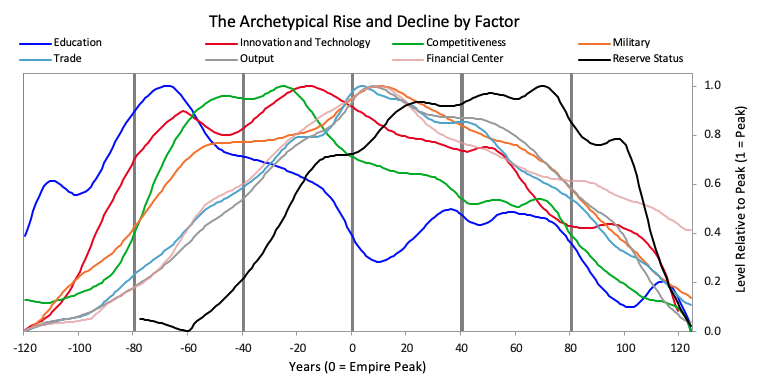

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

Read MoreA digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.

Read MoreThis week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let's not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

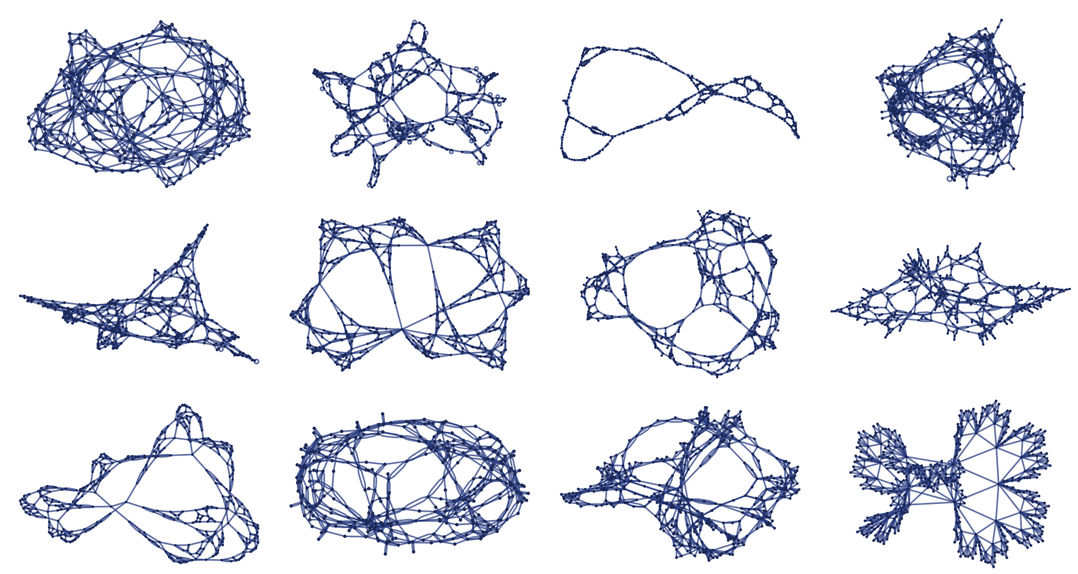

Read MoreI came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

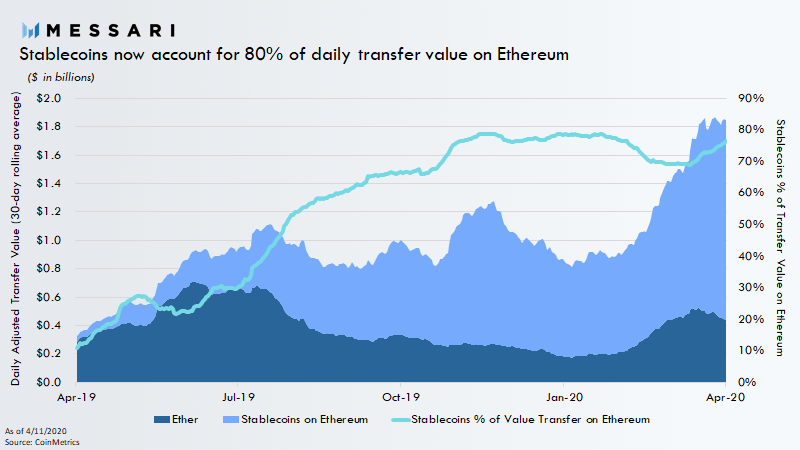

Read MoreThis week, we look at cash -- blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

Read MoreThis week, we dive into the social, economic, and financial implications of data in a post-COVID world. As Apple and Google work to build out the government's contact tracing apps to combat pandemic, what Pandora's box are we opening without consideration? As Plaid reaches into payroll data to accelerate small business bailouts, what power do we hand to aggregators? Will dignity-preserving solutions come to market in time? The opportunity for decentralized identity and data storage is clearer than ever. Or will fear drive us to make permanent compromises?

