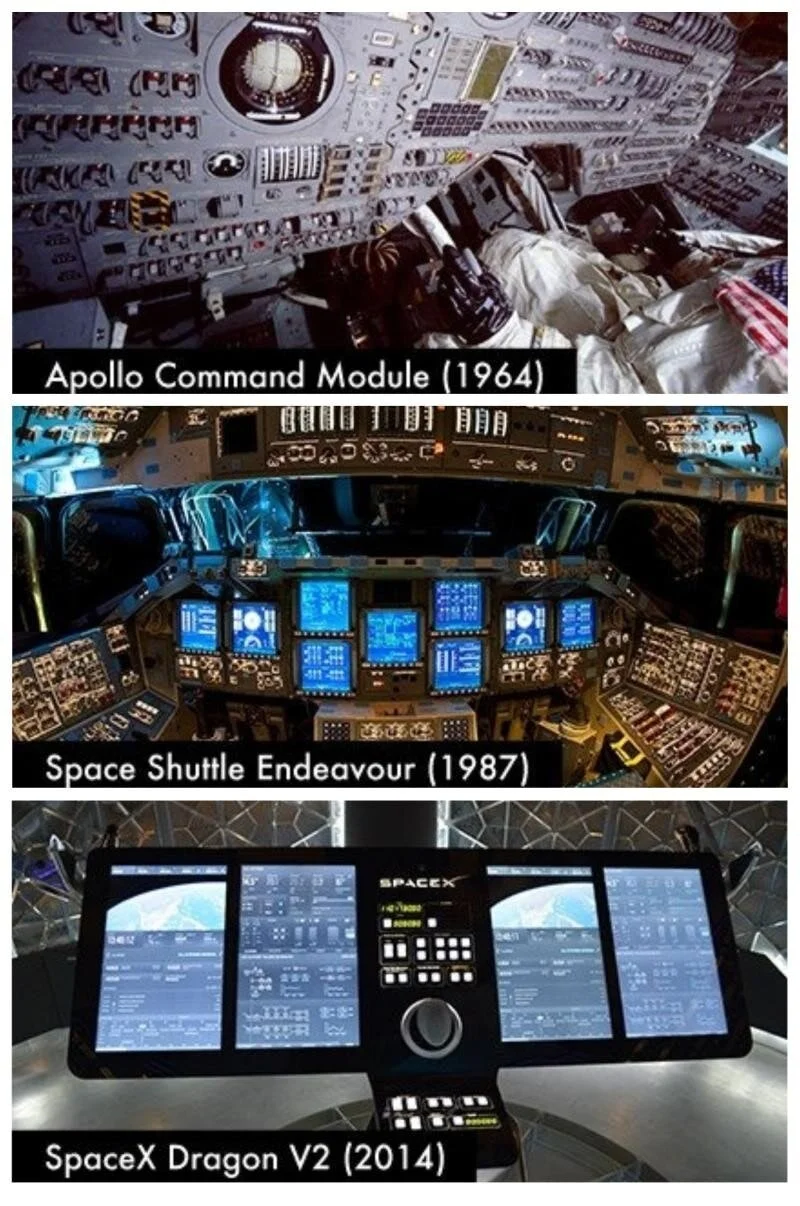

This week I discuss SpaceX, and its Dragon rocket carrying American astronauts to the International Space Station for the first time in 9 years. The 20 year old company is a testament to the incredible iron will and absolute insanity of the most visionary capitalist alive -- Elon Musk. We walk through various attributes of the company and recent launch to derive lessons for the financial industry and the entrepreneurs rebuilding it.

Read MoreI examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

Read MoreWell this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

Read MoreAssurance came on my radar courtesy of Financial Technology Partners, which was the investment banker on Assurance's $3.5 billion sale to Prudential. Notably, the company is just 3 years old -- which comes out to a cool billion of enterprise value per year, likely a record comparable to the very few Ant Financials. Depending on the details, this is about $25 million of value per employee. So what does the company do? Simple, really. It is a destination website licensed to sell all types of insurance product (e.g., life, health, auto), with a clean onboarding questionnaire like any other roboadvisor, which then matches against policies on offer from third parties. AI and data science are used as the recommendation engine. It is a Kayak or Money Supermarket of insurance, simply designed, cleverly wired, with killer founders.

Read More