We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

Read MoreThe macro and crypto economic thesis for 2021, building out the linkages between “Risk-On” assets, flows into and valuation of Bitcoin and Ethereum, and the interplay between value locked, the growth of decentralized application revenue, and the volumes around digital objects. We bring it all together.

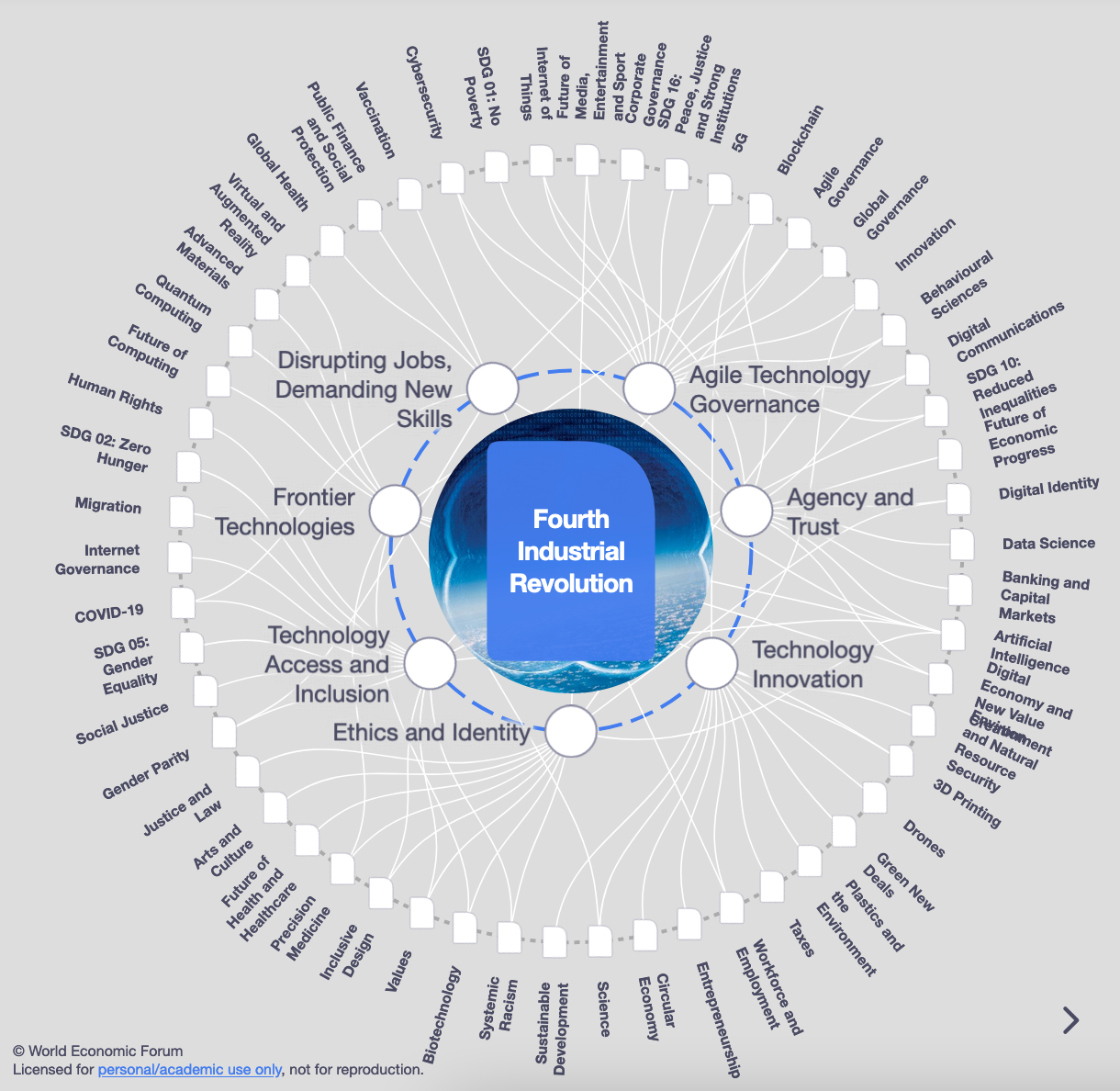

Read MoreIn this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

Read MoreThis week, we cover these ideas:

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

The core narrative of Bitcoin, and its fundamental indicators

The core narrative of Ethereum and Web3, and its fundamental indicators

A sanity check on potential market caps relative to gold, equities, and other assets

This week, we cover these ideas:

That absurd Paul Krugman article about Bitcoin. Also Jim Cramer has things to say about financial regulation.

