We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

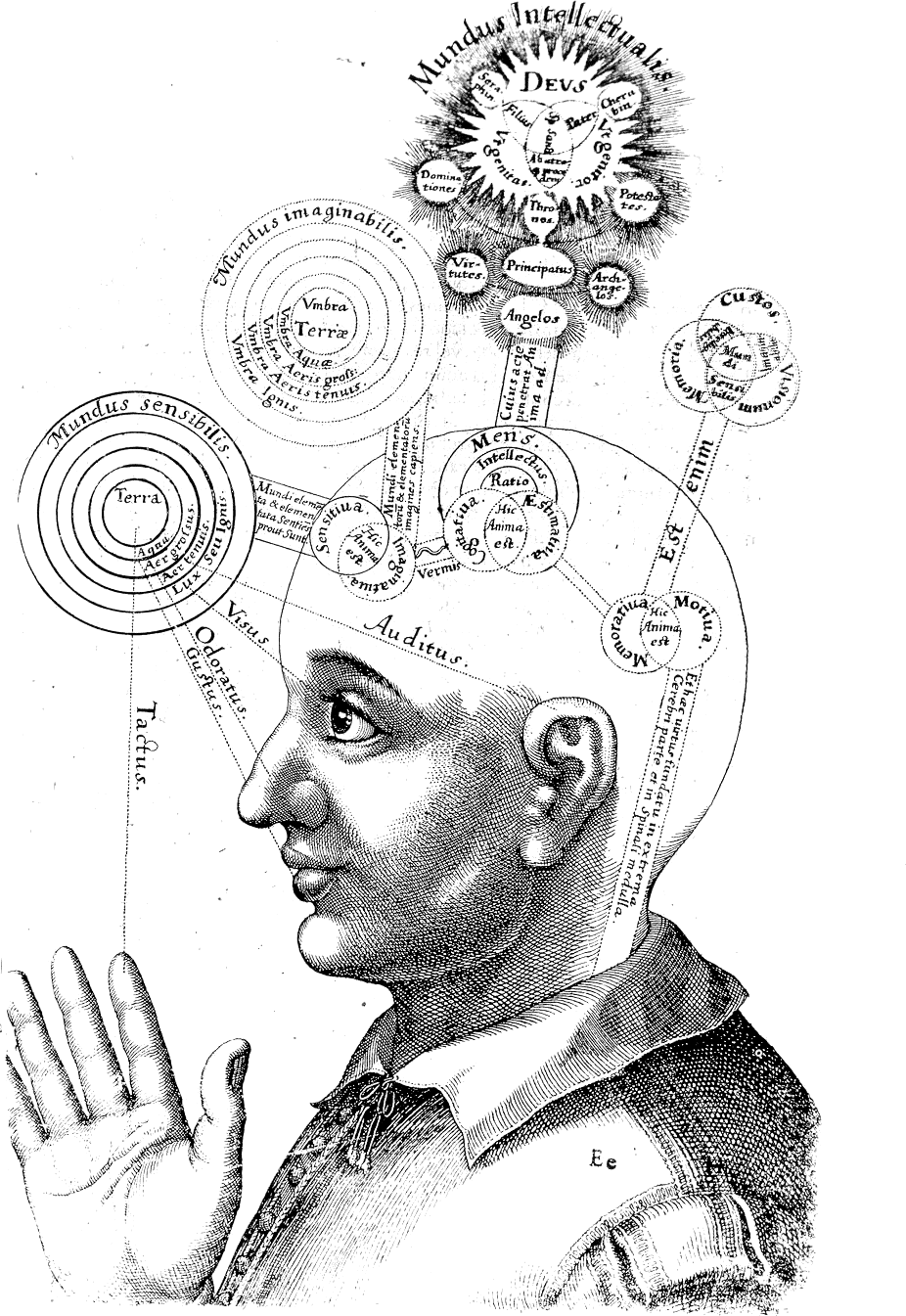

Read MoreWe talk about OnlyFans, and how its bank vendors pressured it to try to ban adult content, and how and why that failed. We also discuss the crypto tax provisions in the Senate version of the $1 trillion infrastructure bill, and their impracticality. These themes are tied together with a metaphysical hypothesis about the role of financial services, anchored in a discussion of the Platonic model of the mind. How are rationality, emotion, and social context involved to define the shape of our industry?

