In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Read MoreIn this discussion, we explore ways that Stripe — arguably the best American fintech company full-stop, although who would want to mess with Square — could be entering the crypto space. We consider approaches similar to the payment onramps, then discuss the underlying market structure powering those experiences, and highlight more generally the role of gateways relative to protocols. We touch on the role of custodians, banks, and wallets, as well as Square’s attempt, the tbDEX, where KYC/AML comes down to forms of opt-in identity. Finally, we address questions about Circle and USDC, and how stablecoins differ from the rails on which they travel.

Read MoreIn this conversation, we chat with Adam Hughes – the Chief Executive Officer at Amount, a technology company focused on accelerating the world’s transition to digital financial services via its digital retail banking platform, world-class digital authentication & fraud prevention tools, and ecommerce point-of-sale financing technology.

More specifically, we touch on digital lending industry Buy Now Pay Later (BNPL), as well as the trends of working with large banks and enabling their digital transformation to access some of these themes as part of embedded finance and banking-as-a-service.

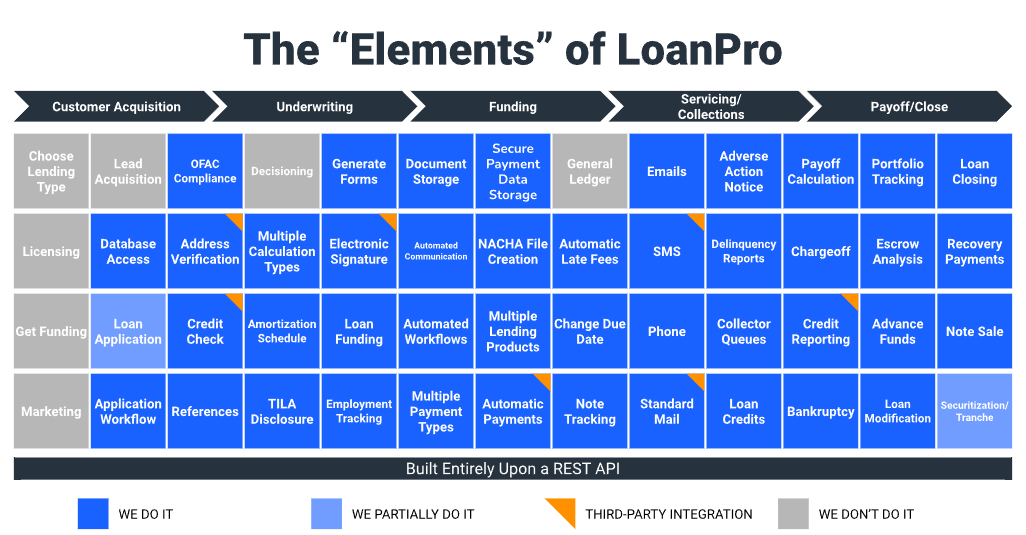

Read MoreIn this conversation, we chat with Rhett Roberts, the Co-Founder and CEO of LoanPro – a new breed of software company that is API-driven, cloud-native and easily scalable. Rhett and his co-founders created the company out of necessity when they ran an auto lending business as they could not find anything flexible enough to suit their own needs.

More specifically, we touch on all things around the lending industry, the auto lending industry and how everything there works, and of course, why LoanPro is such an awesome company, and so much more!

Read MoreIn this conversation, we chat with Kevin Levitt who currently leads global business development for the financial services industry at NVIDIA. He focuses on global trends in accelerated compute and AI for consumer finance – including fintech, retail banking, credit card and insurance. Prior to joining NVIDIA, Kevin served as Vice President of Business Development at Credit Karma, and Vice President of Sales for Roostify.

More specifically, we touch on the role data plays in the financial industry, how the needs of financial institutions have changed, the age of big data, the definitions between artificial intelligence and machine learning, how to train an AI algorithm, the reasoning behind the incredible amount of parameters machine learning solutions consume, the fundamental purpose of AI/ML in financial services, what NVIDIA’s platforms comprise of, and lastly the future of AI/ML.