If all the prices are down, which they are, does that mean that everything is bad and wrong?

How timing is a personal financial planning problem, not a market value problem

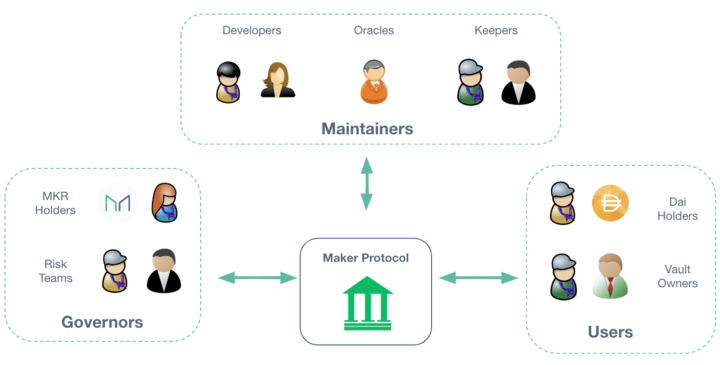

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

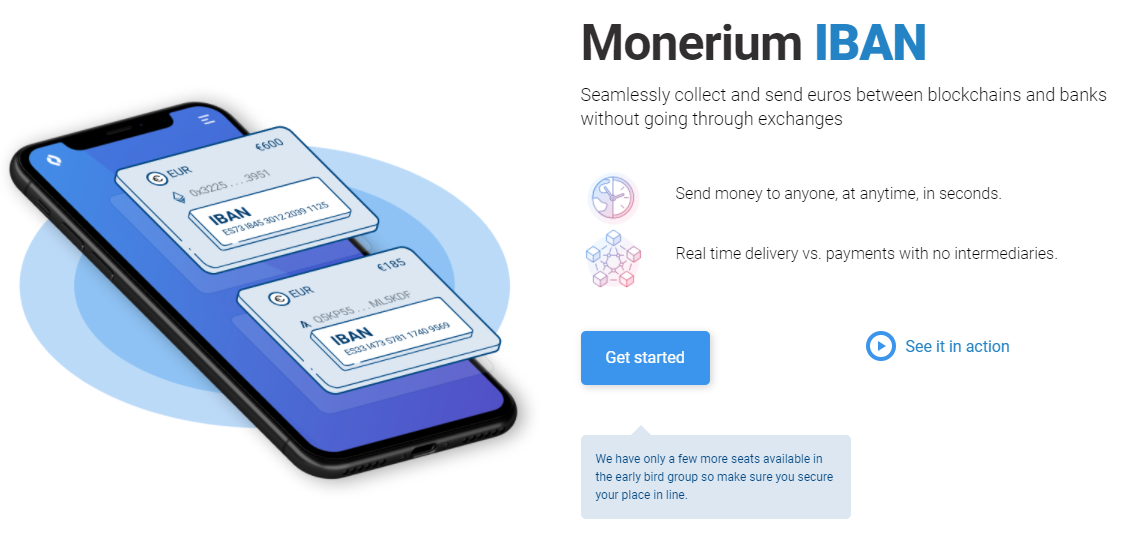

Read MoreIn this conversation, we talk with Jon Helgi Egilsson about his incredible journey to becoming Chairman and a co-founder of Monerium.

Jon is a former chairman and vice-chairman of the supervisory board of the Icelandic Central Bank, a former adjunct professor in financial engineering and MBA lecturer at Reykjavik University, a visiting scholar at Columbia University, and co-founder of four software companies. Additionally, we explore the various concepts of digital money in the framework creating a competitive yet unified environment between fiat money, banking based on fractional-reserve, and the token economy.

