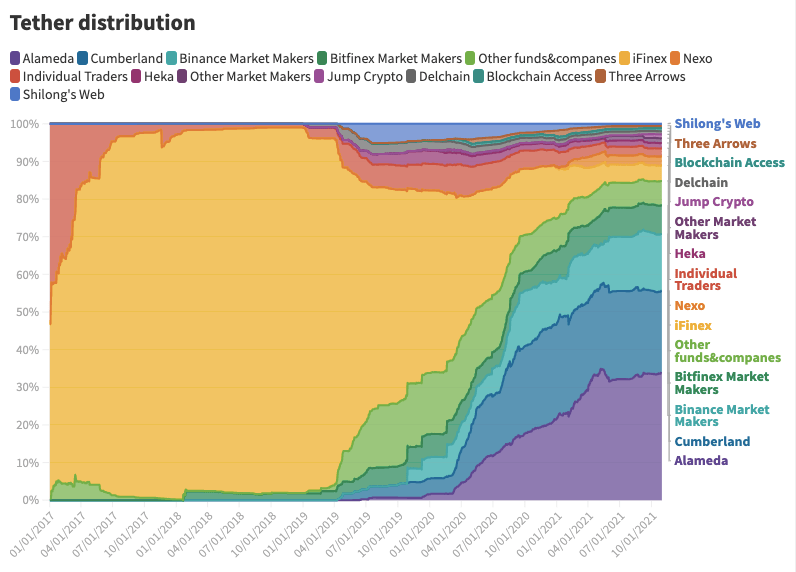

We look at a recent report from Protos that traces the issuance of USDT to the institutional players in the centralized crypto capital markets. The data reveals the market share of players like Alameda, Cumberland, Jump, and others in powering trading in exchanges. We try to contextualize this market structure with what exists both in (1) investment banking and (2) decentralized finance. The analogies are helpful to de-sensationalize the information and calculate some rough economics.

Read MoreThis week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

Read MoreIn this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

Read MoreLast quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

Read MoreDespite its best efforts to the contrary, Robinhood did end up stealing from the rich and giving to the poor.

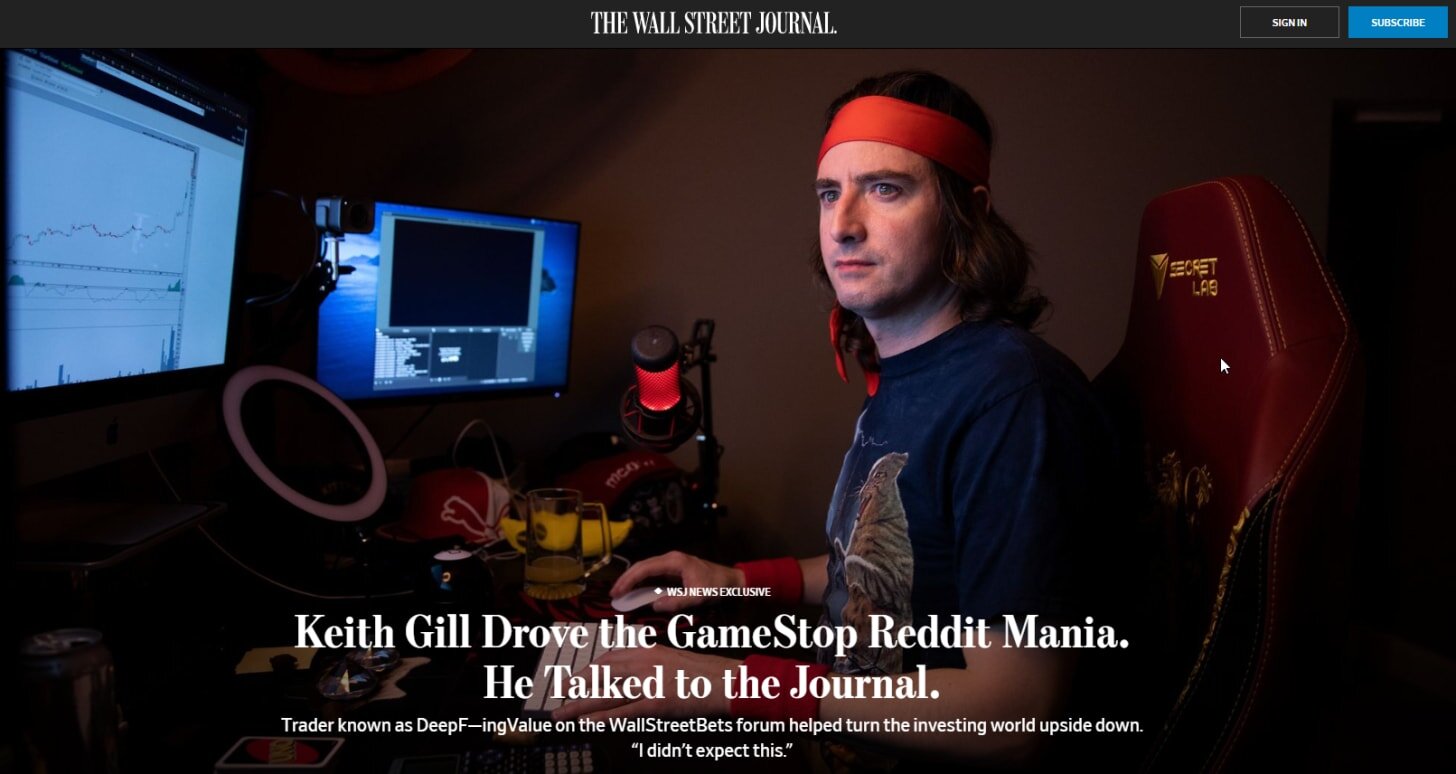

Melvin Capital, the $8 billion hedge fund that didn’t find GameStop funny, lost 53% of its portfolio in January ($7 billion) trying to short against the rallying cries of the Reddit Capitalist Union. Gabe Plotkin also faces the embarrassment of having to get bailed out by your old boss.

Speaking of, New York Mets owner and former name-on-the-door of SAC Capital, known most recently for its insider trading fine of $1.8 billion, Steven A. Cohen, put $2.8 billion of capital into Melvin’s fund.

Ken Griffin, owner of the Citadel hedge fund (an investor in Melvin), and Citadel Securities (a massive market maker and buyer-of-order-flow for Robinhood), is seeing capital losses in the former and Washington cries for scrutiny into market structure in regards to the latter.

Robinhood itself — which for goodness sake is *not Wall Street*, but as *Silicon Valley* as it possibly gets — raised $1 billion immediately to protect itself from class action lawsuits, DTCC capital calls, and a now-rapidly-closing IPO window. That means Yuri Milner of DST Global chipping in yet again.

That’s at least 4 people that have had a very bad, no good day.

Read MoreIn this conversation, we talk with Paul Rowady, who is the Director of Research for Alphacution Research Conservatory. Paul has a deep background in capital markets, derivatives, and the macro structure of the industry. He has been uncovering the transformation of that structure with data driven analyses, making visible the economics of market makers like Citadel and retail order flow aggregators like Robinhood. This is a rich discussion of what trading stocks is really like. And make sure to check out Alphacution.

Read MoreLooking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

Read More