Read MoreIn this video conversation we feature a roundtable by The Defiant exploring how and if the gap between Fintech and DeFi will be bridged.

DeFi Panelists

Lex Sokolin, head economist at ConsenSys

Santiago Roel Santos, angel investor

Spencer Noon, Investor at Variant

Vance Spencer, co founder at Framework Ventures

Fintech Panelists

Keith Grose, head of Plaid international

Nik Milanović, founder of This Week in Fintech

Simon Taylor, co-founder of 11:FS

Bruno Werneck, Business & Corporate Development at Plaid

Moderator

Camila Russo, Founder of The Defiant

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

Read MoreIn this conversation, we delve deep into next generation finance and banking with CJ MacDonald, the Founder and CEO of Step – an incredibly successful neobank on a mission to improve the financial future of the next generation.

More specifically, we discuss traditional vs. digital banking, how personal experiences influence entrepreneurial the spirit, immersive market research, banking-as-a-service, the importance of financial literacy amongst Millenials and Gen-Z, the power of influencers who actually believe in a brand, aspirational brands vs. plastic Wells Fargo stage coaches, and lastly the proliferation of crypto in the minds of the next generation.

Read MoreIn this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

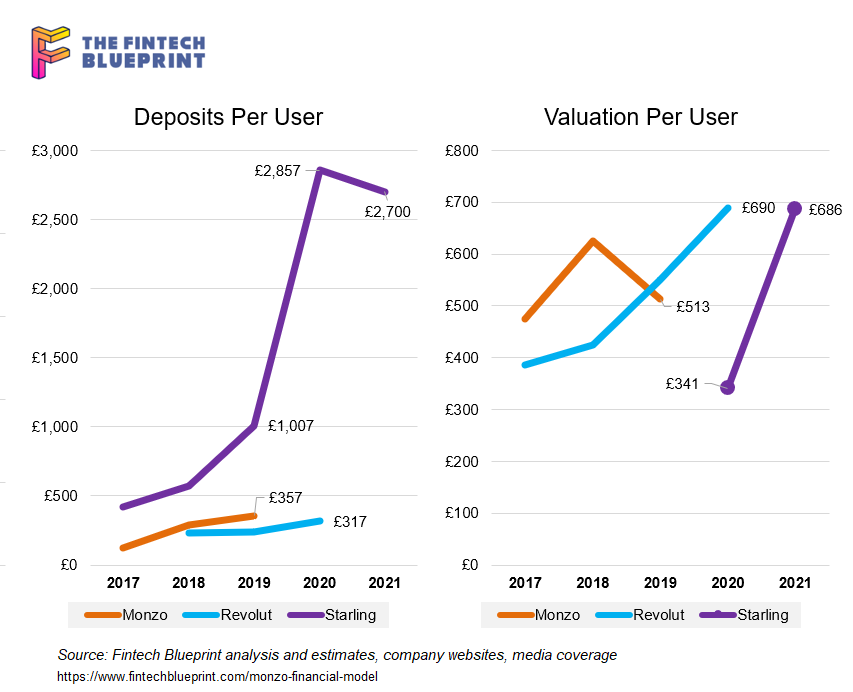

Read MoreThe fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

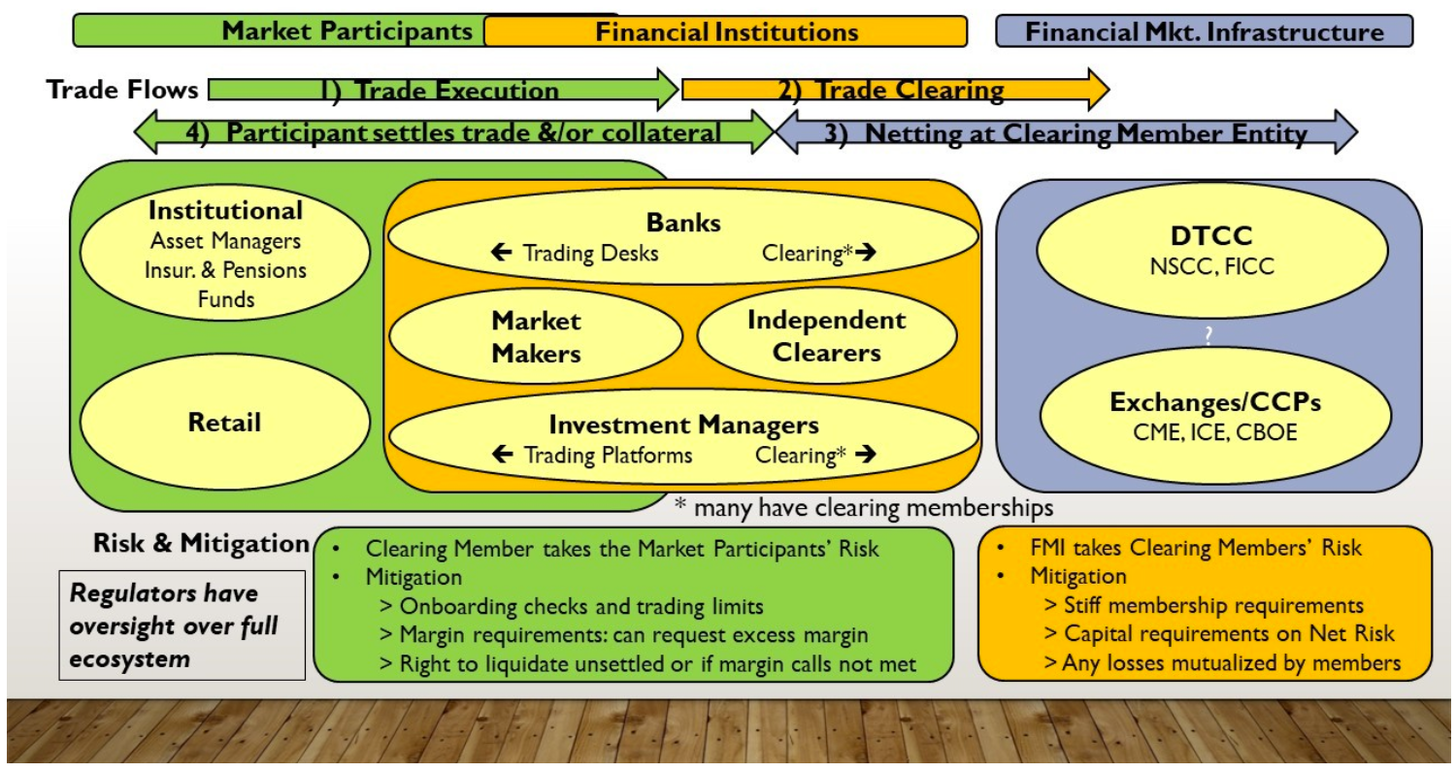

Read MoreIn this conversation, we geek out with Horacio Barakat, who serves as the Head of Digital Innovation for Capital Markets and the Head of DLT for the Repo Platform of Broadridge, about digital transformation, capital markets, and the role of blockchain in the institutional part of the financial industry.

Additionally, we explore the embedded complexities of capital markets and how fundamental they are to the smooth functioning of our economy, determining the growth of companies, and funding expansion. Touching on everything from the engine that powers capital markets, how that engine has evolved to becoming computational, and lastly how companies like Broadridge are leading the deep work going on in making that engine better.

Read MoreThis week, we look at:

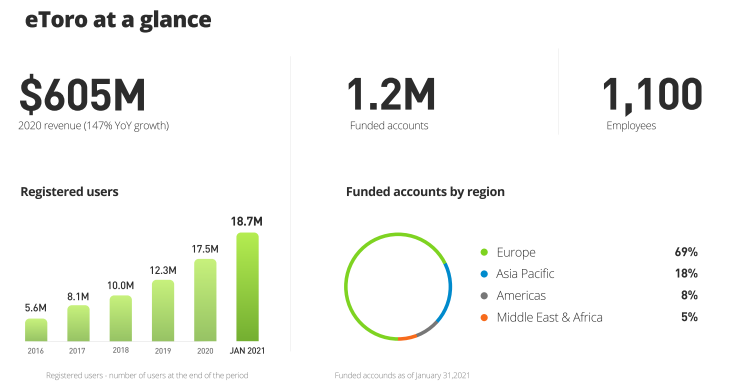

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

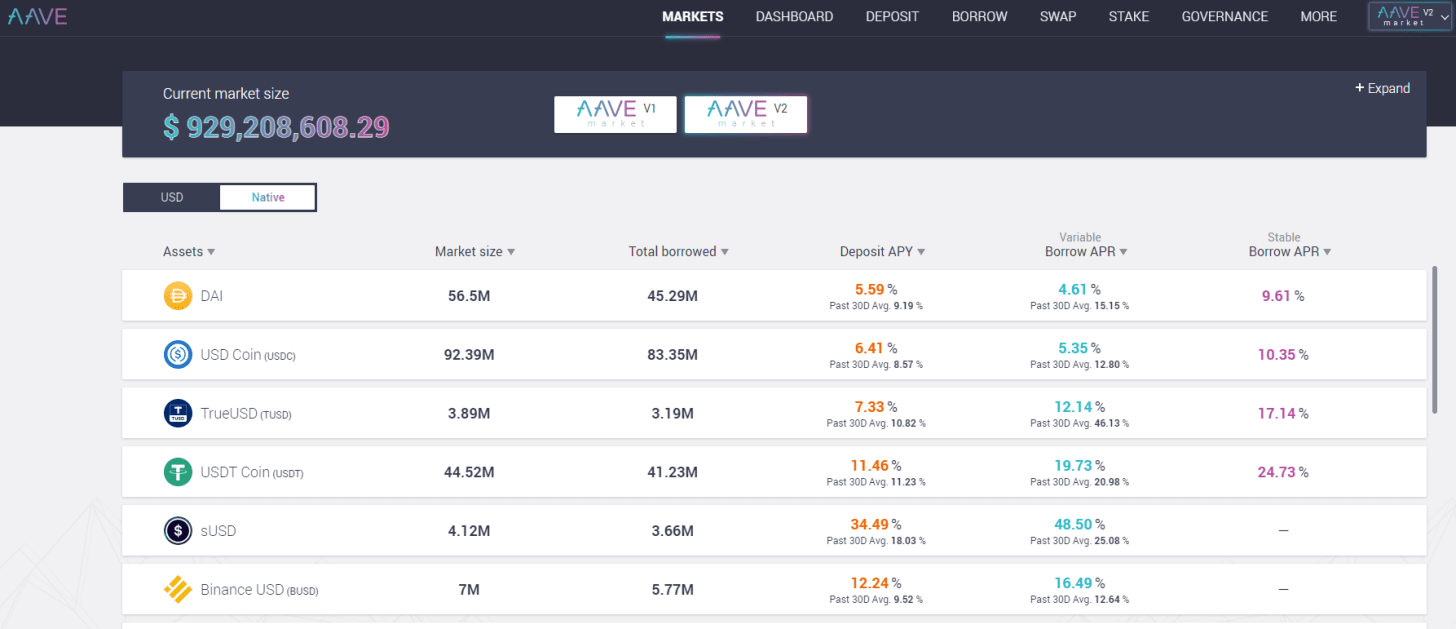

In this conversation, we talk Ajit Tripathi, currently the Head of Institutional Business at Aave and a former colleague of mine at ConsenSys, about the path from traditional finance, to enterprise blockchain and “DLT” consulting, to full-on decentralized finance.

Thinking about how to connect these worlds and different available journeys? Or the timeless risks developing in tranched DeFi that look like mortgage-backed securities? We even touch on hegelian dialectics! Check out our great conversation.

Read MoreThis week, we look at:

The nature of innovation hubs, and how close groups of actors within a particular environment can be massively, fundamentally productive. Take for example the 30 million years of the Cambrian explosion.

