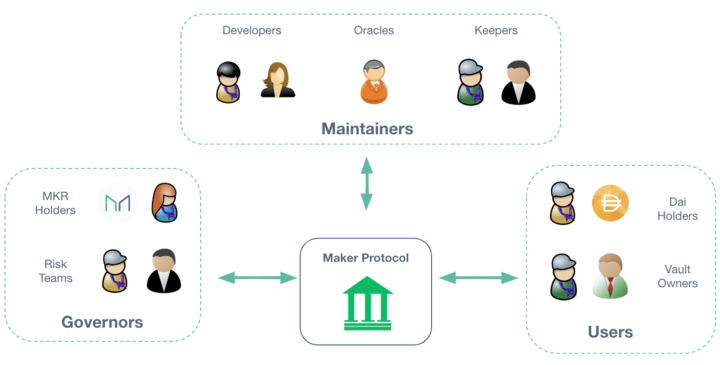

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

Read MoreThis week, we look at:

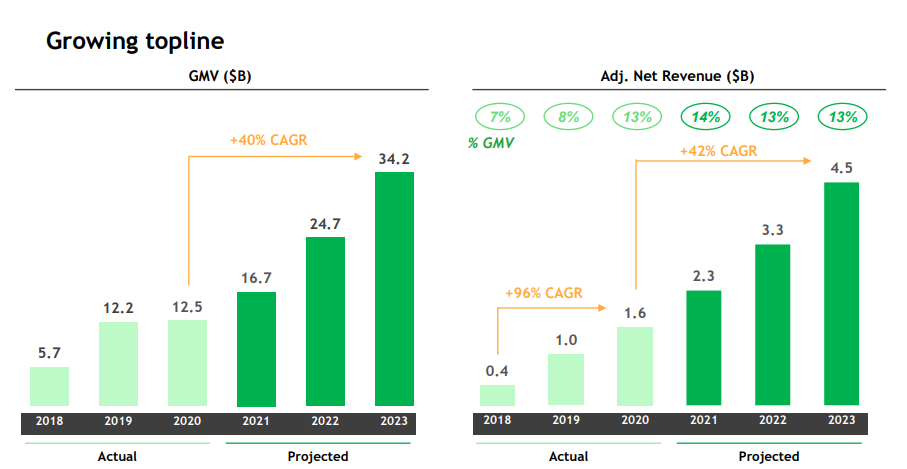

The economics of Southeast Asia’s largest super-app and its $40 billion SPAC valuation

The industrial logic of building out financial features adjacent to the core business of transportation and delivery

Why this model has not worked for Uber, but has worked for Apple, and the broader impact on financial services.

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

Read MoreCrypto isn’t magic. It’s math. Two trillion dollars worth of math.

We are still, often, asked incorrect questions about the crypto currency markets. Questions like — “but what is the fundamental value?”

You have to unpack the word “fundamental”. That word signals a Warren Buffet view of the world: there are companies out there, they have equity shares well specified by corporate law in a particular jurisdiction, some are expensive while some are cheap, and that bargain shopping can be determined by a spreadsheet analysis of their cashflows relative to others. It’s so fundamental!

The story of such fundamental truth is anchored in our cultural and social history. We can point to the intellectual tradition of rationalism and classical economics, and talk about the theory of the firm, and its production function. We can point to how these things grew out of governance by religion, and natural rights as granted by a deity, and all sorts of other non-empirical hand waving.

