In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

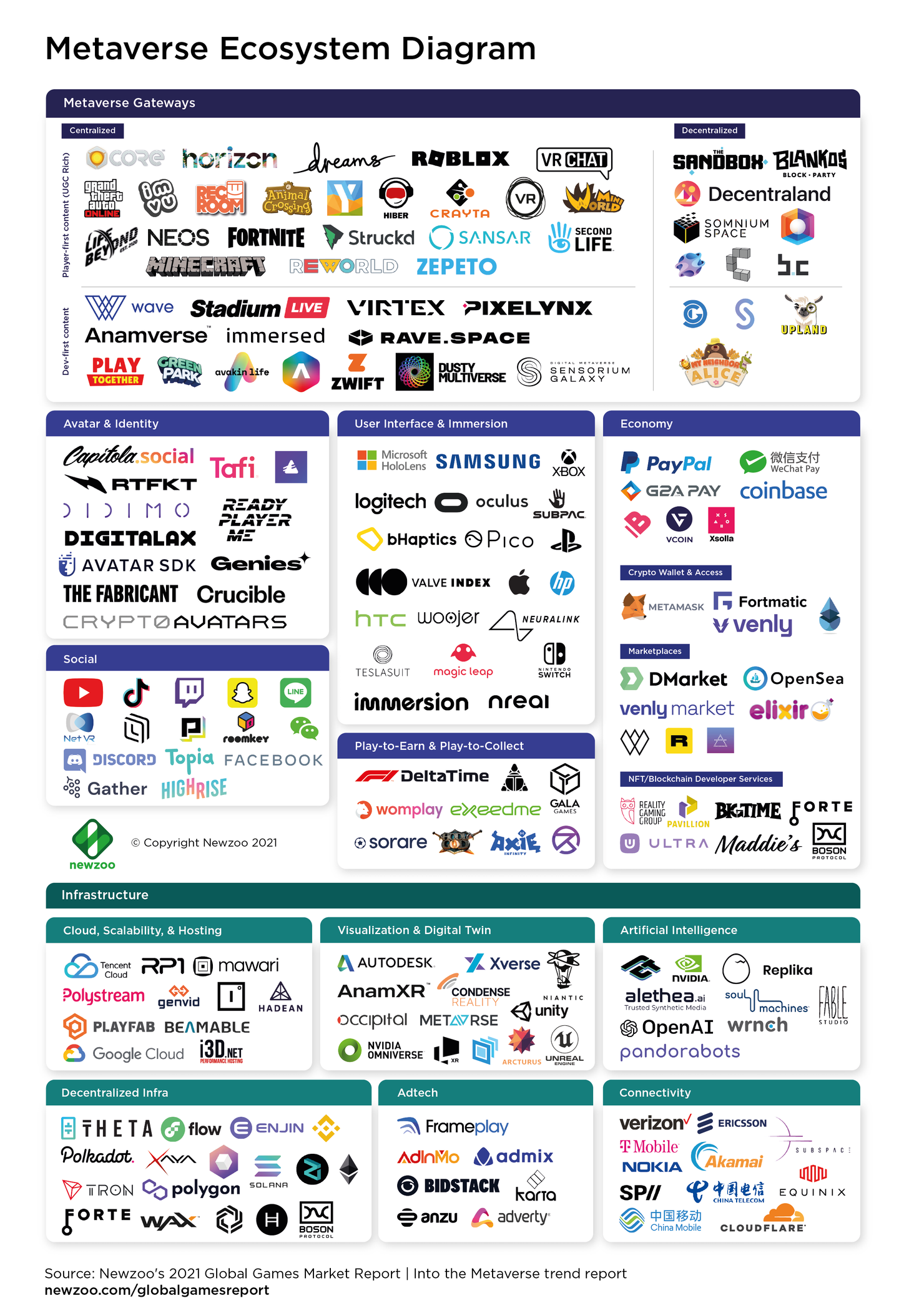

