We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

Read MoreWe look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

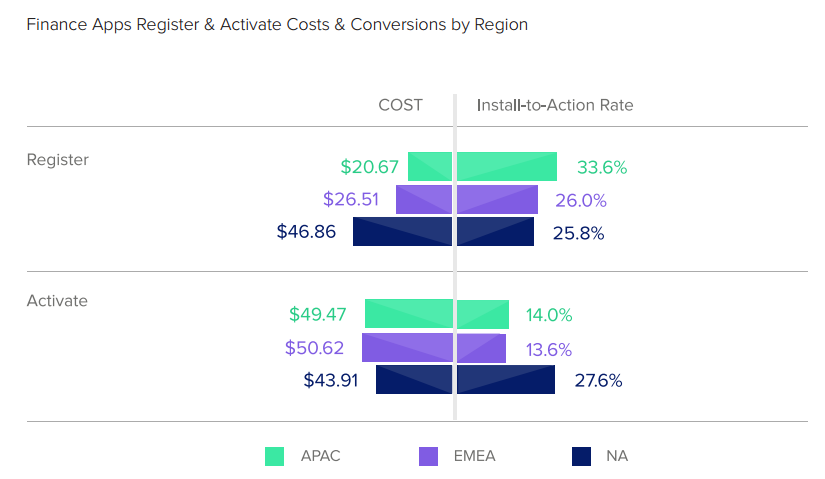

Read MoreThis week, we look at:

The $12 billion in cumulative SPAC capital focused on Fintech, of which $3.6 billion has been raised in 2021 Q1 alone

Analysis of the private and public financial services markets and their valuations of profitability and revenue

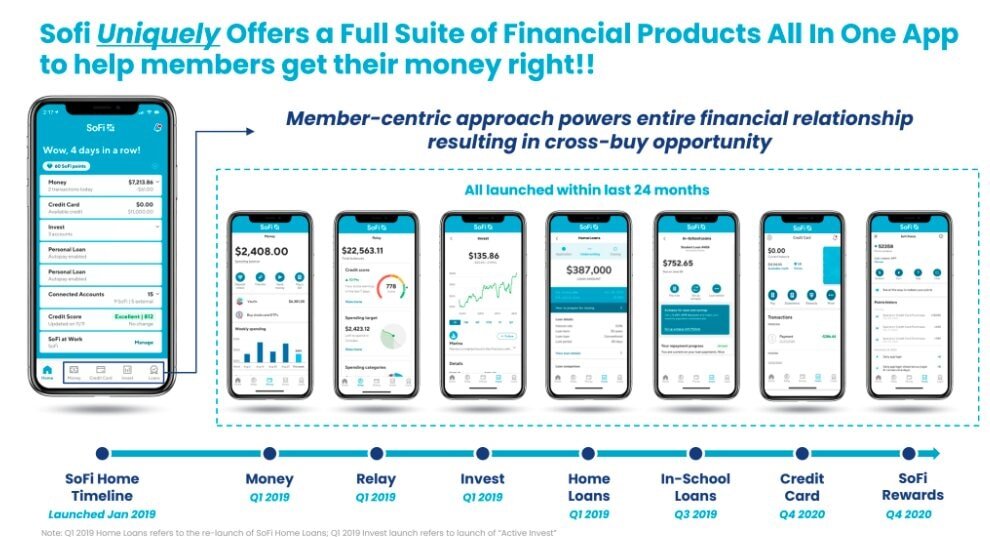

A deeper look at the fundamentals and business mix of SPAC targets MoneyLion, Payoneer, Apex Clearing, and SoFi

Not everything that glitters is gold

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

Read MoreIn this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

Read MoreThis week, we look at:

An overdue analysis of the SPAC structure, reflecting on the $75 billion size and stage of the market

Economics and regulatory paths of going public via investment bankers, SPACs, and direct listings

The marquee teams in Fintech looking to do deals, and what criteria for target selection look like

This week, we look at:

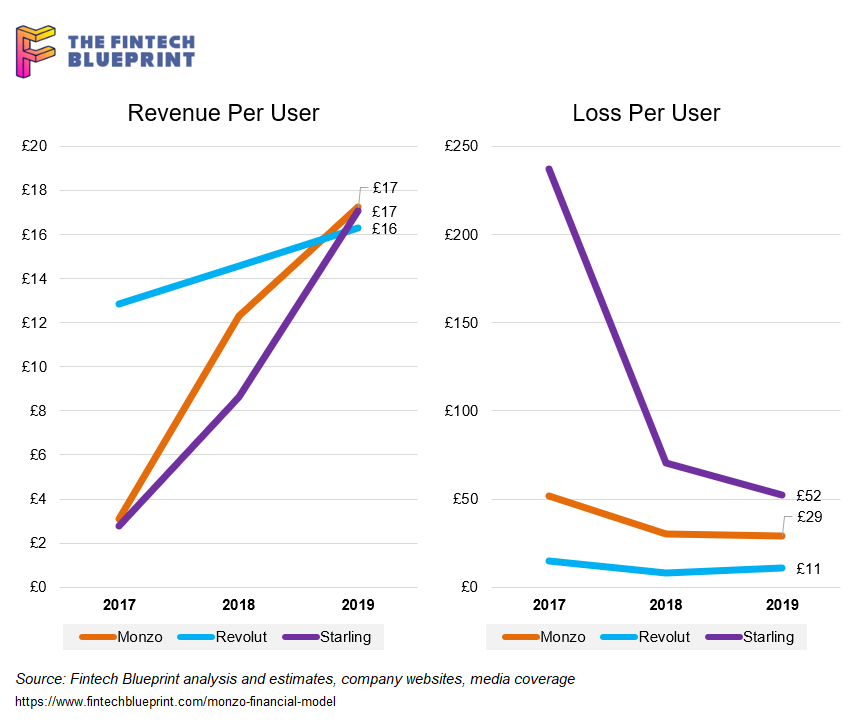

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

Read MoreMike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

Read MoreThis week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let's not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

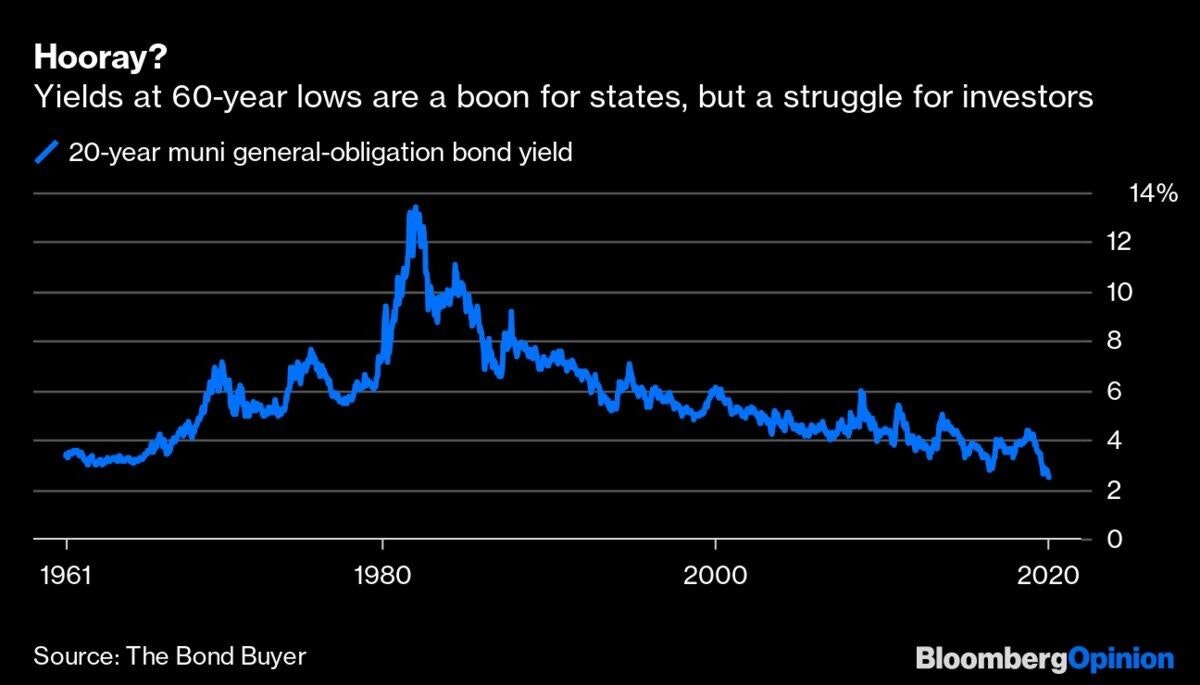

Read MoreI reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

Read MoreWell this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

Read MoreIn news of cross-selling financial products across categories, roboadvisor Wealthfront has gathered a nifty $1 billion of deposit assets for its 2.29% interest-yielding non-bank cash account. Given that the firm has a little over $10 billion in managed investment assets, charges somewhere between 0 and 25 bps on those assets, and took years of wiggly pivoting to get to the current stage, it is fair to consider this influx a big win in terms of client traction. It is also $22 million of annual interest payments. A couple of things come to mind that are worth pulling apart.

Read More