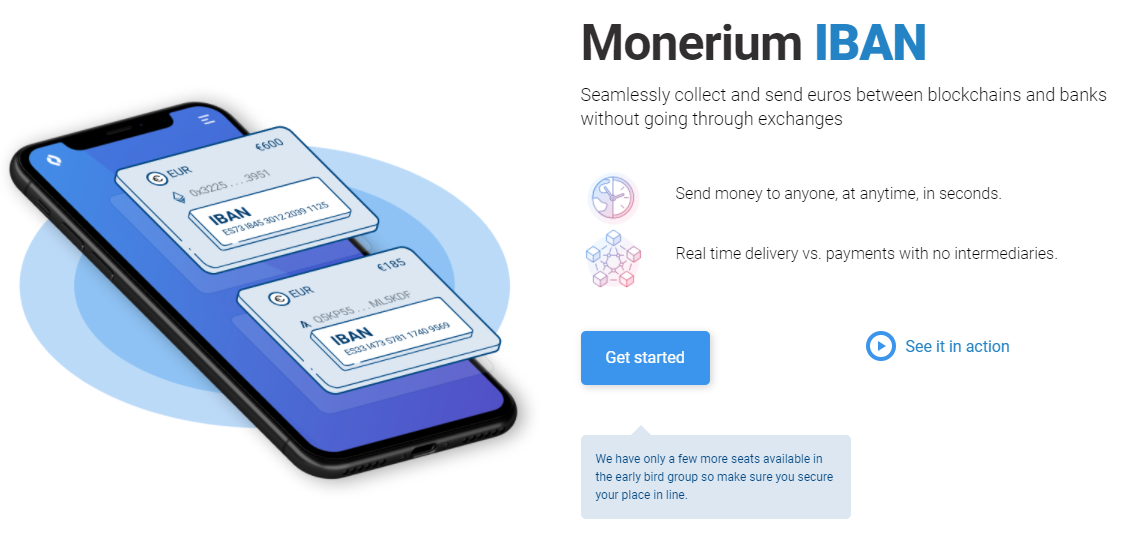

Read MoreIn this conversation, we talk with Jon Helgi Egilsson about his incredible journey to becoming Chairman and a co-founder of Monerium.

Jon is a former chairman and vice-chairman of the supervisory board of the Icelandic Central Bank, a former adjunct professor in financial engineering and MBA lecturer at Reykjavik University, a visiting scholar at Columbia University, and co-founder of four software companies. Additionally, we explore the various concepts of digital money in the framework creating a competitive yet unified environment between fiat money, banking based on fractional-reserve, and the token economy.

Read MoreThis week, we look at:

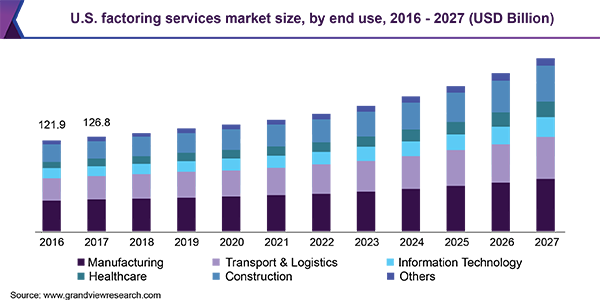

Pipe’s $150 million raise at a $2 billion valuation to turn annualized revenue run-rate into a new peer-to-peer asset class

BitClout’s $200 million of Bitcoin contributions and its mechanisms to turn social media profiles into digital assets

How both projects trade future performance for current monetization

This week, we look at:

The fundraises of Jumio ($150MM), Feedzai ($200MM), and Chainalysis ($100MM) and the function they perform in the fintech industry

The nature of human competition and hierarchies, and why inequality is recreated across the various economic networks that exist

How the NFT markets have higher engagement than DeFi, which is more participatory than Fintech, which is more participatory than finance

The emergence of signalling in the crypto economy that resembles digital citizenship and social capital