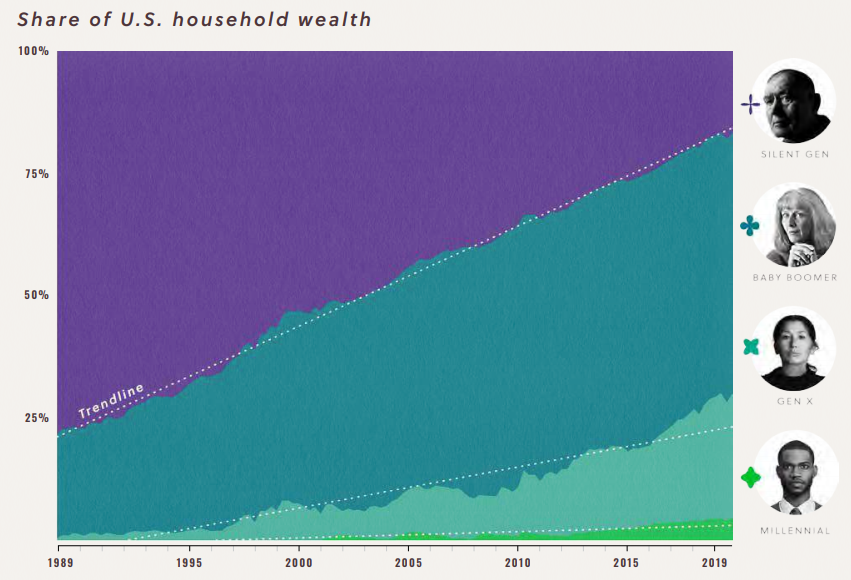

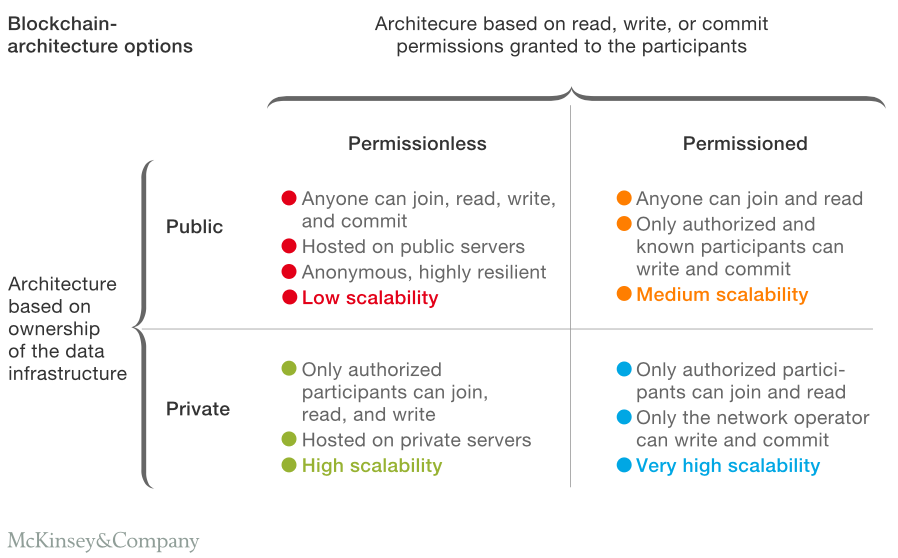

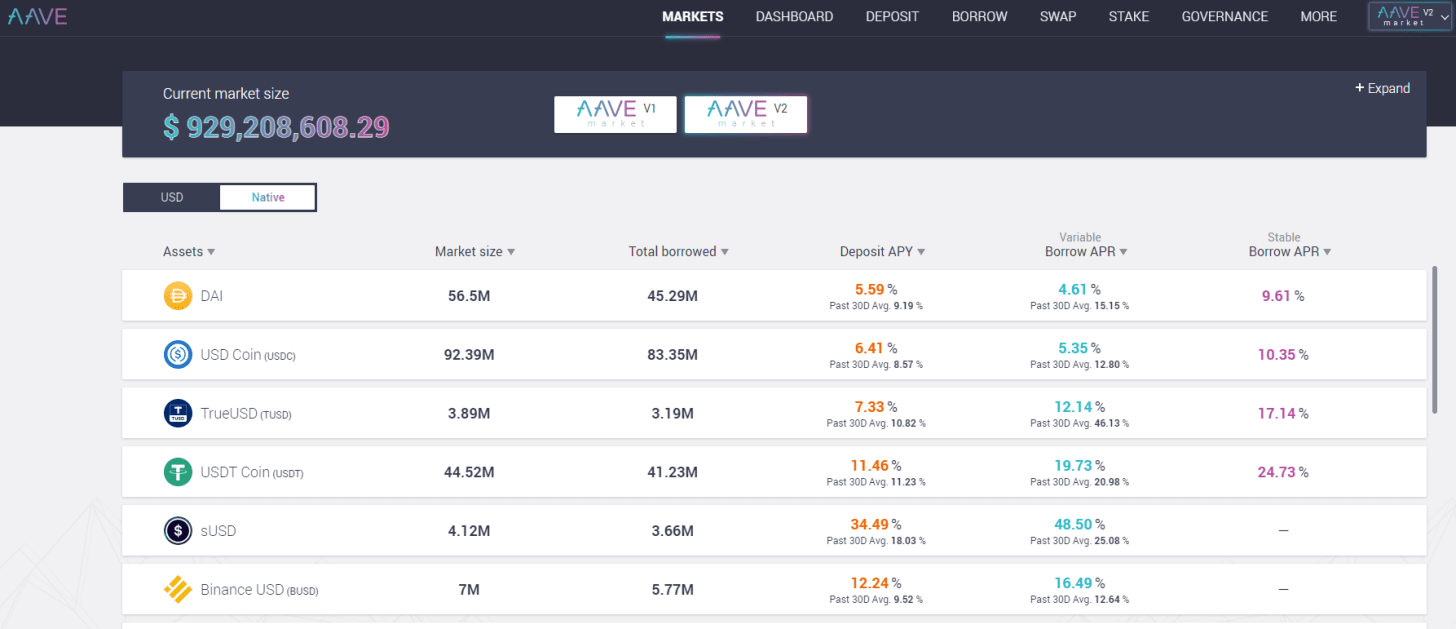