Read MoreThis week, we look at:

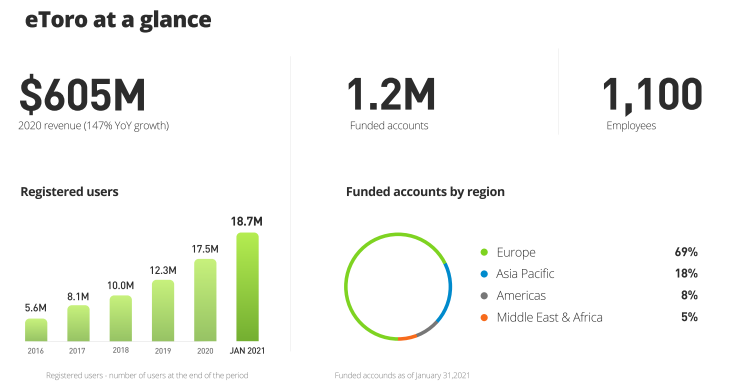

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

In this exciting conversation, we talk with none other than Joe Lubin of ConsenSys and Ethereum, about his journey from being exposed to advances in artificial intelligence at Princeton to becoming the household name in programmable blockchain. Additionally, we get an insider look into his founding of Ethereum and ConsenSys, and how the technology and individuals behind these two companies are transforming the very fabric of financial institutions that exist today and how new products/services are started for the betterment of humanity.

Read MoreThis week, we look at:

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

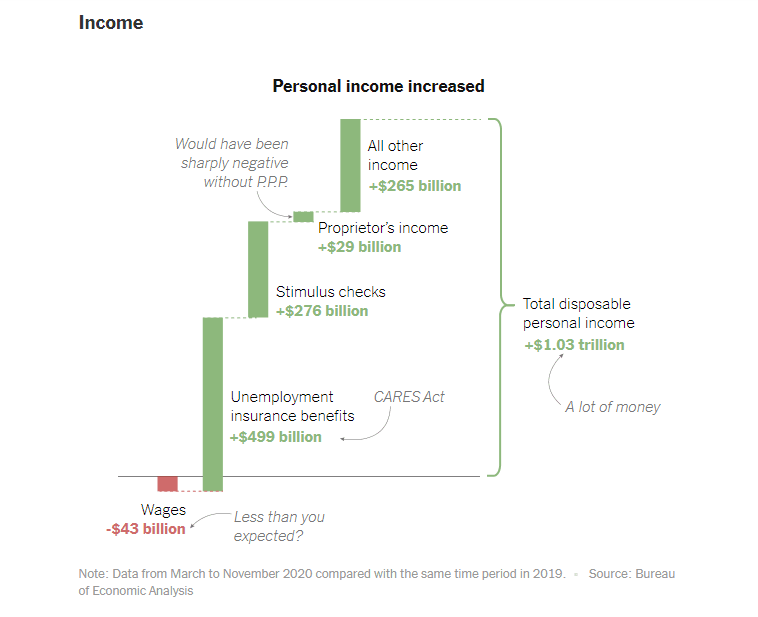

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

Read MoreThis week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

This week, we look at:

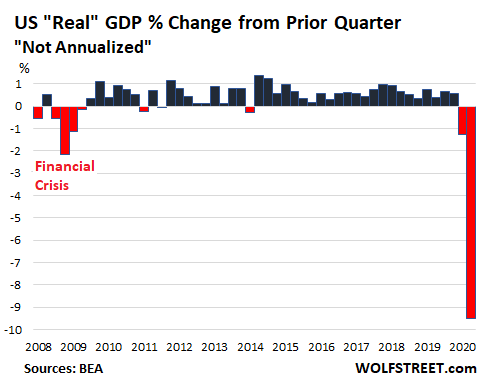

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

Read MoreIf you are in finance and only looking at banks, you are missing out on the real change agents. Here's some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.

