The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

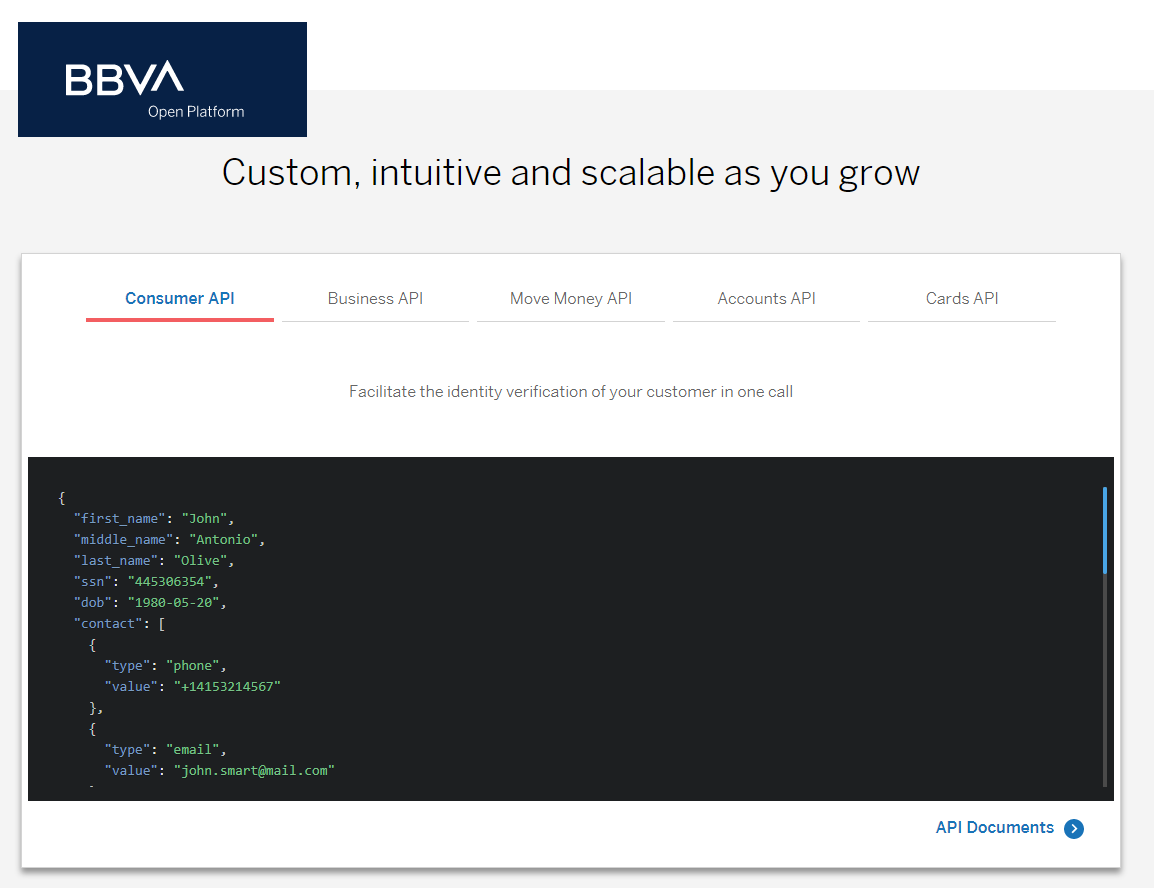

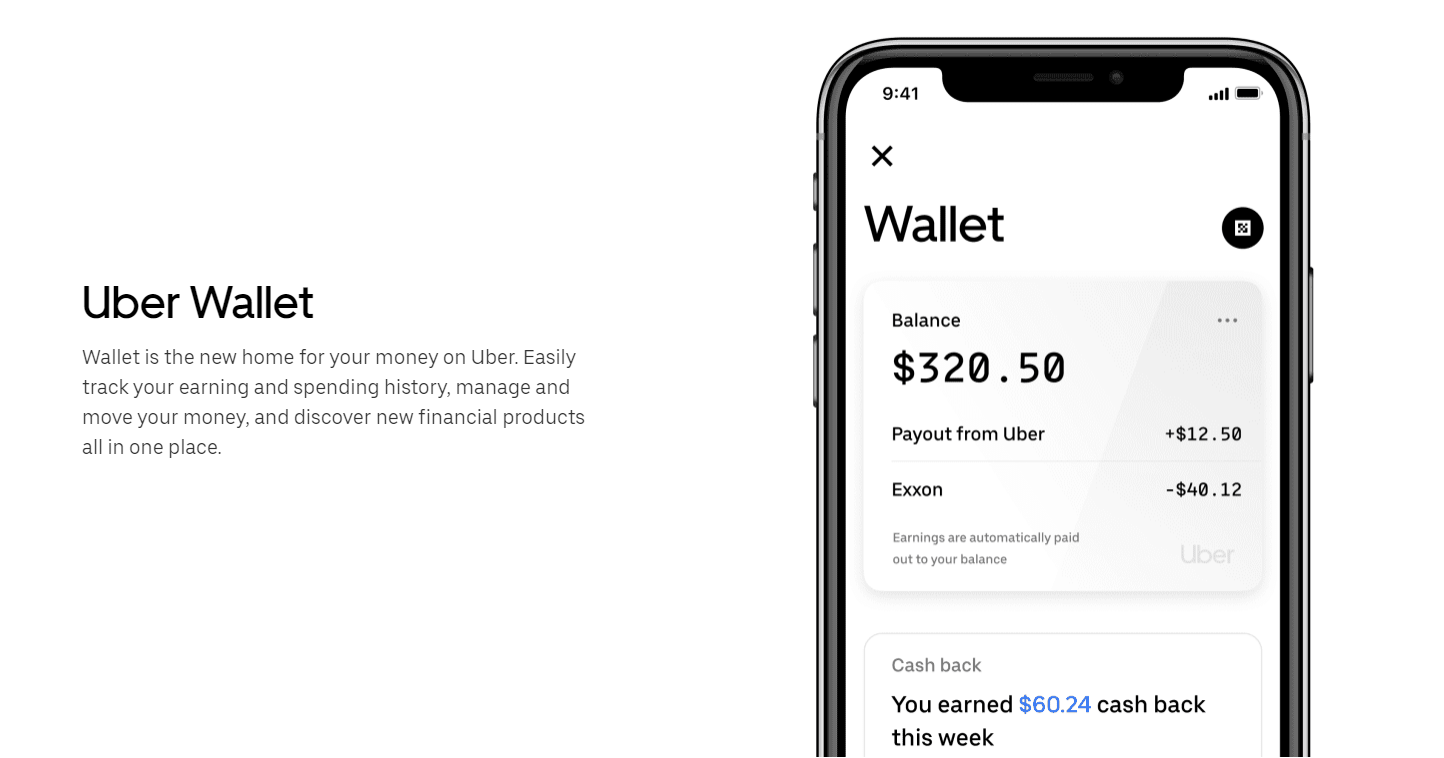

There is no finance, there is only WeChat / Tencent?

I don't know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

Read More