In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta's $300MM of revenue & Ethereum's $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.

Read MoreWe look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

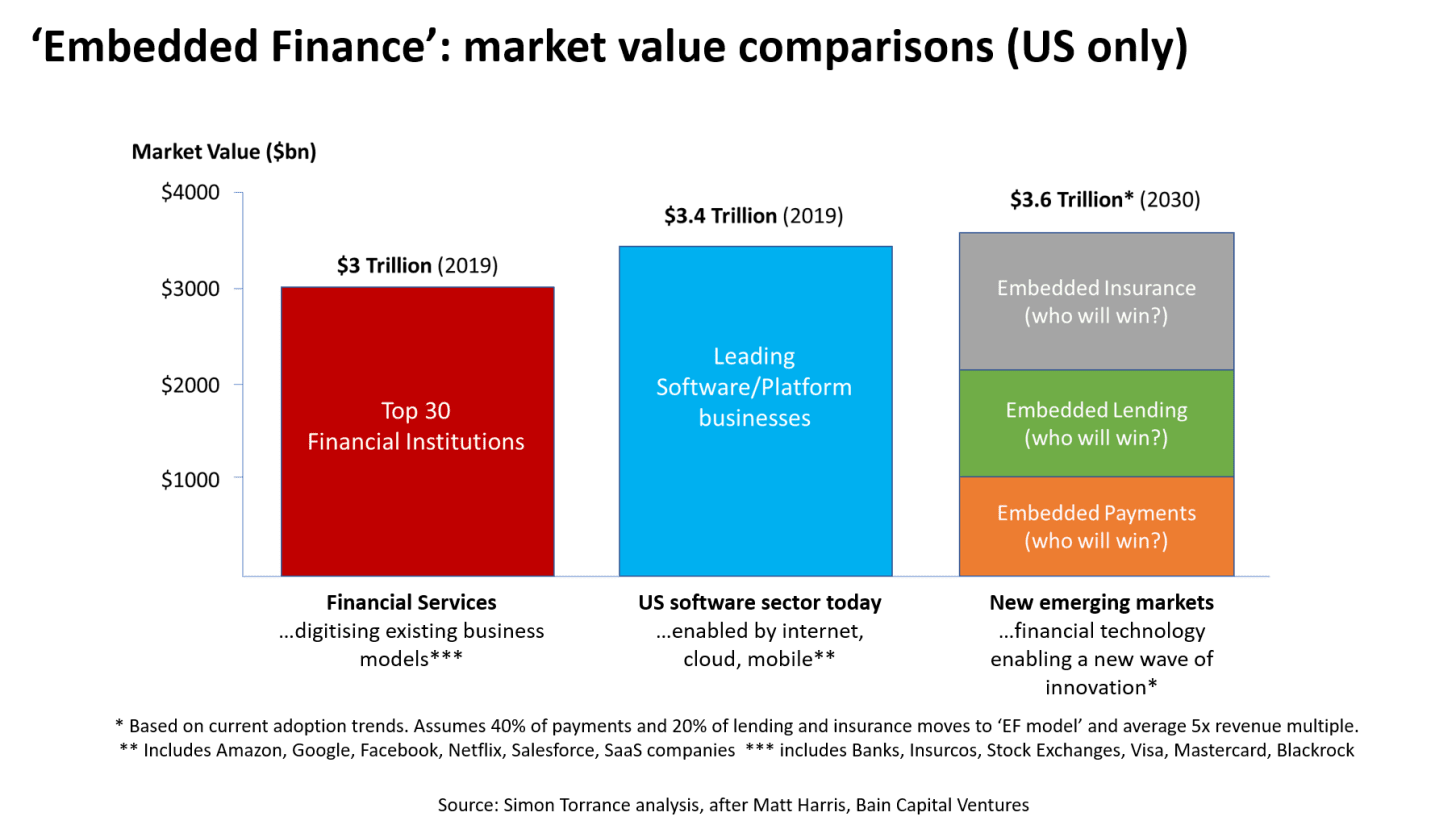

Read MoreIn this conversation, we talk all things embedded finance, platform banking, and APIs with Simon Torrance – one of the world’s leading thinkers on business model transformation, specializing in platform strategy, breakthrough innovation and digital ventures.

There’s an enormous gap between the financial needs of humanity and what the financial sector is able to deliver there. This gap is being filled by tech-savvy solutions and embedded finance plays which are putting into question the role of a bank in this new ecosystem.

Read MoreThis week, we look at:

Over $1 billion in raises announced last week, and over $10 billion in Fintech company value creation: Checkout.com with $450 million at a $15 billion valuation, Affirm more than doubling after its IPO to $30 billion, lending enabler Blend raising $300 million, and payments enabler Rapyd raising $300 million.