Read MoreYou work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

Read MoreThis week, we cover these ideas:

The nature of digital identity, and the difference between a representation at some moment of time vs. a record of your being

The launch of the DeFi Passport by Arcx and how it can be useful for underwriting

The European Digital Wallet, and the implication of such a development for CBDCs and government services

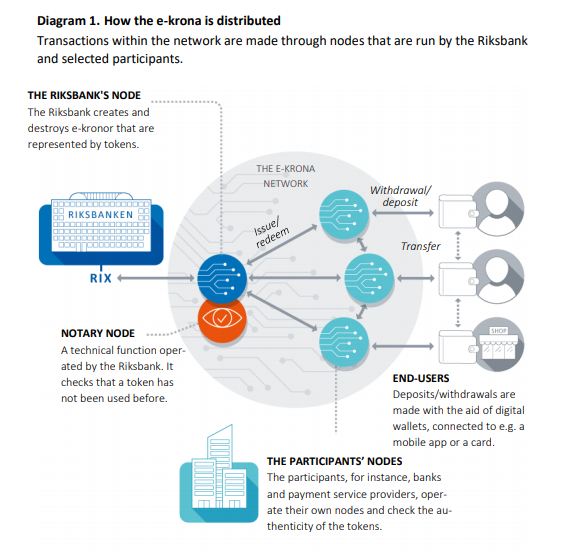

China’s CBDC, Sweden’s BankID, and other existential crises

If you want to go deeper on this topic, we strongly recommend our conversation with Michael Cena of the Ceramic Network here. Whereas Michael started working on the identity problem by trying to add labels to people, where he ended up is creating a protocol that tracks historic software activity and interactions between actors. In thinking about the Ship of Theseus, this is the solution that says — your identity is your journey through the river of time itself, and not any particular stop you make along the way.

Read MoreThis week, we cover these ideas:

That absurd Paul Krugman article about Bitcoin. Also Jim Cramer has things to say about financial regulation.

If all the prices are down, which they are, does that mean that everything is bad and wrong?

How timing is a personal financial planning problem, not a market value problem

This week, we cover these ideas:

The difference between building a Fintech company, and building an empire to transform the world

How Warren Buffett is the best in the world at getting leverage through third party capital to grow

How Elon Musk is the best in the world at re-investing capital into his own judgment and view of the future

The $1.2B BitGo acquisition by Galaxy Digital, and the growing footprint of Alameda Research

DAOs as a way for all of us to participate

Crypto isn’t magic. It’s math. Two trillion dollars worth of math.

We are still, often, asked incorrect questions about the crypto currency markets. Questions like — “but what is the fundamental value?”

You have to unpack the word “fundamental”. That word signals a Warren Buffet view of the world: there are companies out there, they have equity shares well specified by corporate law in a particular jurisdiction, some are expensive while some are cheap, and that bargain shopping can be determined by a spreadsheet analysis of their cashflows relative to others. It’s so fundamental!

The story of such fundamental truth is anchored in our cultural and social history. We can point to the intellectual tradition of rationalism and classical economics, and talk about the theory of the firm, and its production function. We can point to how these things grew out of governance by religion, and natural rights as granted by a deity, and all sorts of other non-empirical hand waving.

Read MoreThis week, we look at:

Square acquiring Tidal and its 1-2 million of subscribers for $297 million, and the logic for what a payment processors has in common with the creative industry

How celebrities and creators like Mark Cuban, Gary Vaynerchuk, Grimes, 3LAU and others are generating millions in NFT sales

The impact on the economic model of the music industry, including a look at royalty structures, revenue pools, and financial vehicles when tokenized

The philosophical divide growing between a feudal platformed commons (e.g., YouTube) and a collectivist anarchist capitalism

This week, we look at:

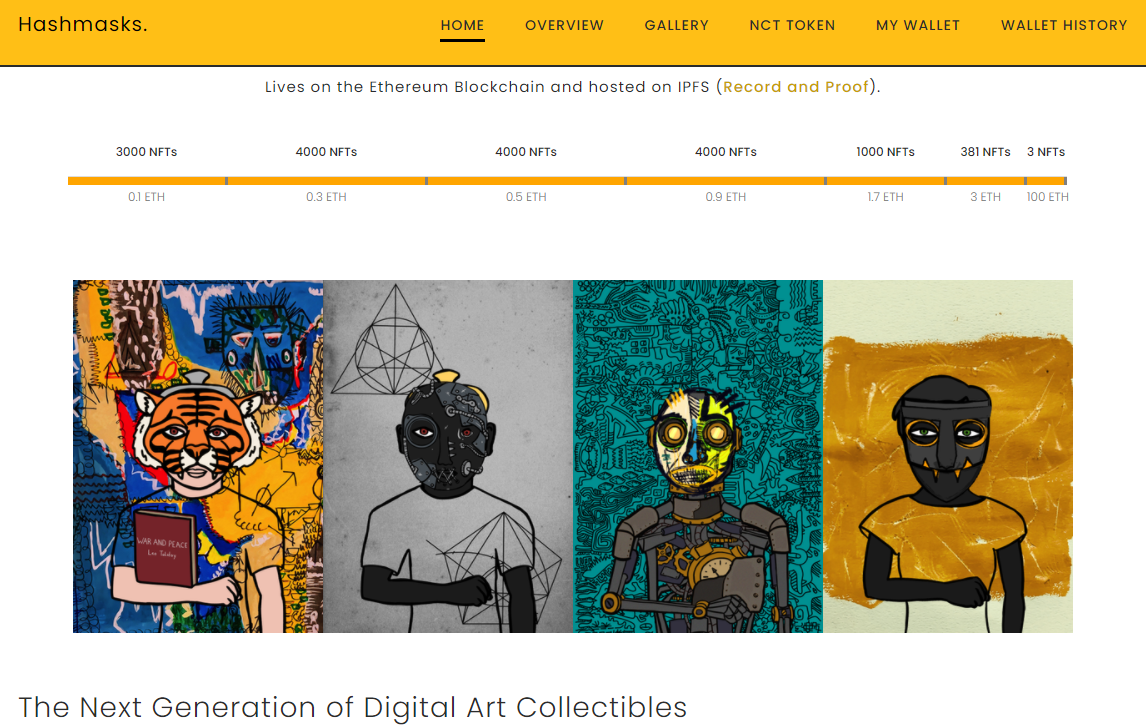

Hashmasks, CryptoPunks, and other large NFT / crypto art projects generating tens of millions of USD trading volume

Perceptions of financial value, as well as whether it matters to have an “original” digital art piece relative to its digital copy

The intersection of collectibles with decentralized finance, and its collateralization, tranching, lending, and trading, as well as a view on 2021