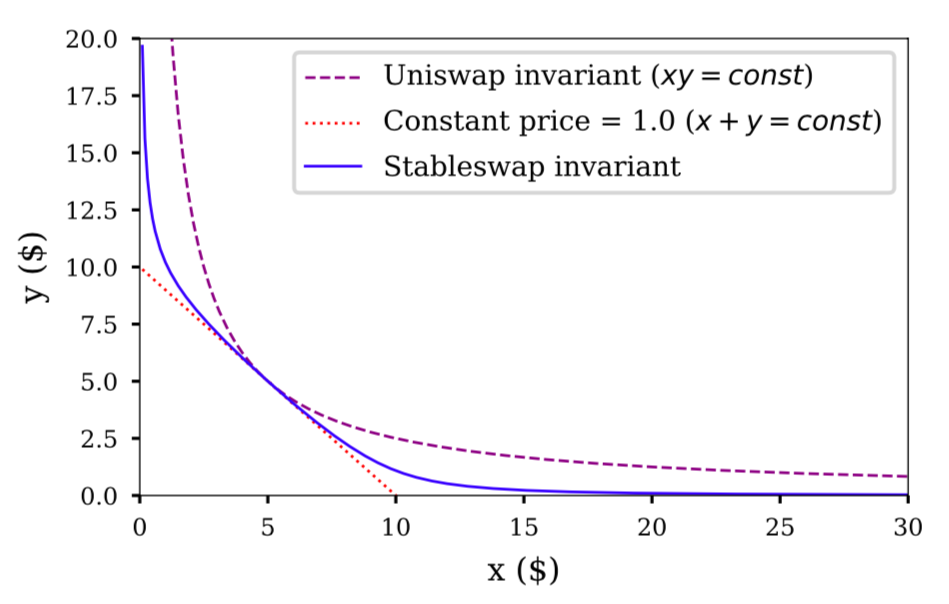

The most popular AMM, Uniswap, is annualizing to $1 billion in fees. That’s a chunky amount of value for its users.

The team has just released the third version of its protocol, and it is an innovation in the structure of the AMM logic. Instead of providing liquidity across the entire price curve, users are now able to specify pricing ranges for which they are participating in the curve. This protects market makers from the extreme price fluctuations which they may prefer not to fund. Because most trading also happens in narrower price bands, it is possible that capital is much more actively used in those bands, and generates higher fee returns comparatively.

Read MoreThis week, we look at:

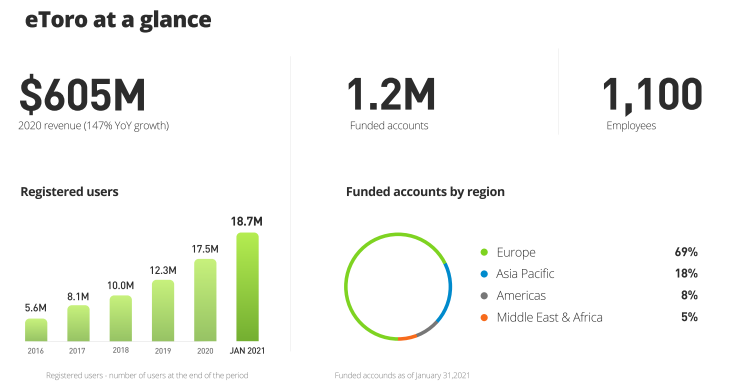

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

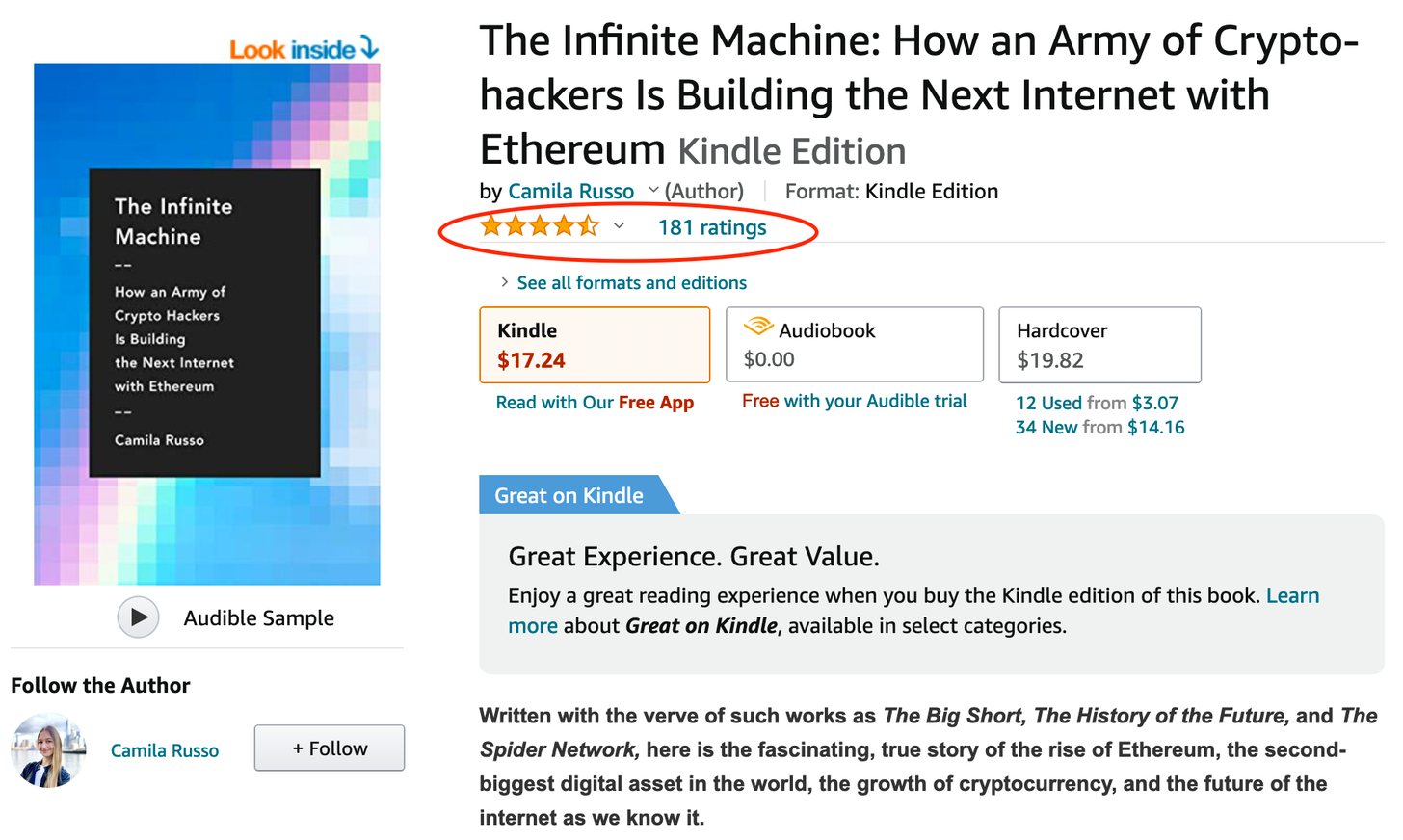

In this conversation, we talk with Camila Russo of The Defiant and author of The Infinite Machine, about her journey as a successful financial journalist was derailed by the Crypto boom and subsequent winter of 2017. Additionally, we explore the success behind her first book, the nuances of the NFT craze, and how The Defiant became one of the most popular crypto media brands to date.

Read MoreThis week, we look at:

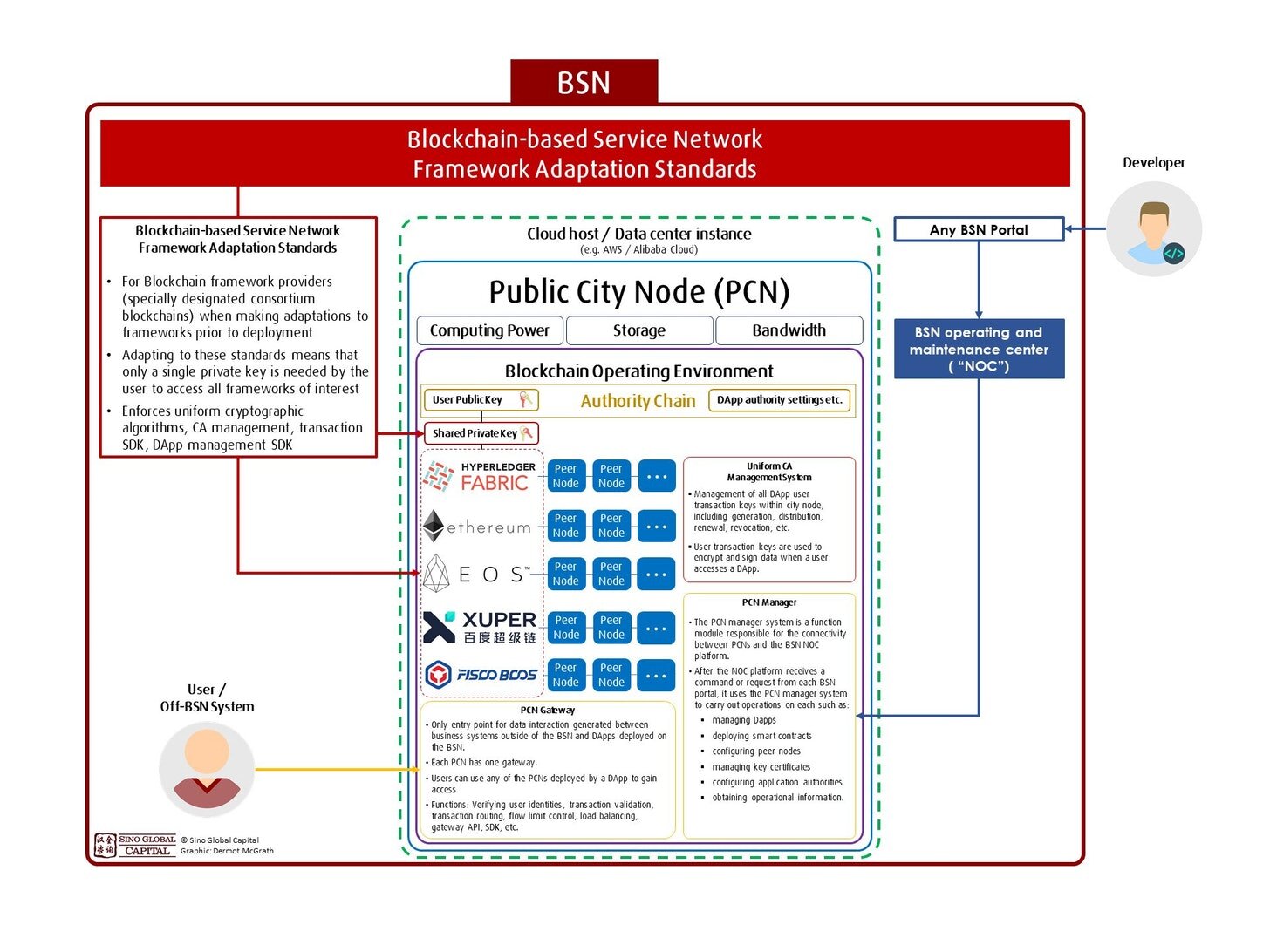

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

Footnote: Stripe worth $95 billion, closing $600 million investment

In this exciting conversation, we talk with none other than Joe Lubin of ConsenSys and Ethereum, about his journey from being exposed to advances in artificial intelligence at Princeton to becoming the household name in programmable blockchain. Additionally, we get an insider look into his founding of Ethereum and ConsenSys, and how the technology and individuals behind these two companies are transforming the very fabric of financial institutions that exist today and how new products/services are started for the betterment of humanity.

Read MoreThis week, we look at:

Square acquiring Tidal and its 1-2 million of subscribers for $297 million, and the logic for what a payment processors has in common with the creative industry

How celebrities and creators like Mark Cuban, Gary Vaynerchuk, Grimes, 3LAU and others are generating millions in NFT sales

The impact on the economic model of the music industry, including a look at royalty structures, revenue pools, and financial vehicles when tokenized

The philosophical divide growing between a feudal platformed commons (e.g., YouTube) and a collectivist anarchist capitalism

In this conversation, we talk with Tyler Mulvihill of Treum and EulerBeats, about how he became involved in the very first non-financial production grade blockchain use case, tracking & tracing tuna from Fiji to New York using Treum. Additionally, we explore the nuances of NFTs and how EulerBeats is using bonding curve economics to price the future of NFT use rather than mere collection.

Read MoreLet’s do some math homework. It’s good for you:

The Federal Reserve money movement system broke for several hours. We look deeply into its volumes and transactions, and value it like a Fintech unicorn.

The Ethereum ecosystem is throwing around as much volume in settlement as the Fed check processing system. We explore scalability barriers and solutions.

Can eCommerce fit into our emerging infrastructure? We anchor to the market numbers in China and the United States.

Things break.

Sometimes the things that break are the US Federal Reserve ACH service, Check 21, FedCash, Fedwire, and the national settlement service. They were down for a few hours — discovered at 11AM on Feb 24th and still in trouble at 3PM that day. Everything is now up and running again.

Read MoreIn this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.

Read More