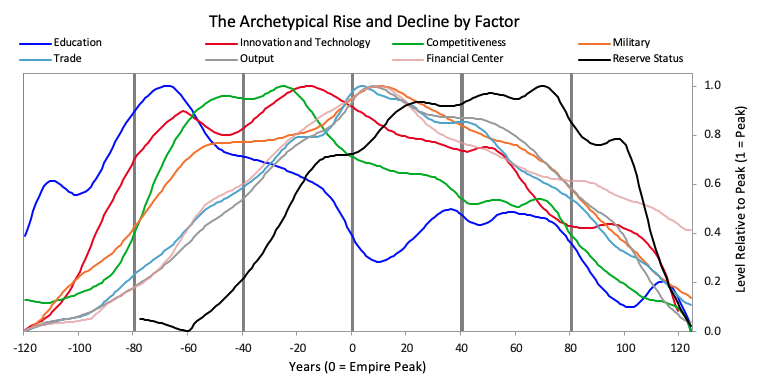

Read MoreThis week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

Read MoreThis week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let's not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

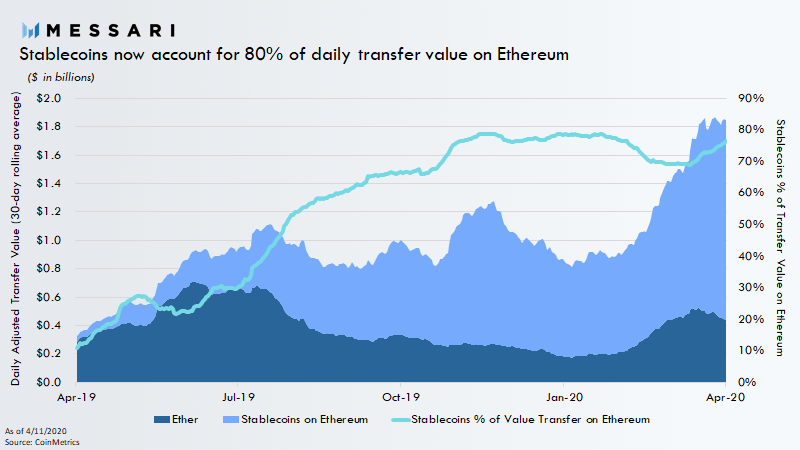

Read MoreThis week, we look at cash -- blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

