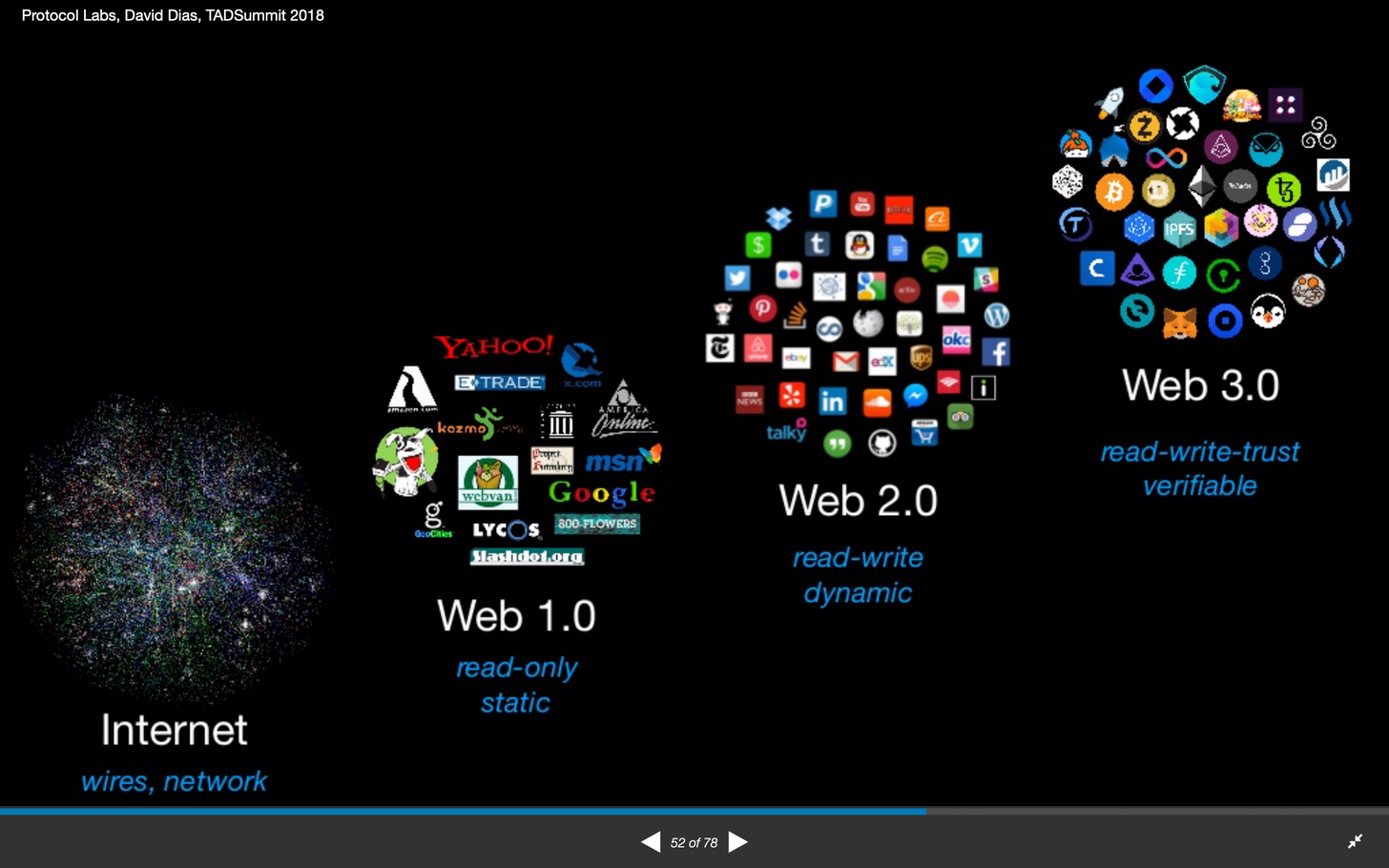

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