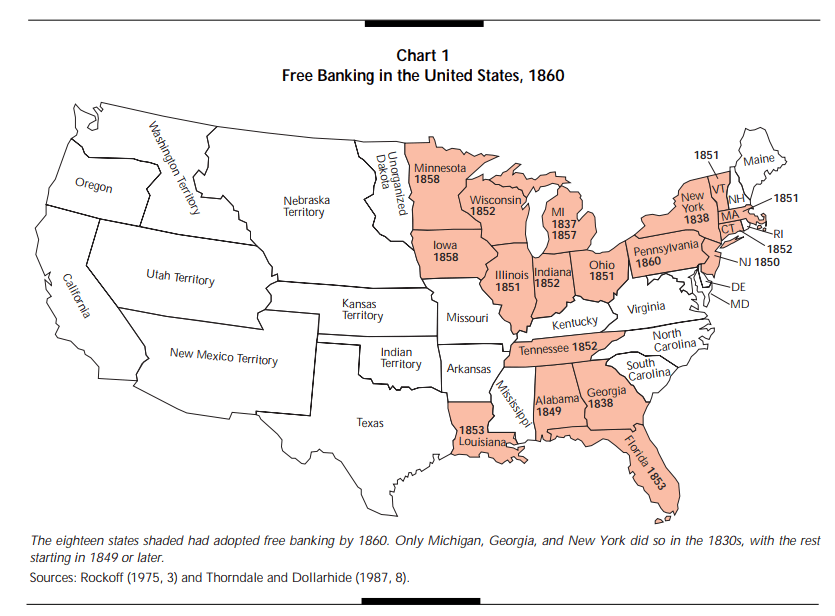

The difficulty of experimenting with banking and money frameworks, the limits of traditional econometrics, and an overview of “free banking” in the 1840s.

How evolutionary theory can help us think about selection of economic models, and the hyper-competition and hyper-mutation that we see in crypto. DeFi protocols, like BadgerDAO and ArcX among hundreds of others, are experiments in designing different monetary policies and banking regime experiments in real time.

We have never before had such acceleration in the design space of the economic machine, subject to evolutionary pressures, built by a closely-wound nexus of developers. It is a fortune for the curious.