Read MoreWe look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

Read MoreThis week, we look at what positive innovations could arise from the pressure cooker of the pandemic. I touch on health care data and privacy, molecular technology, digital work- and play-spaces, and their financial implications. Channeled productively, the next decade could see advances in these fields that we can't yet imagine.

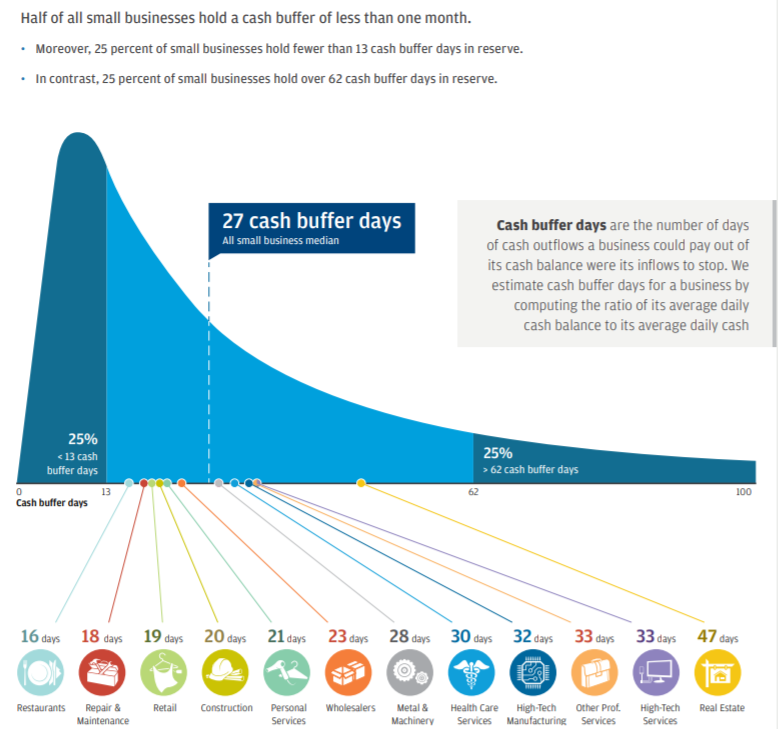

Read MoreAnother heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

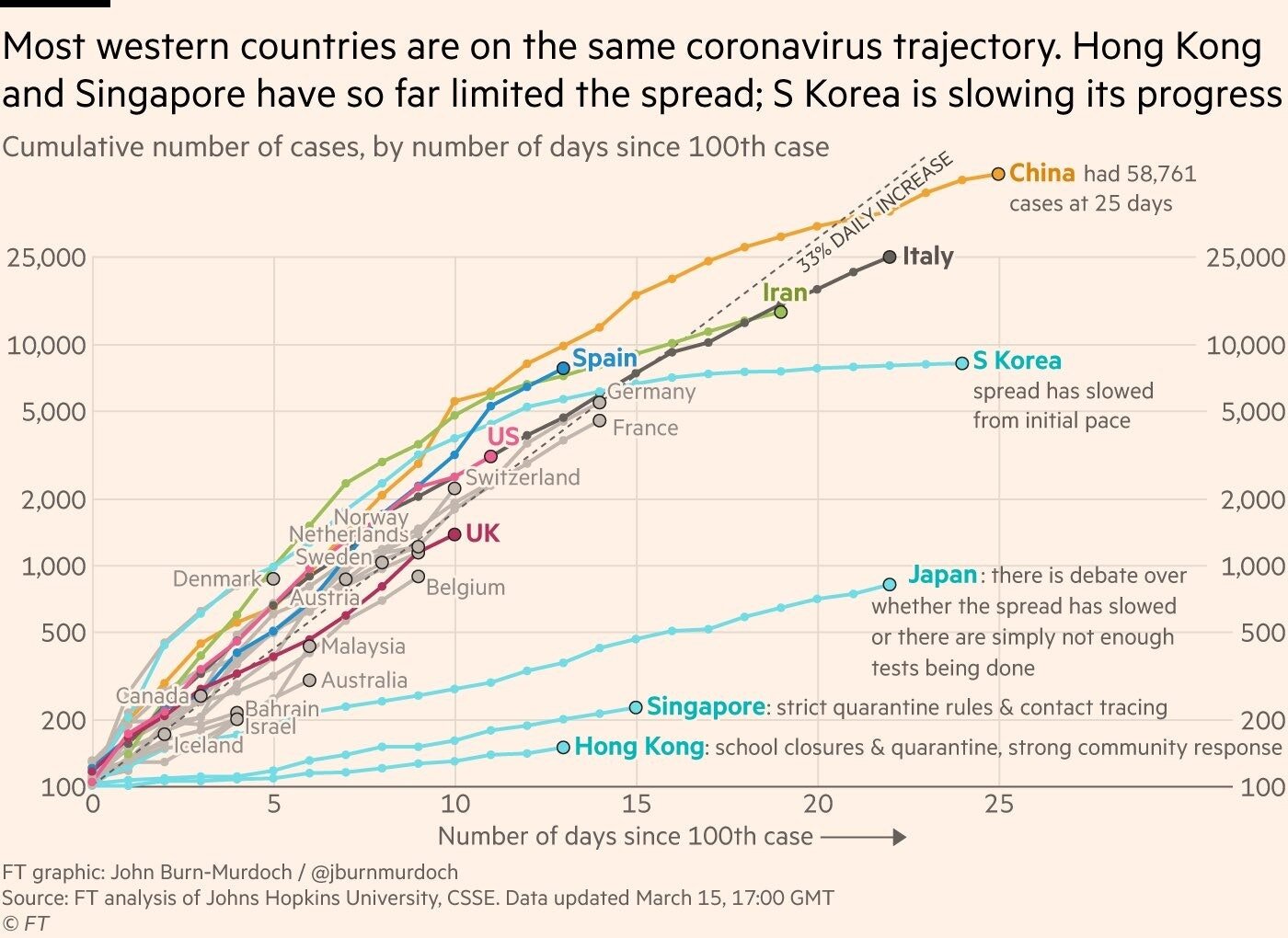

Read MoreI hope that you and yours are OK, socially distanced and stocked on essentials. Whether you feel it yet or not in daily life, the world is bracing for coronovirus impact. In this week's analysis, I look at the difficult trade-offs between health and economy, and try to quantify the impact of the likely slow-down. We look at some grim but useful concepts, like (1) the value of a statistical life, (2) what happened to the Soviet economy and life expectancy after perestroika, and (3) how our financial machines (NYSE, Robinhood, Maker DAO) are cracking at the edges. If you can do one thing -- be kind and gracious with each other as some things inevitably break.