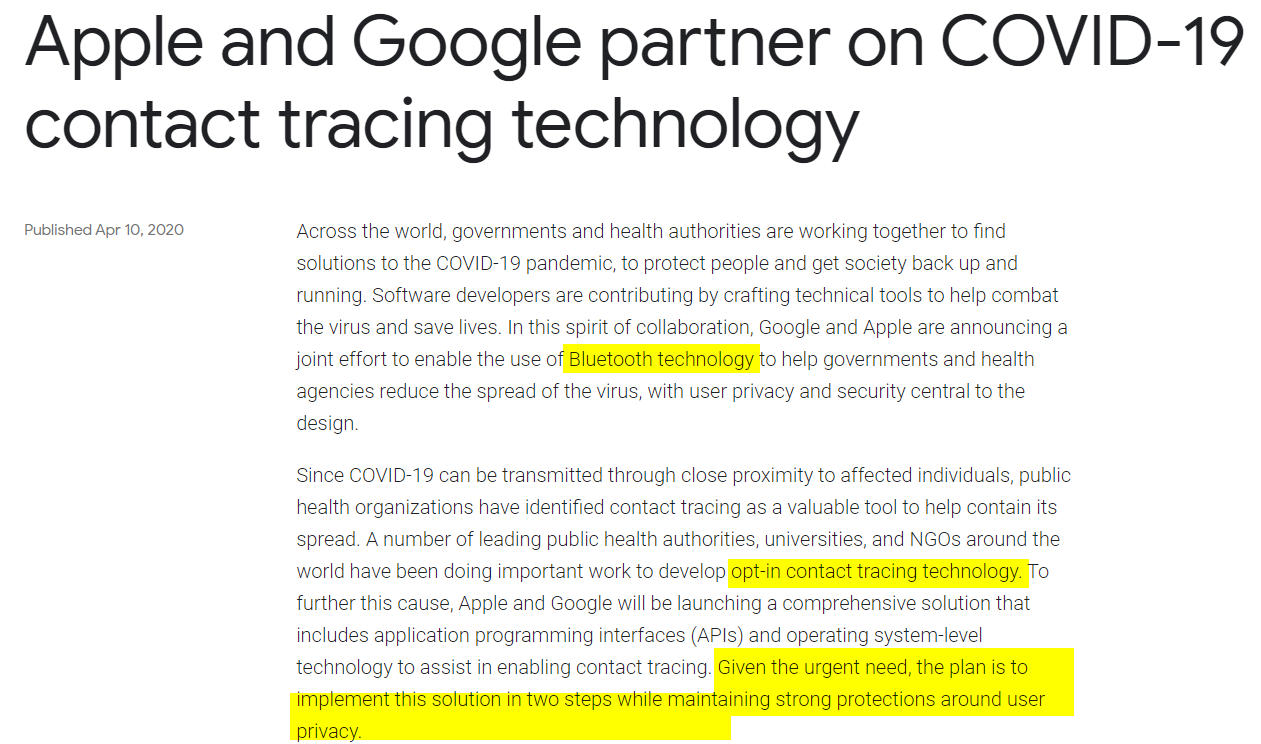

Read MoreThis week, we dive into the social, economic, and financial implications of data in a post-COVID world. As Apple and Google work to build out the government's contact tracing apps to combat pandemic, what Pandora's box are we opening without consideration? As Plaid reaches into payroll data to accelerate small business bailouts, what power do we hand to aggregators? Will dignity-preserving solutions come to market in time? The opportunity for decentralized identity and data storage is clearer than ever. Or will fear drive us to make permanent compromises?