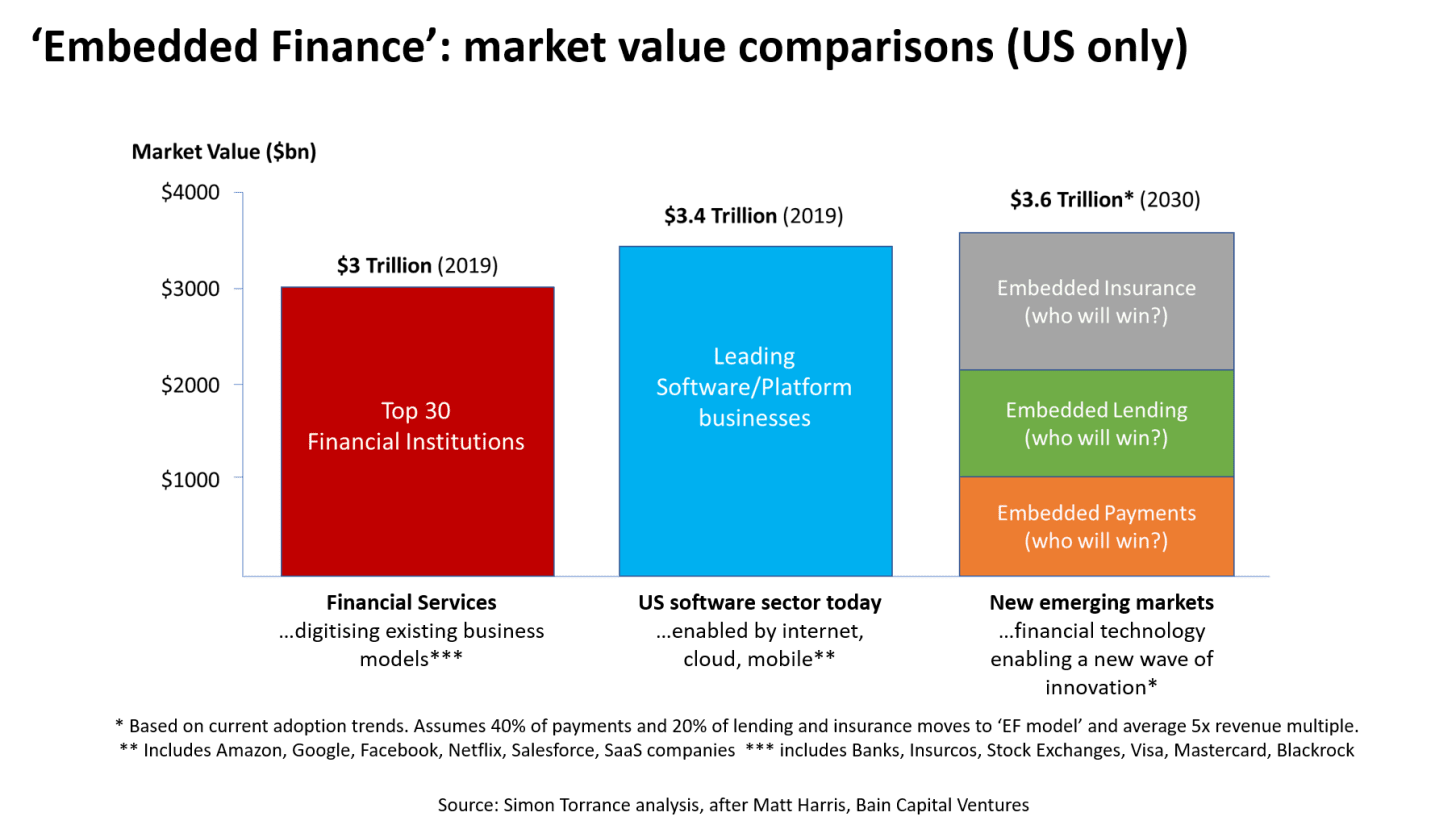

Read MoreIn this conversation, we talk all things embedded finance, platform banking, and APIs with Simon Torrance – one of the world’s leading thinkers on business model transformation, specializing in platform strategy, breakthrough innovation and digital ventures.

There’s an enormous gap between the financial needs of humanity and what the financial sector is able to deliver there. This gap is being filled by tech-savvy solutions and embedded finance plays which are putting into question the role of a bank in this new ecosystem.