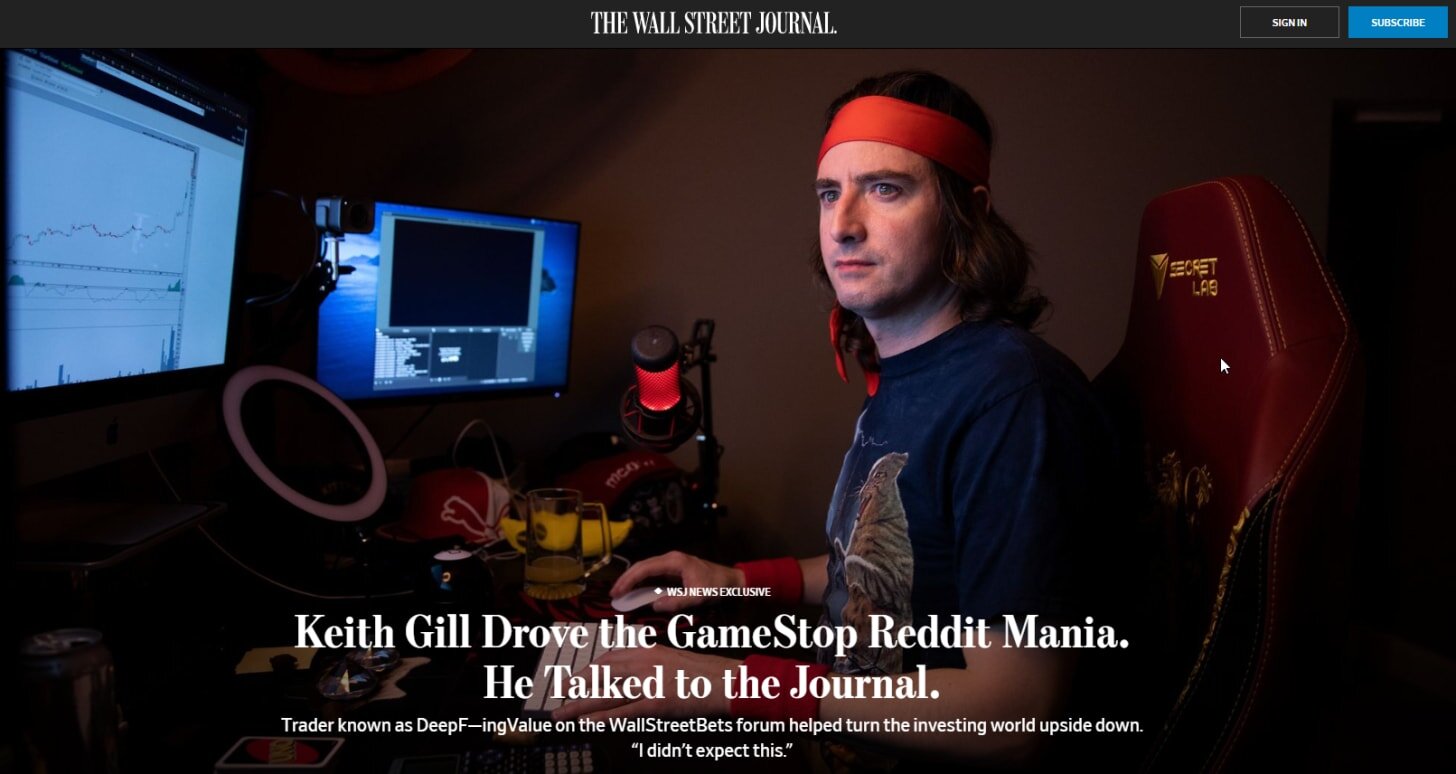

Despite its best efforts to the contrary, Robinhood did end up stealing from the rich and giving to the poor.

Melvin Capital, the $8 billion hedge fund that didn’t find GameStop funny, lost 53% of its portfolio in January ($7 billion) trying to short against the rallying cries of the Reddit Capitalist Union. Gabe Plotkin also faces the embarrassment of having to get bailed out by your old boss.

Speaking of, New York Mets owner and former name-on-the-door of SAC Capital, known most recently for its insider trading fine of $1.8 billion, Steven A. Cohen, put $2.8 billion of capital into Melvin’s fund.

Ken Griffin, owner of the Citadel hedge fund (an investor in Melvin), and Citadel Securities (a massive market maker and buyer-of-order-flow for Robinhood), is seeing capital losses in the former and Washington cries for scrutiny into market structure in regards to the latter.

Robinhood itself — which for goodness sake is *not Wall Street*, but as *Silicon Valley* as it possibly gets — raised $1 billion immediately to protect itself from class action lawsuits, DTCC capital calls, and a now-rapidly-closing IPO window. That means Yuri Milner of DST Global chipping in yet again.

That’s at least 4 people that have had a very bad, no good day.