A systems theory framework that explains the stocks and flows of goods and services, and what monetization strategies are available to fintechs

How transactional models are thriving and creating 50-100x revenue multiples

This week, we look at:

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

This week, we look at:

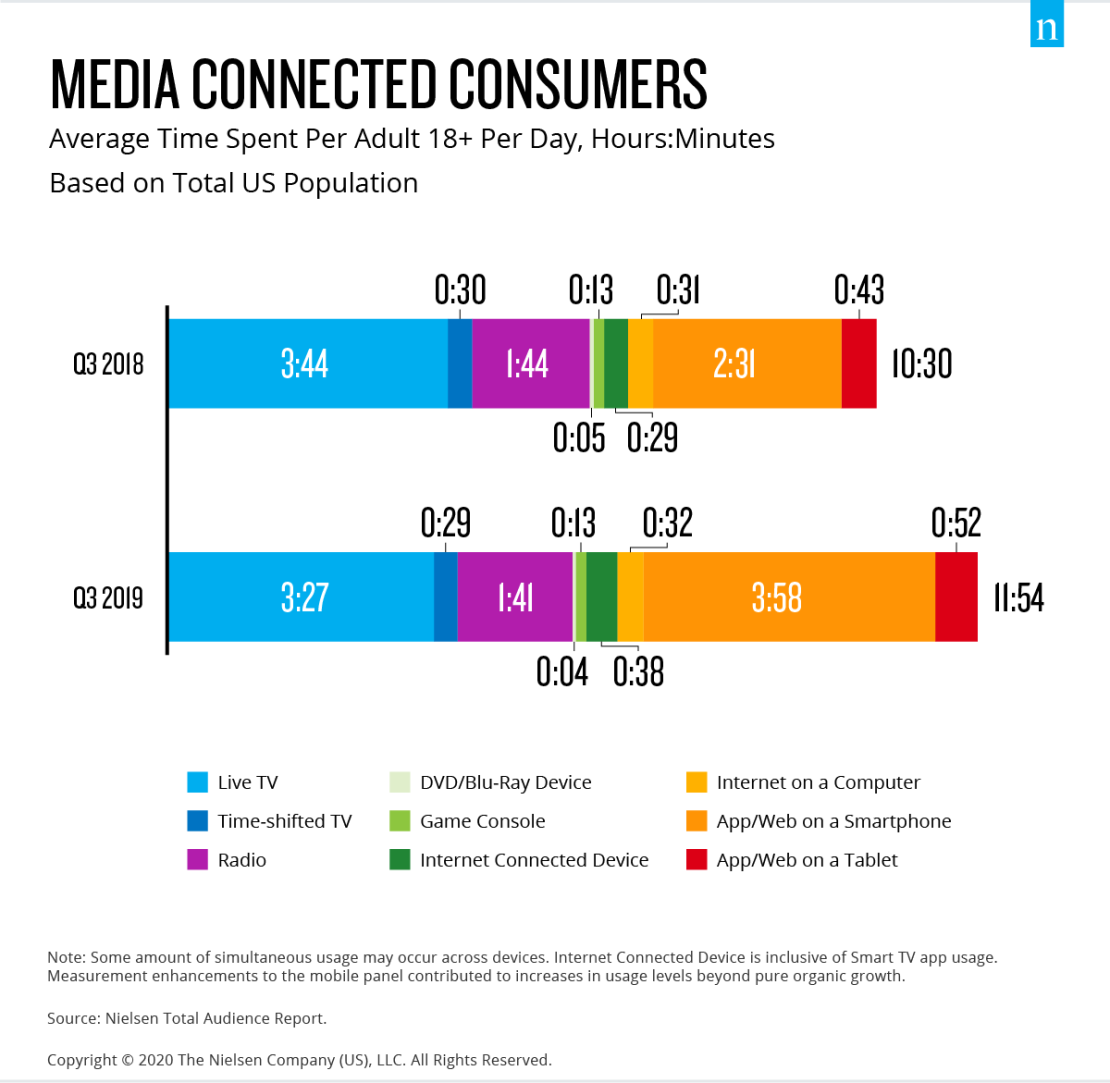

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

There is no finance, there is only WeChat / Tencent?

I don't know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

Read MoreFinance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

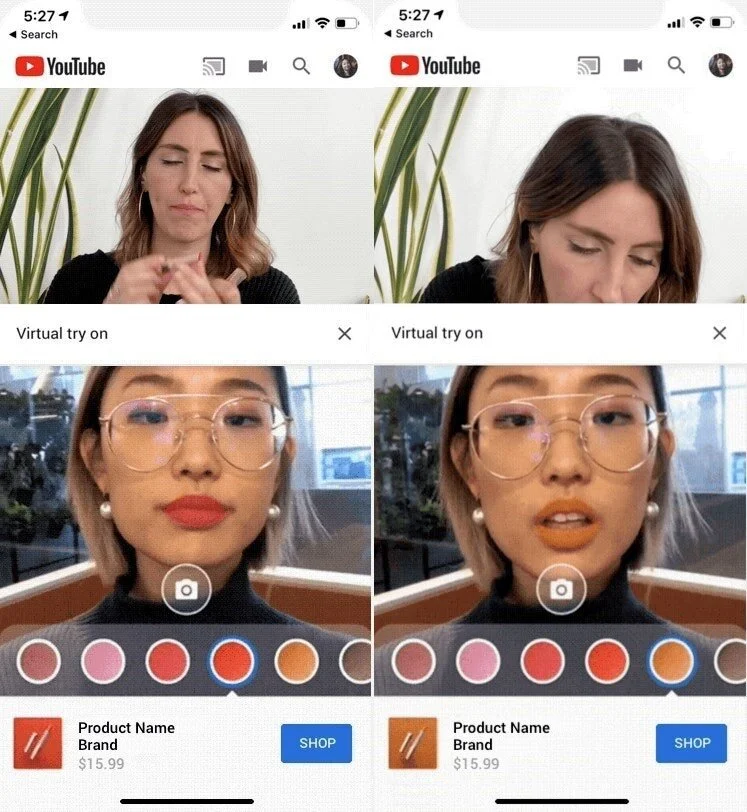

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

Read More