his week, we look at:

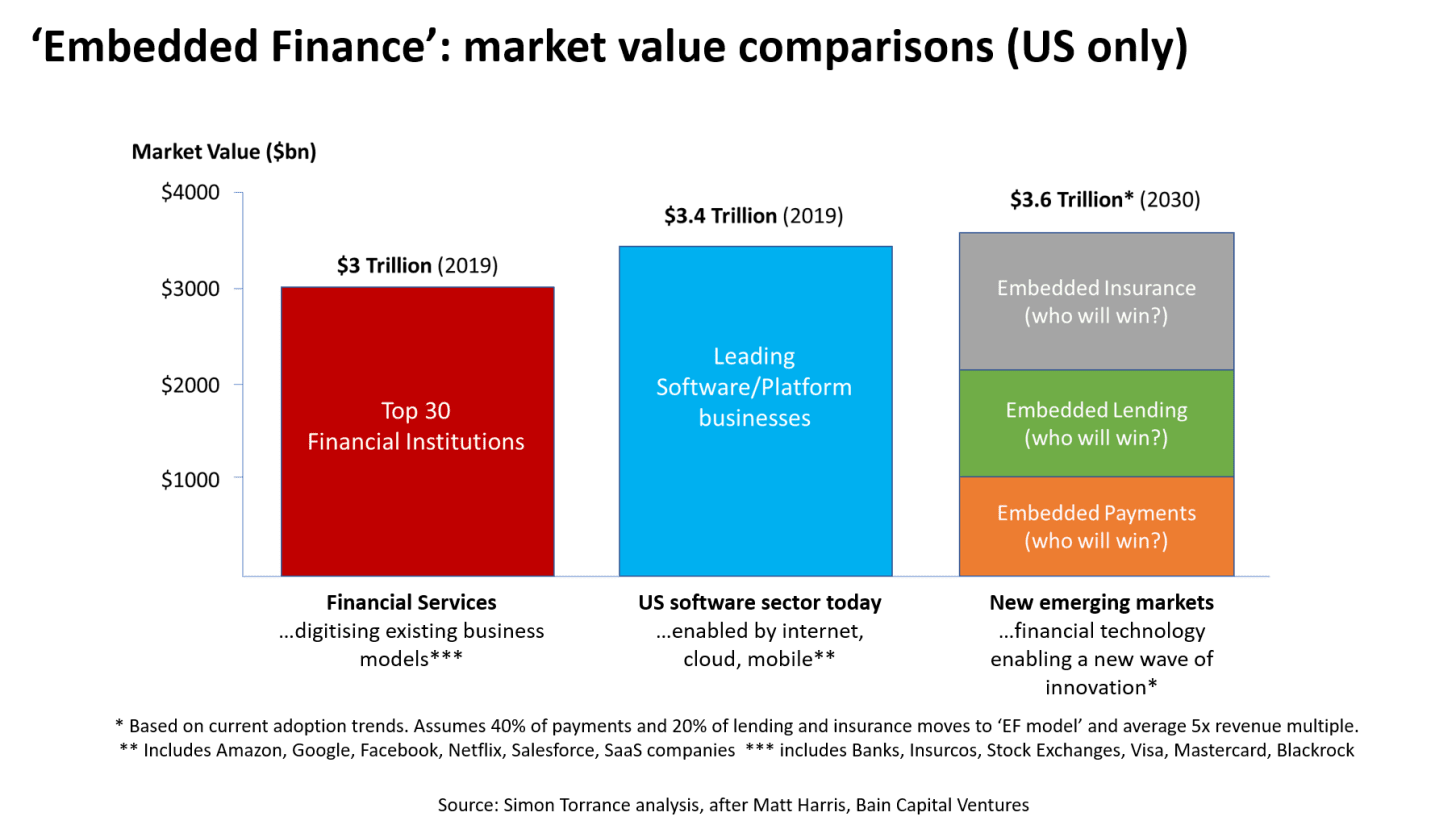

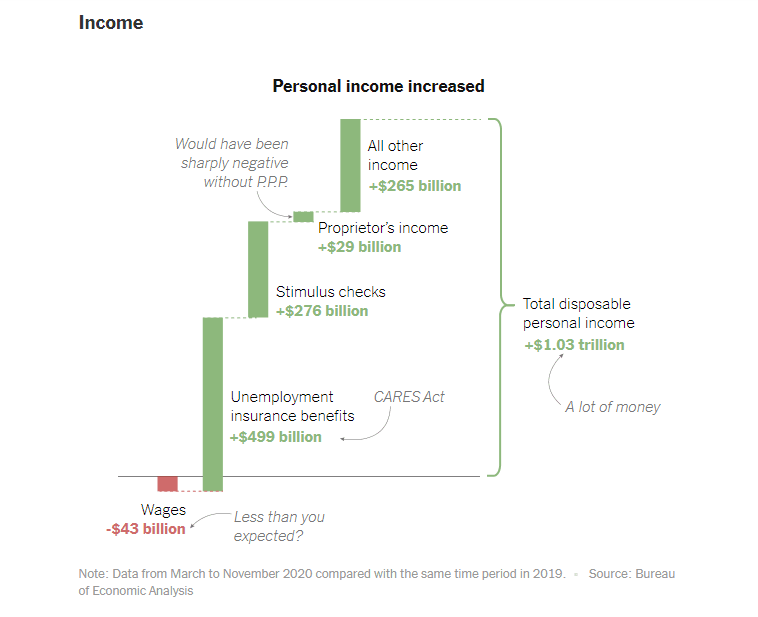

There are two very large revenue pools in the crypto asset class — (1) mining, and (2) trading. There are some large revenue pools in crypto-as-a-software, too, but those tend to be less sensational.

