In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

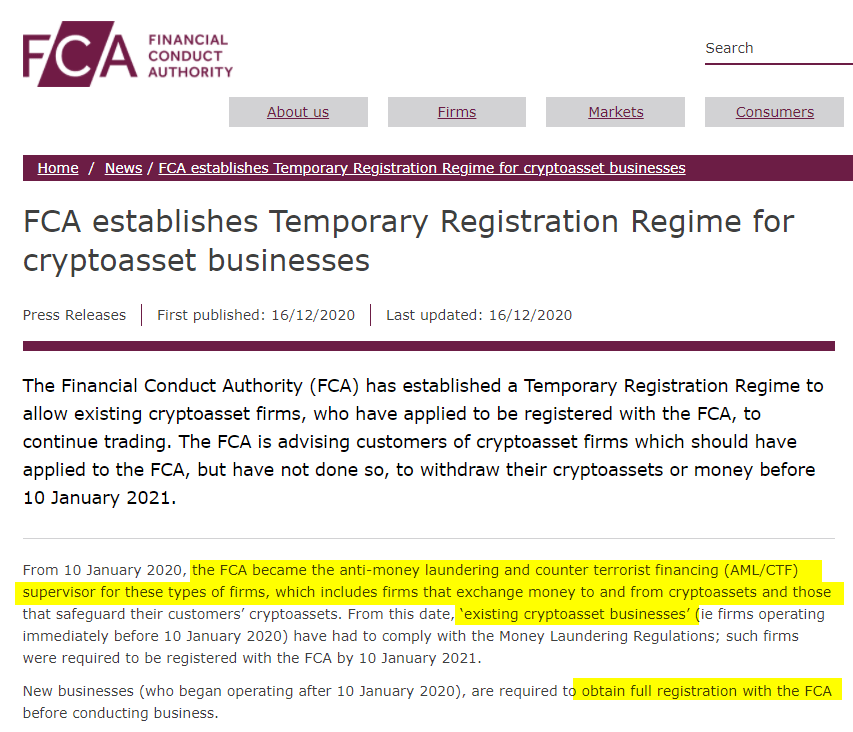

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

Read More