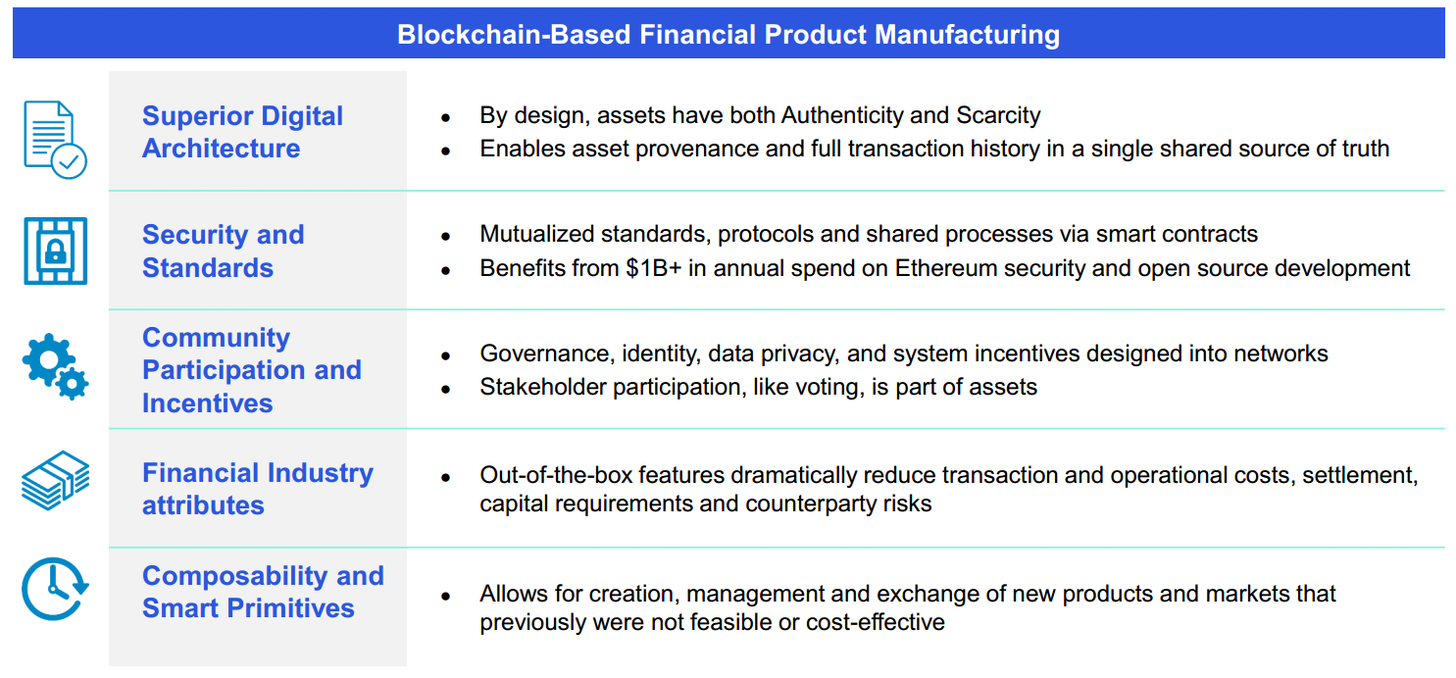

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

Read More