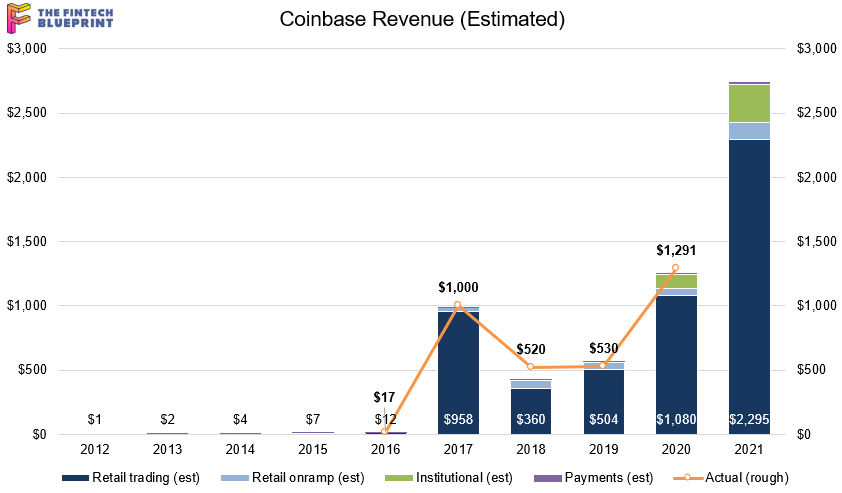

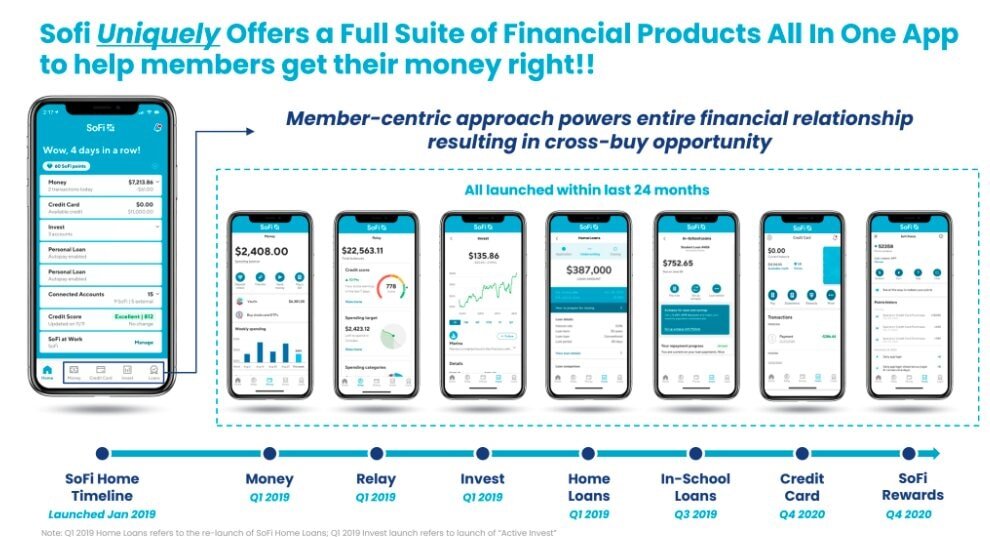

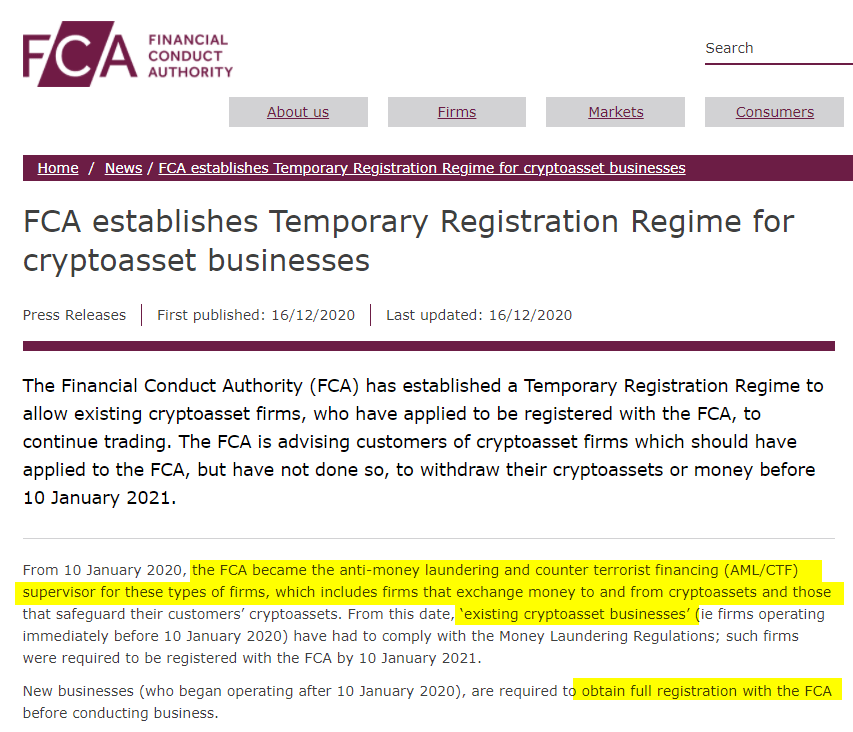

This analysis will establish a 2021 baseline for the most regulated of crypto exchanges, Coinbase, including a detailed financial model building a $100B+ valuation case