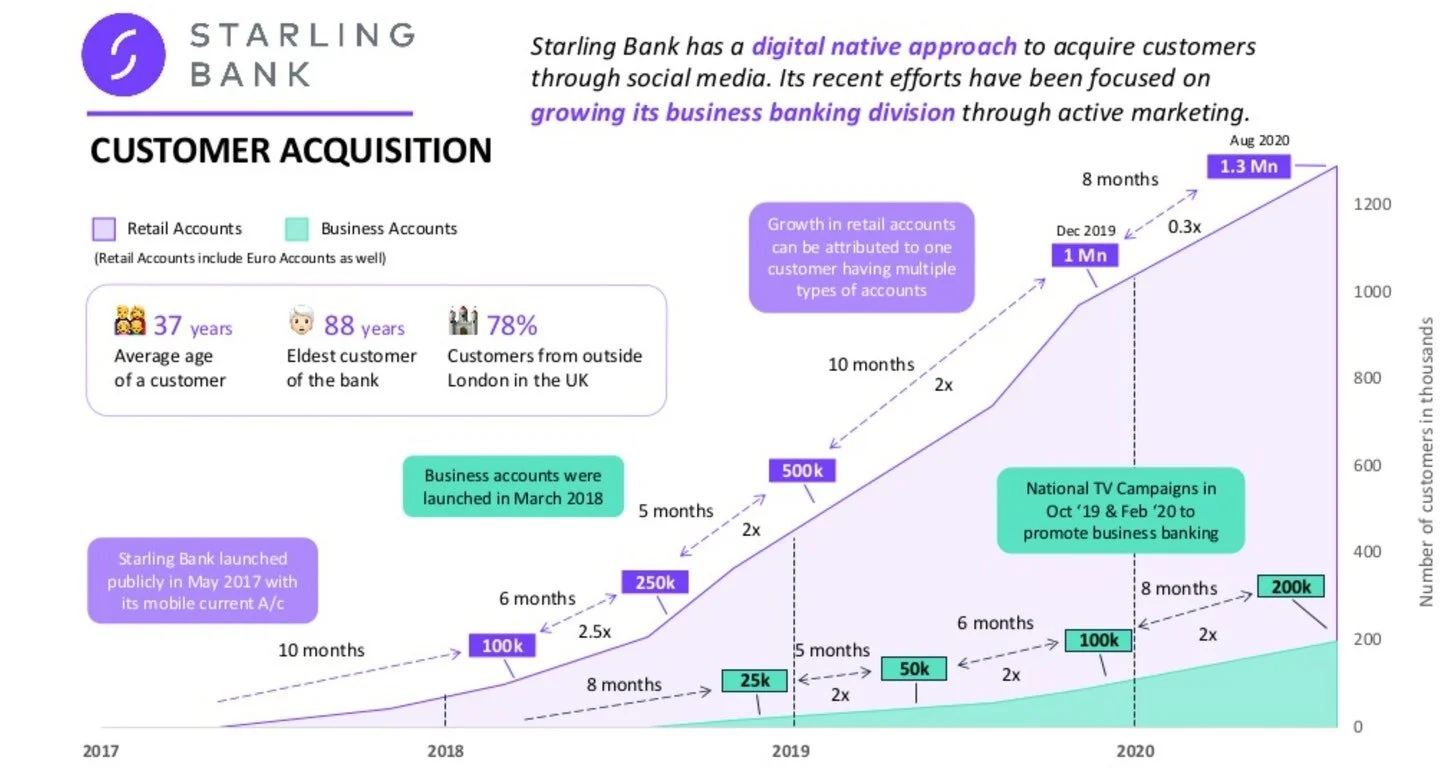

Read MoreIn this conversation, we talk with Anne Boden, the CEO of Starling Bank. Starling has just turned profitable, and reached several significant milestones in terms of 1.8 million clients, $4 billion in deposits, and $1.5 billion of lending.

That is quite meaningfully ahead of our model, and probably ahead of everyone’s model, of where neobanks would be in 2020. While COVID has accelerated the digital lifestyle, Anne credits deeper demographic, technology, and cultural insights and choices she has made in building Starling for success.

Read MoreGoogle has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

Read MoreThis week, we look at:

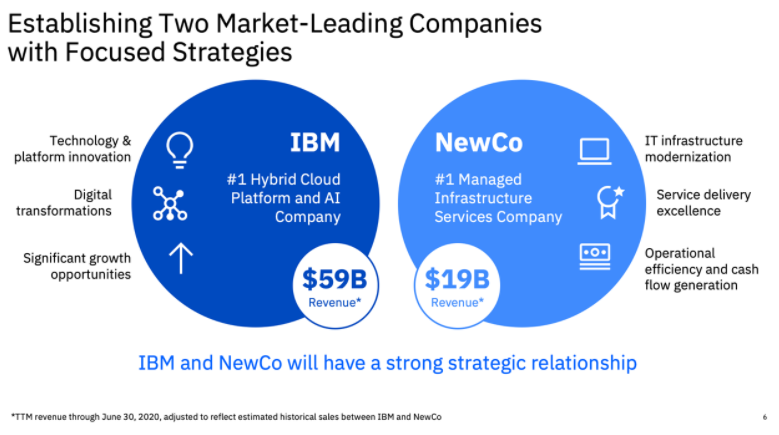

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

This week, we look at:

PwC estimating that $900 billion has been wasted on digital transformation projects for enterprise, meaning finance is vulnerable