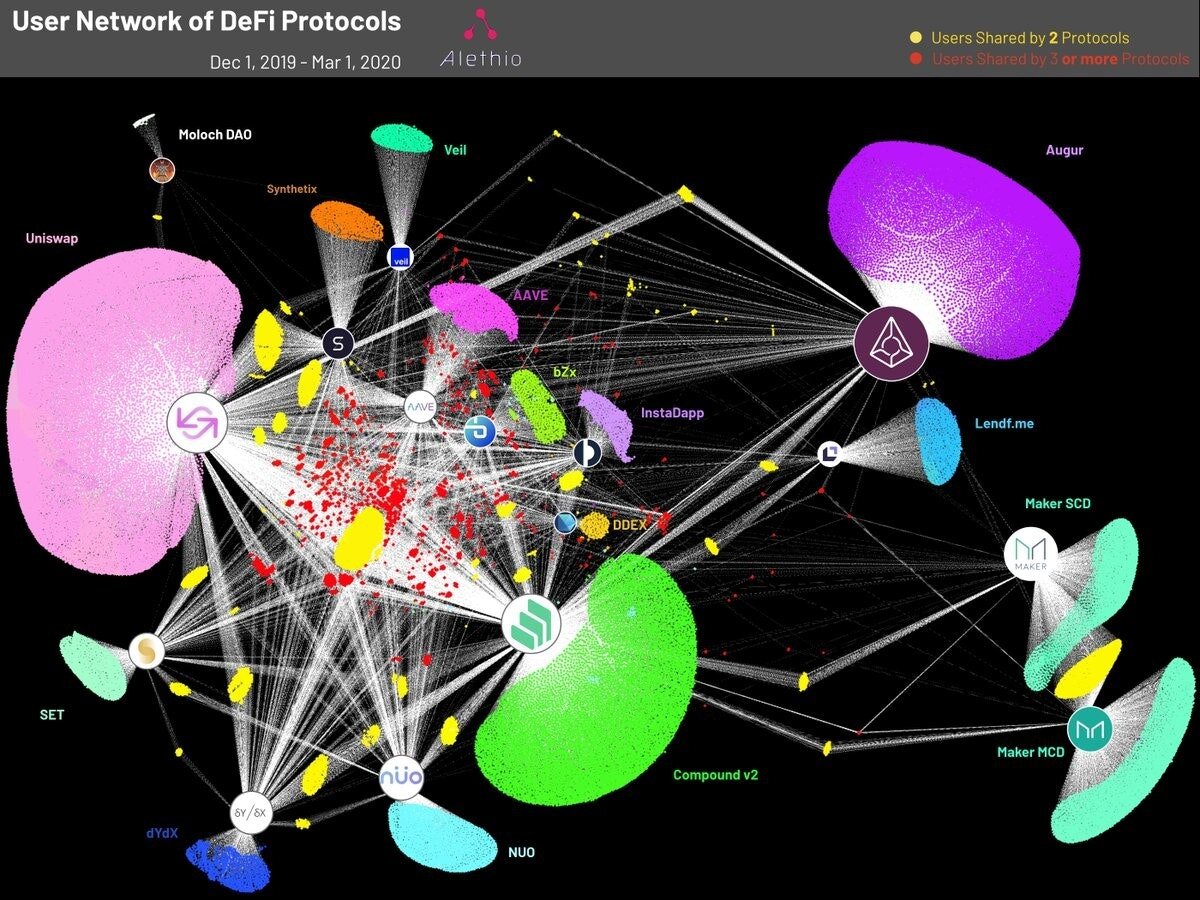

Read MoreI anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

Read MoreI look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!

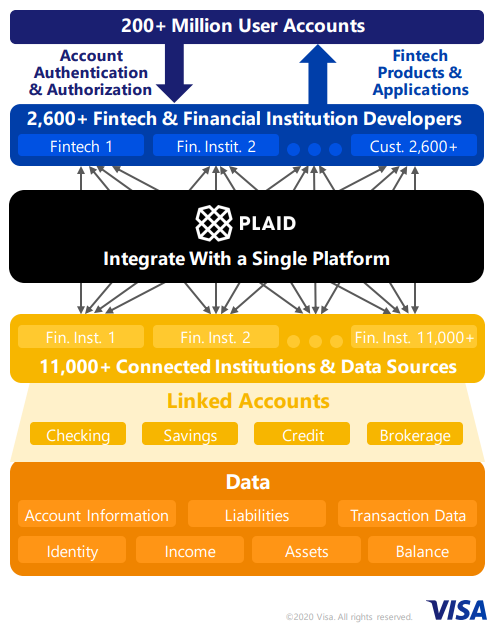

Read MoreI examine the unbelievable transformation and restructuring happening in high finance. Global bank HSBC is planning to lay off over 10% of staff, looking at reductions of 35,000. E*TRADE is being acquired by Morgan Stanley, integrating its 5,000,000 