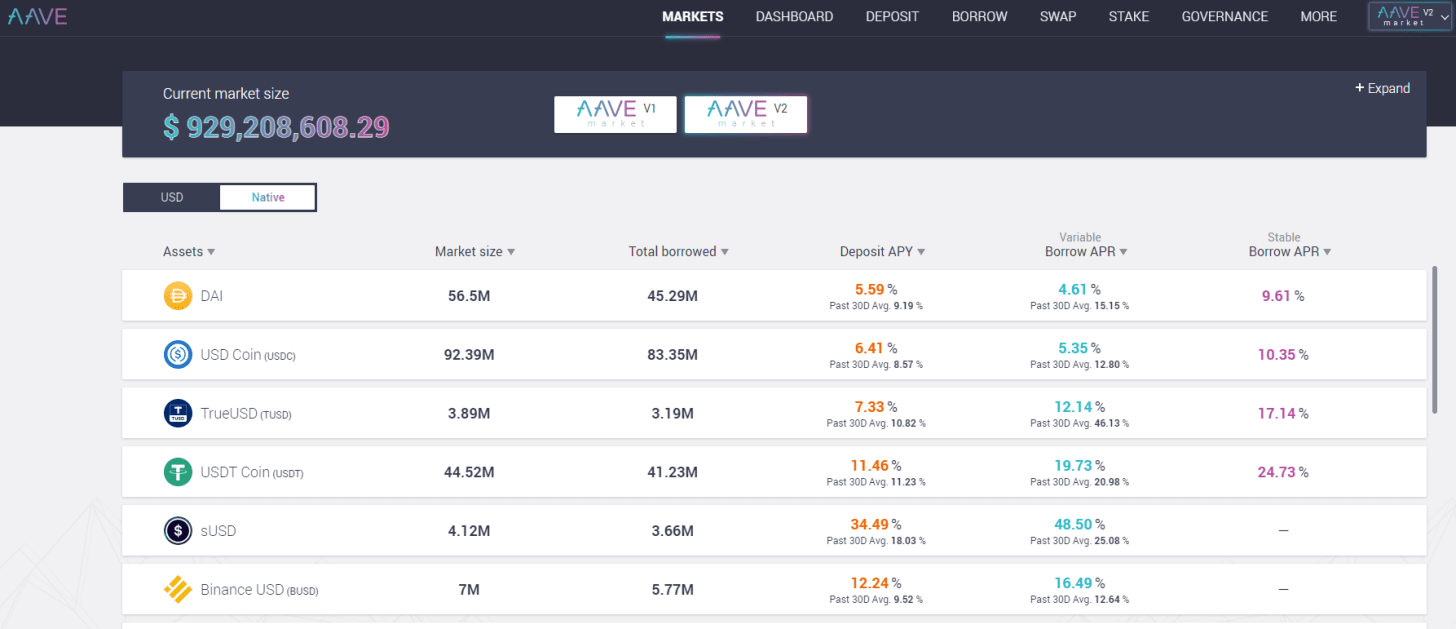

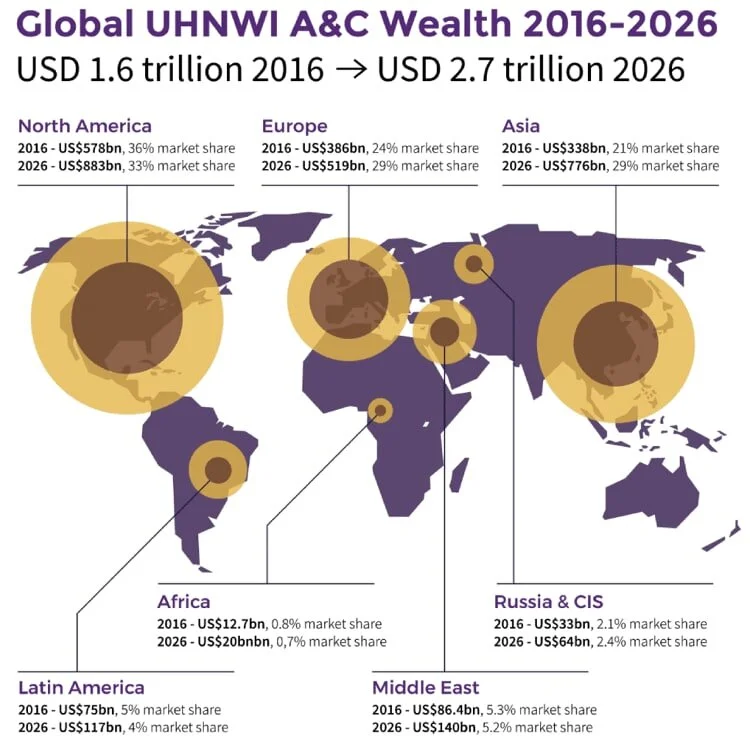

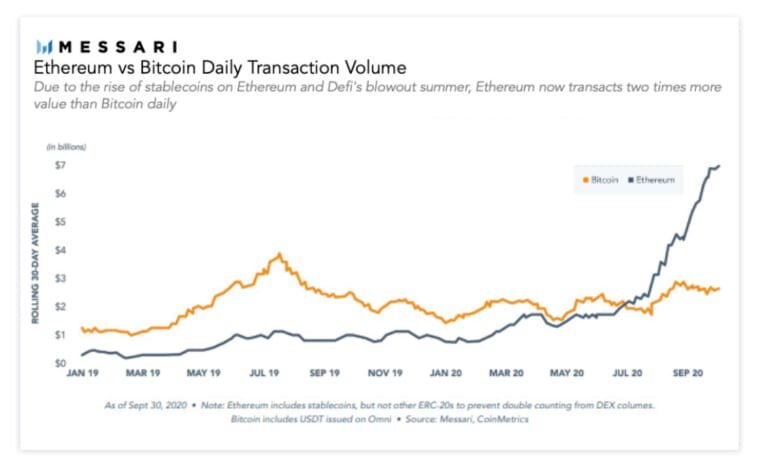

We then consider the valuations and multiples of capital markets protocols in Decentralized Finance of Ethereum, now making up over $60B in token value

Lastly, we look at Binance’s $1B in profits, its $35B BNB token, and the activities on Binance Smart Chain