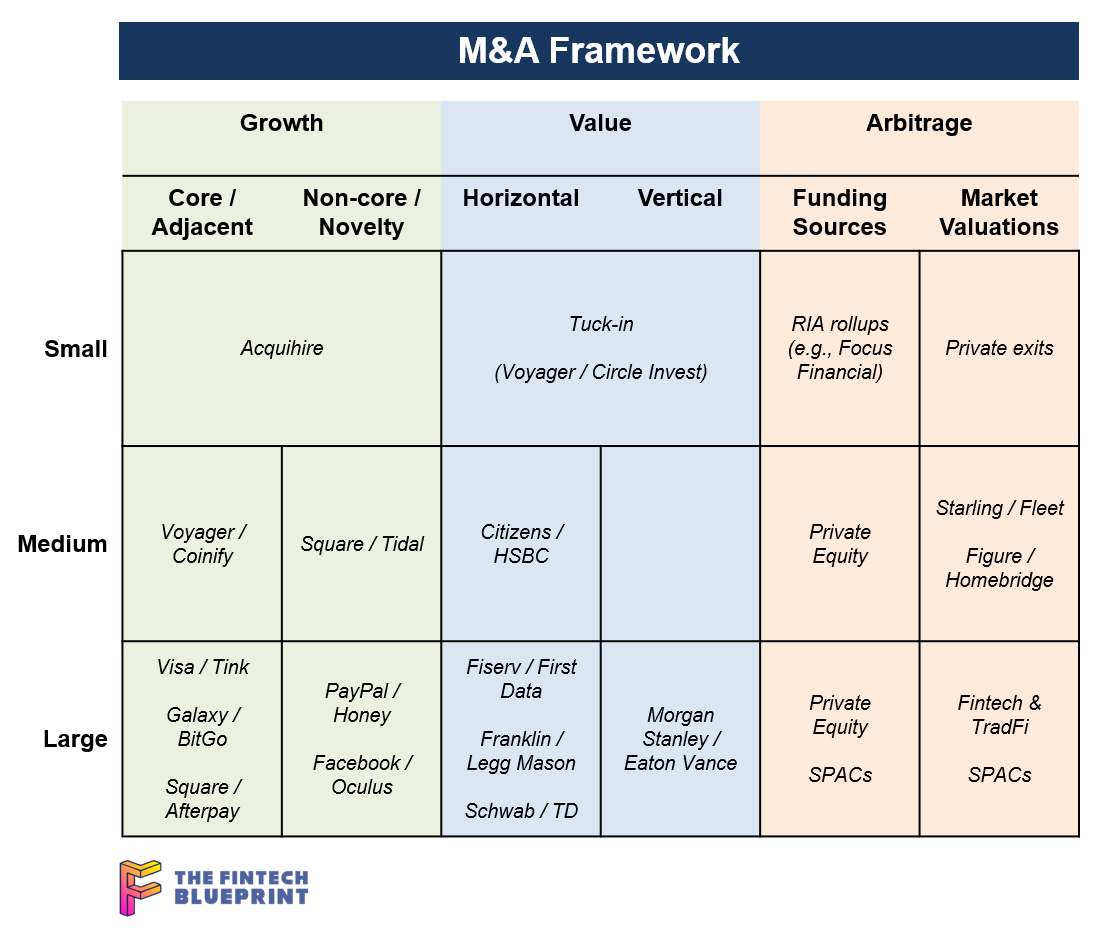

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

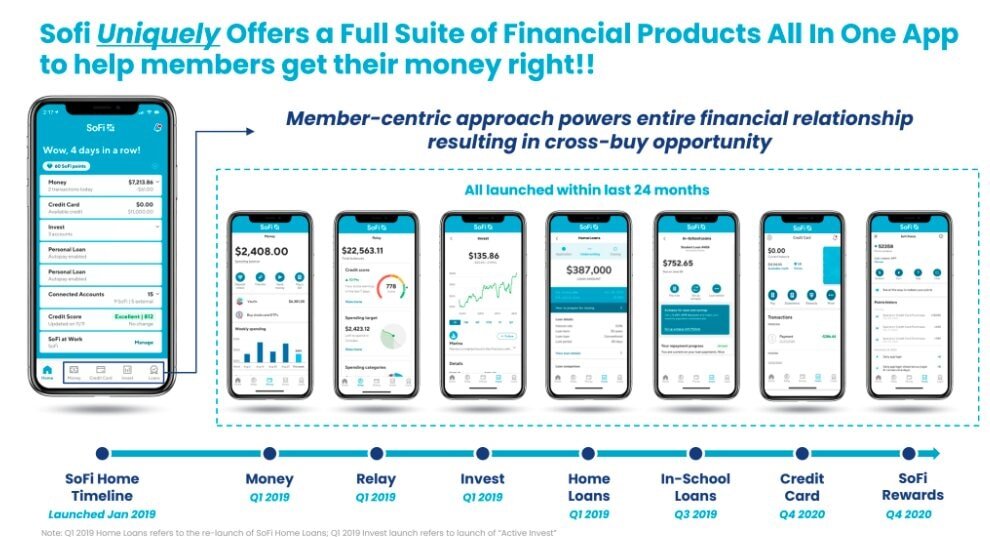

Read MoreIn this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

Read MoreThis week, we look at:

An overdue analysis of the SPAC structure, reflecting on the $75 billion size and stage of the market

Economics and regulatory paths of going public via investment bankers, SPACs, and direct listings

The marquee teams in Fintech looking to do deals, and what criteria for target selection look like