Read MoreThis week, we look at:

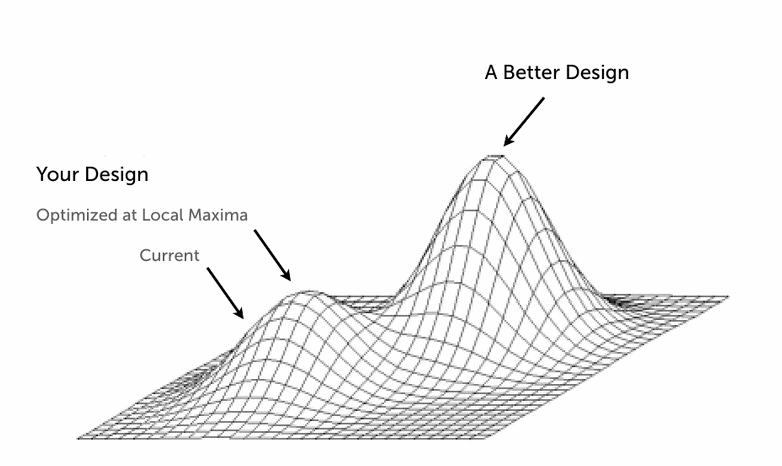

The nature of innovation hubs, and how close groups of actors within a particular environment can be massively, fundamentally productive. Take for example the 30 million years of the Cambrian explosion.

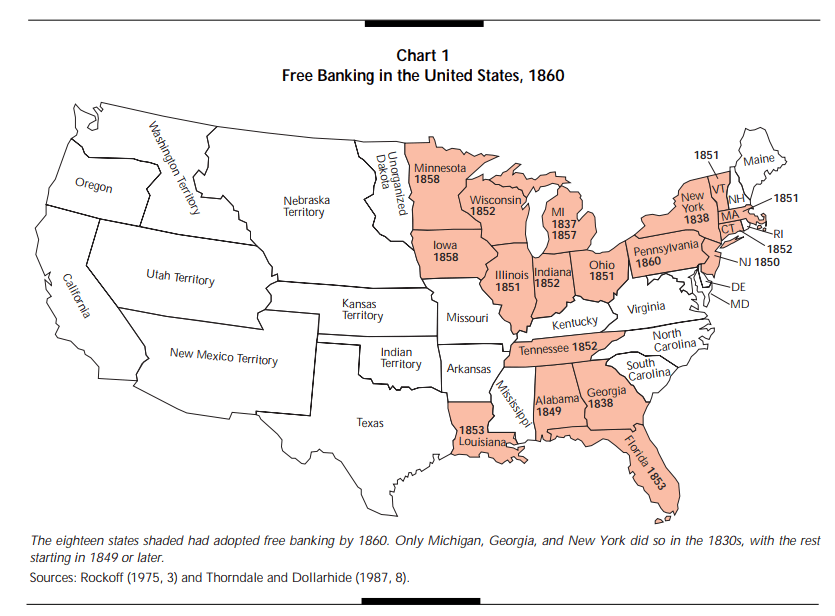

The difficulty of experimenting with banking and money frameworks, the limits of traditional econometrics, and an overview of “free banking” in the 1840s.

How evolutionary theory can help us think about selection of economic models, and the hyper-competition and hyper-mutation that we see in crypto. DeFi protocols, like BadgerDAO and ArcX among hundreds of others, are experiments in designing different monetary policies and banking regime experiments in real time.

We have never before had such acceleration in the design space of the economic machine, subject to evolutionary pressures, built by a closely-wound nexus of developers. It is a fortune for the curious.

Read MoreThis week, we look at:

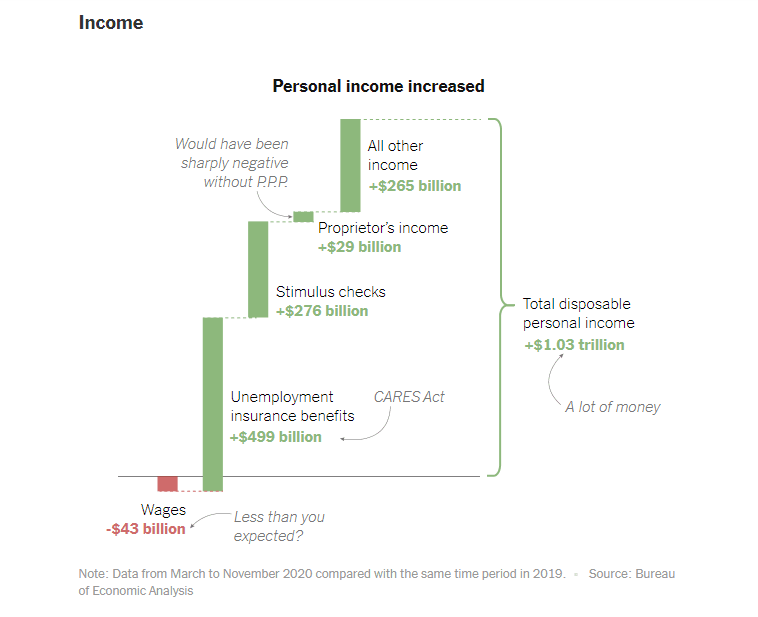

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

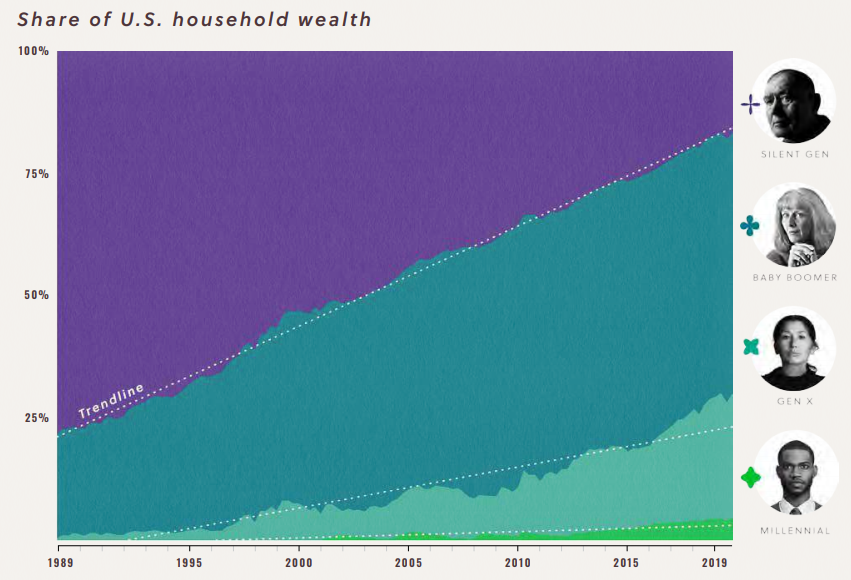

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

Read MoreThis week, we look at:

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless -- the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.

Read MoreThis week, we look at:

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

Why the Communist Party stopped Ant Financial's IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

This week, we look at:

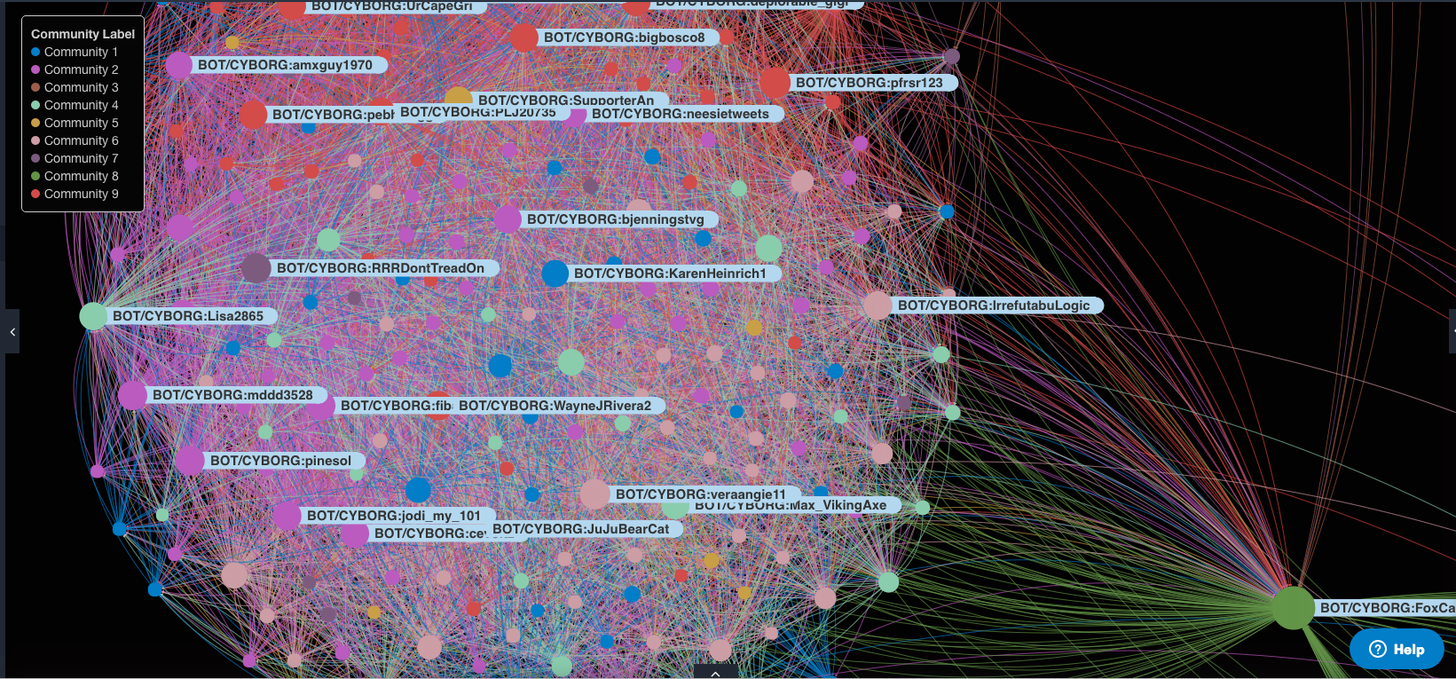

Deep Fakes behind South Park creators' new parody, Sassy Justice

The AI-created author of the fake Hunter Biden intelligence report

GPT-3 winning the love and attention of people on Hacker News

How should we react to these robots and their desire to mess with our minds

Unlike equities, the crypto markets were born from machines, and are constructed from code. Hold dear the tokens in which you believe, and stay away from the stories of easy money. Nothing is easy. To win Russian roulette is not good fortune. It is, instead, a grave mistake to play a lethal game. Have you nothing to lose?

And then Brexit. And then Taiwan and China. And then Covid, again. And then, who knows.

From now on and forever, your counterparty is the data center running an AI cluster on top of the Internet. The data center that has already profiled you and knows everything about you. Bring the tinfoil hat.

Read MoreThe question of consciousness goes to the root of why we build, what we create, and how we decide what is valuable and what is not. And if we can control our self-conception and the modeling we do of the world, the texture of life becomes better. A recurrent theme in our writing is that systems don’t care about their agents per se. There are many game theoretical equilibria where agents suffer, but systems perpetuate. So figuring out how an agent within a system reflects on happiness is paramount.

Read MoreThis week, we look at:

PayPal and Square being larger than Bank of America and Goldman Sachs

The SoftBank $4 billion in tech oligopoly call options, and why people feel uneasy

Uniswap vs. SushiSwap, and Bitcoin vs. Litecoin, and why these forks felt wrong

How understanding signalling can help make better decisions

This week, we get philosophical and look at:

Embedded finance and how it will be woven into the fabric of the Internet

Applying the philosophies of existentialism, nihilism, and absurdism to Finance

Parsing symptoms in decentralized finance (Based Protocol) as artistic protest

Finding Dadaist beauty in chaos

This week, we look at:

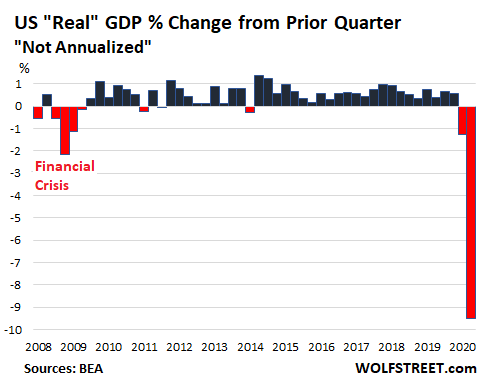

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

Read MoreLooking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

Read More