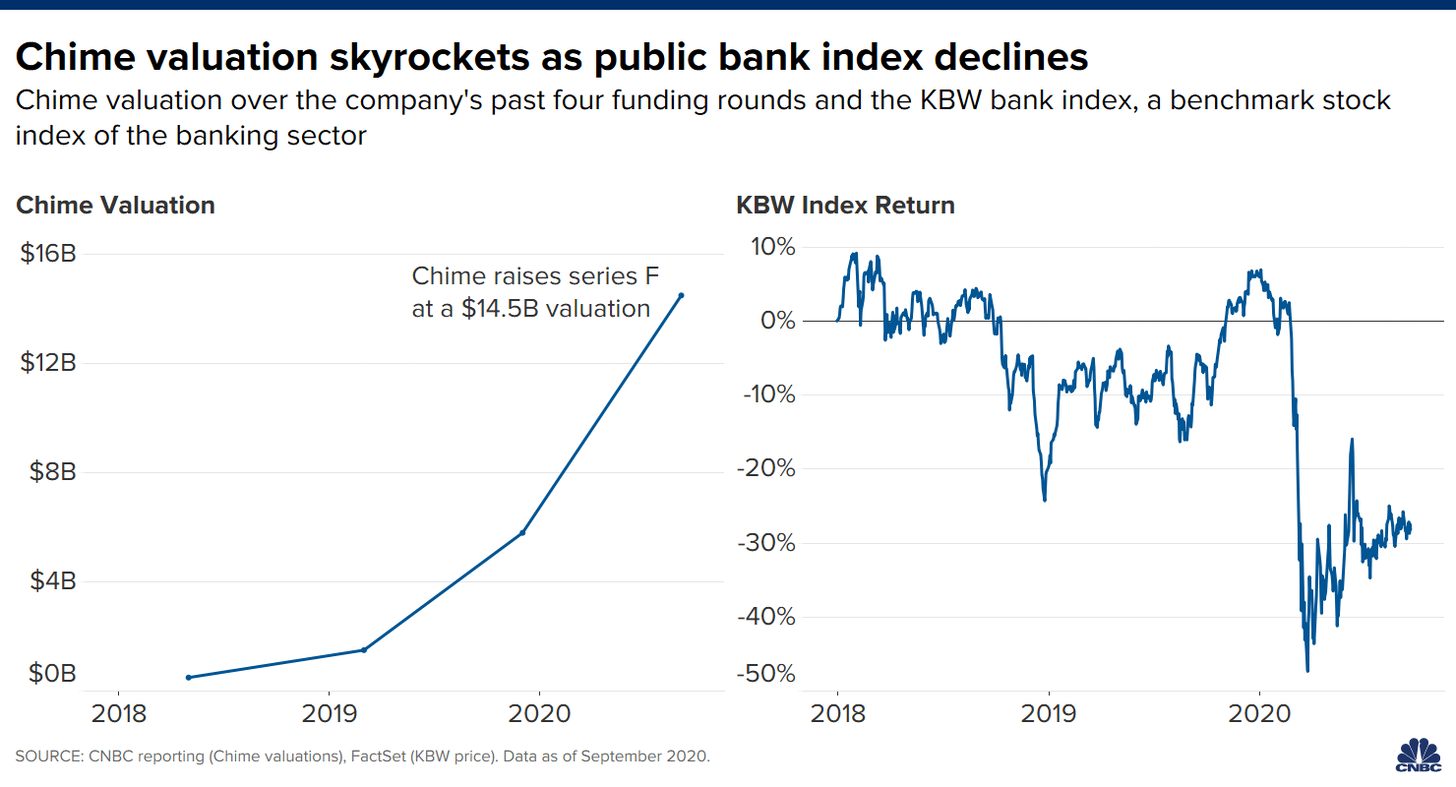

Chime is worth $15 billion in the latest round of valuation, same as $200B+ depository bank Fifth Third, which is quite the achievement

Decentralized exchange Uniswap distributing 60% of its token to the community, flipping the ownership and value accrual model

As a thought experiment -- today, if you want to save for a house, you may create a financial plan in Betterment and wait for the portfolio to accrue. Tomorrow, you may bring cashflows to a housing protocol which intermediates property markets, and build your portfolio directly into your desired goal of buying a house. Your stated selection and articulation of that goal, by choosing the housing protocol, generates value on its own through rewards, participation, governance, and various interest rate products.

Read More