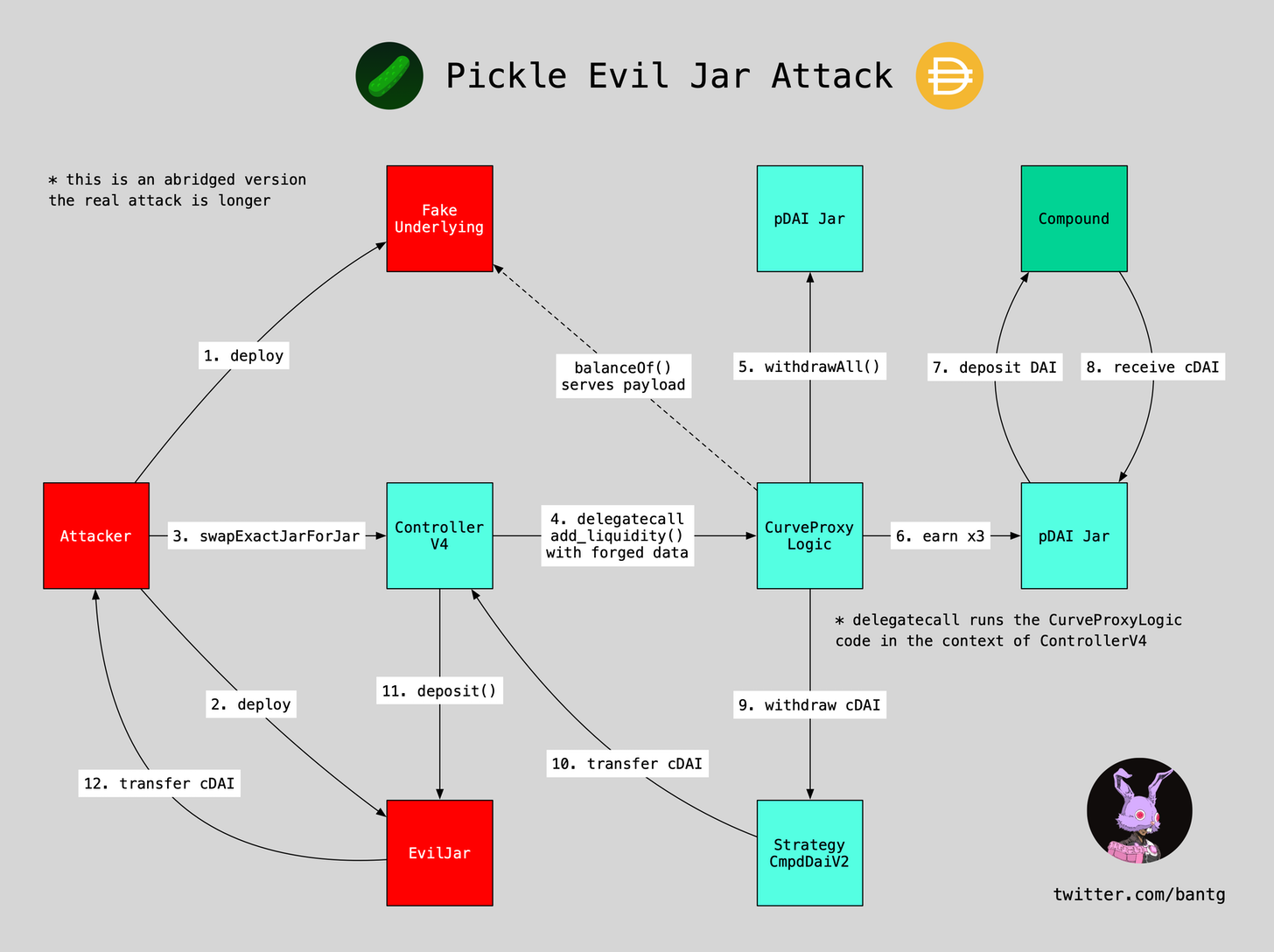

This week, we look at:

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

Robo 1.0 success Personal Capital was acquired for nearly $1 billion by Empower, a major retirement savings manager. Softbank-backed insurtech darling Lemonade IPOed at less than $2 billion, in a successful fundraise and listing, and has since seen its market cap rise to over $4 billion. The IPO is a landmark for an insurtech industry in desperate need of successes. And PayPal announces the impending launch of crypto trading to its 325 million users. The move isn’t overly interesting in its own right, but the implications for the crypto space are worth exploring.

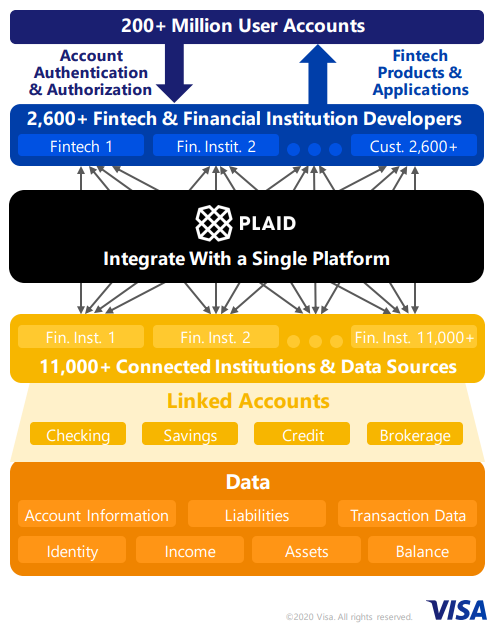

Read MoreWhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

Read MoreThis week, we put on the Goldman hat and go shopping for companies. We buy a little bit of Folio and sell some Motif. We look at Personal Capital and the $1 billion it wants for its $12 billion of assets. We examine the private markets with Addepar / iCapital and SharesPost / Forge, and then move over to the banking sector. Should we buy Wells Fargo, as rumored, or some digital wallet apps? Read on for how to acquire a best-in-class Fintech.

Read MoreI dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

Read MoreTwo things are on my mind: (1) the acquisition of United Capital by Goldman Sachs, and (2) Mike Cagney's Figure securing a $1 billion funding line from Jefferies and WSFS for blockchain-tracked home equity loans. Both are outcomes of complex, interesting, somewhat unexpected processes -- and both are examples of demand-driven market expansion. Let me highlight that again. Both of these are consumer-centric developments, and not product-driven developments, which goes to the core of the problem in the financial services industry.

Read More