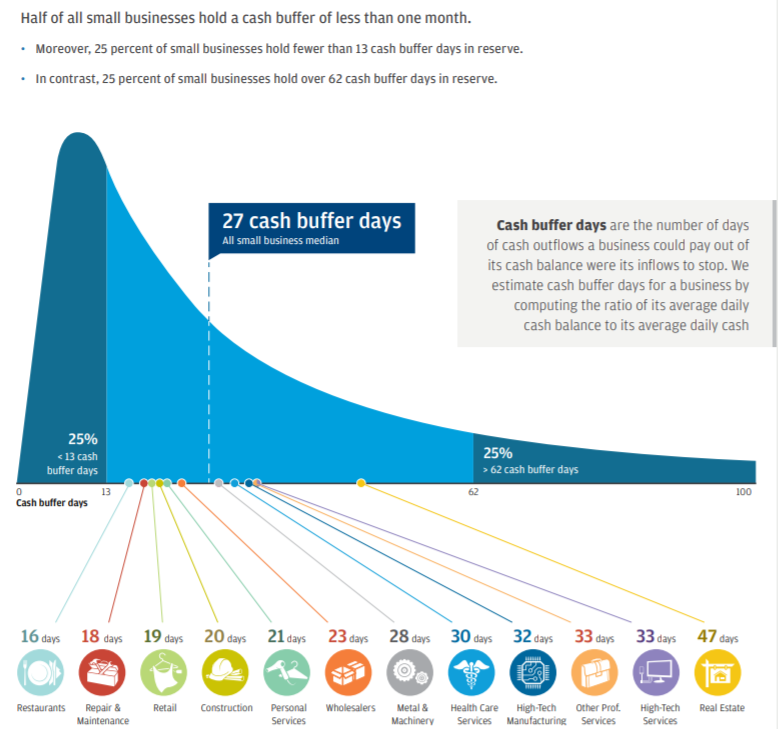

Read MoreAnother heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

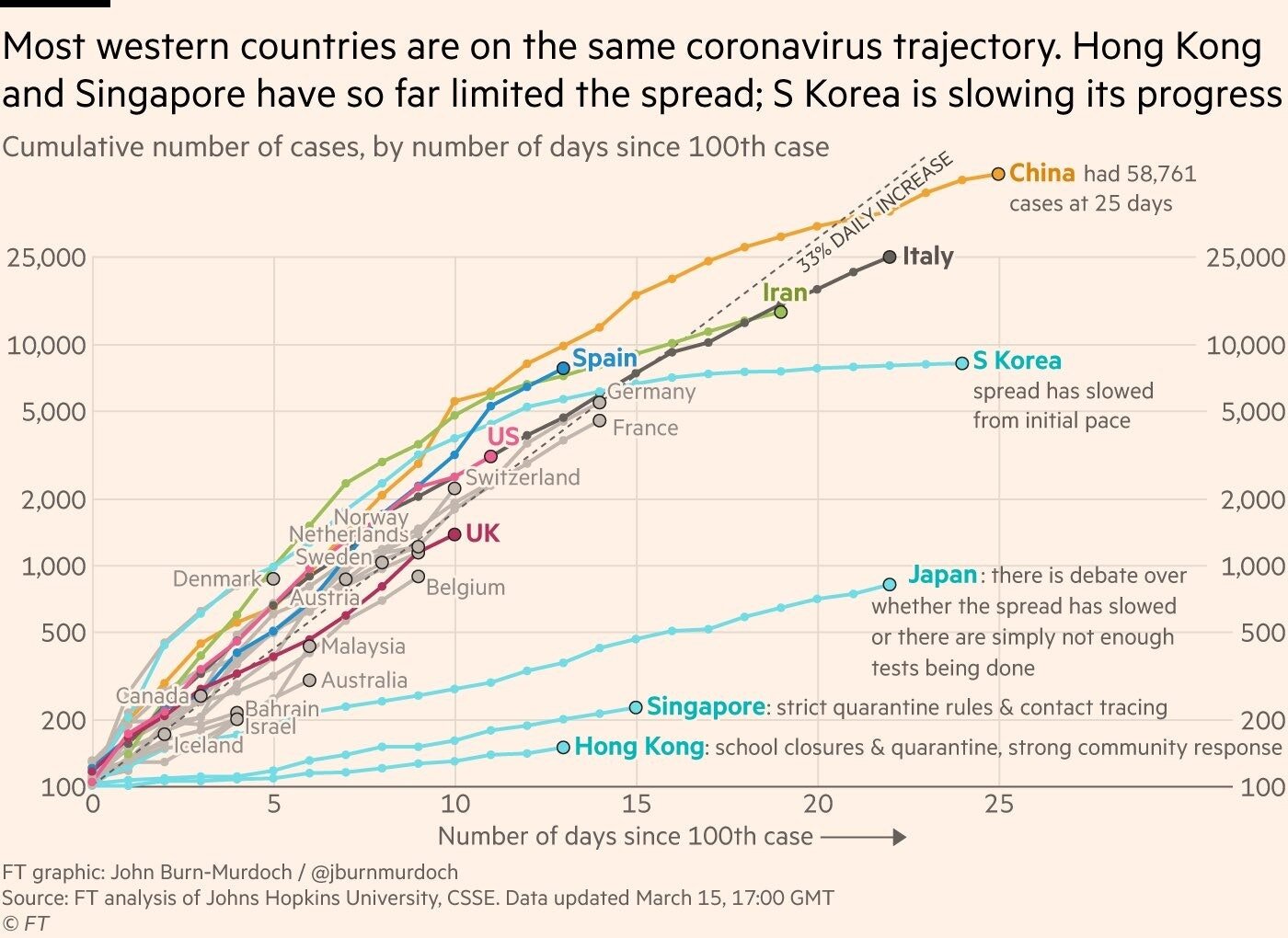

Read MoreI hope that you and yours are OK, socially distanced and stocked on essentials. Whether you feel it yet or not in daily life, the world is bracing for coronovirus impact. In this week's analysis, I look at the difficult trade-offs between health and economy, and try to quantify the impact of the likely slow-down. We look at some grim but useful concepts, like (1) the value of a statistical life, (2) what happened to the Soviet economy and life expectancy after perestroika, and (3) how our financial machines (NYSE, Robinhood, Maker DAO) are cracking at the edges. If you can do one thing -- be kind and gracious with each other as some things inevitably break.

Read MoreI look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!

Read More