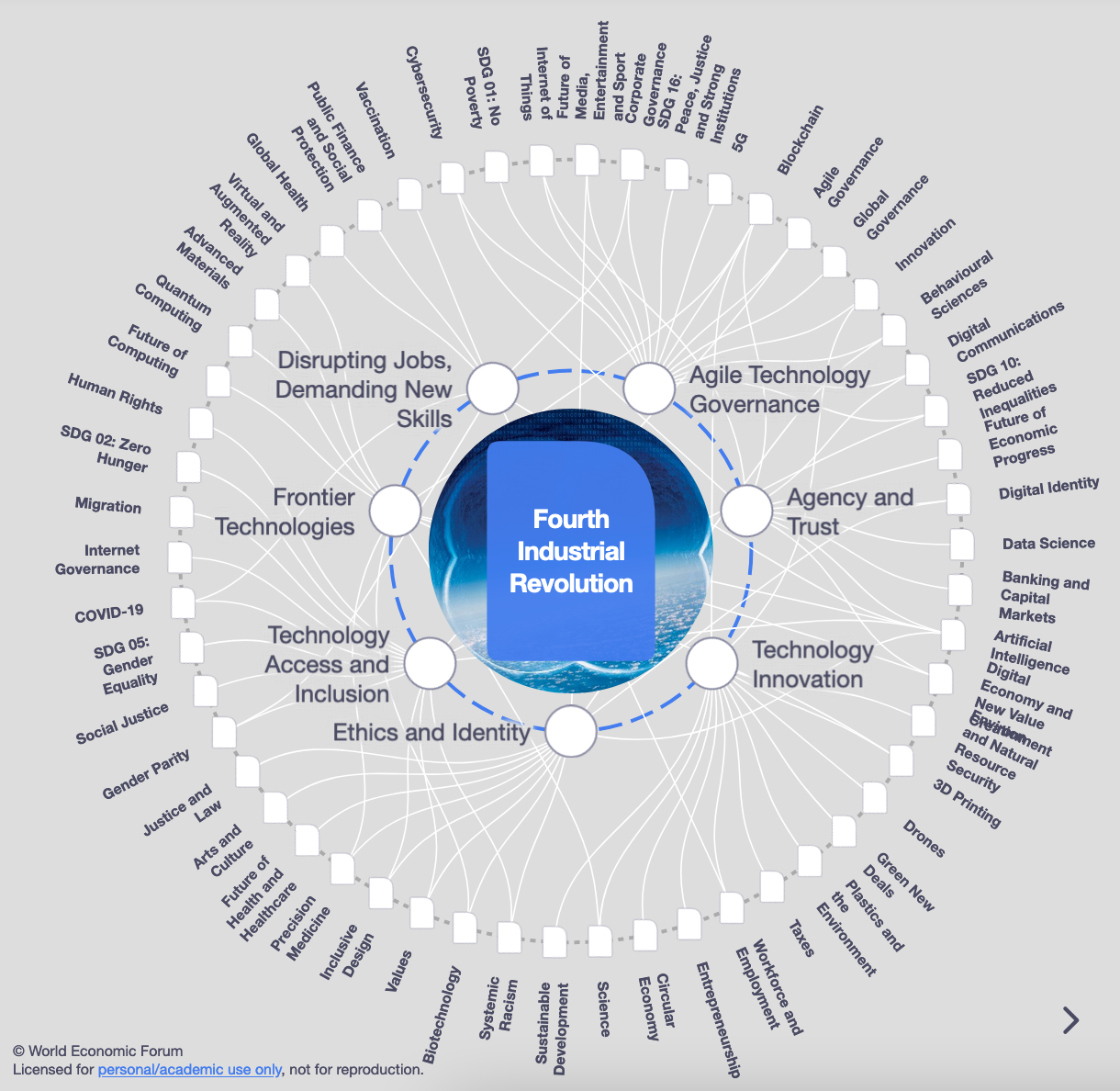

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.