accounts and $360 billion of assets into the Wall Street investment firm. Legg Mason and its $800 billion of assets are being folded into Franklin Templeton for $4.5 billion, less than what Visa had paid for fintech data aggregator Plaid and half of what Robinhood is likely valued privately. How do we make sense of these developments? How do we appeal to the heart?

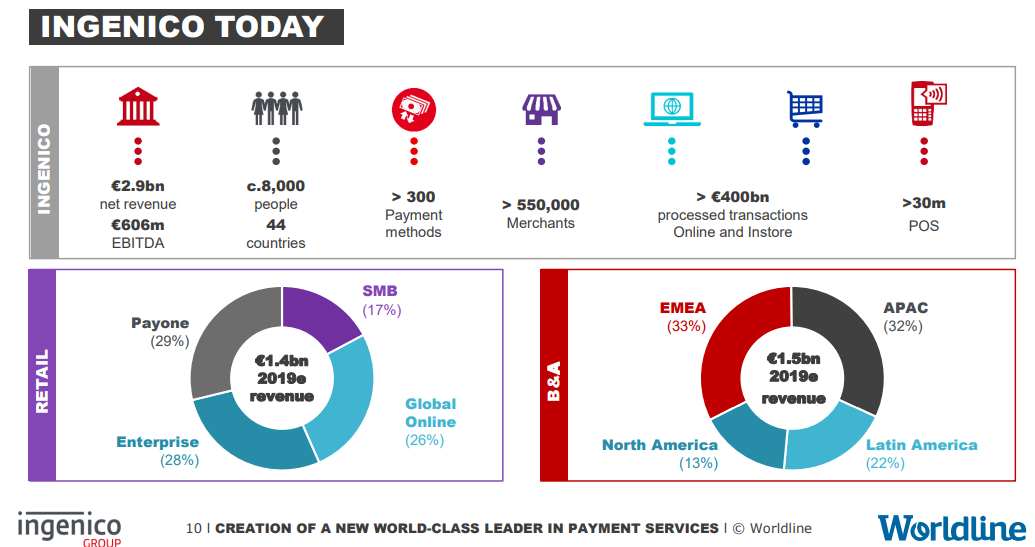

Read MoreI look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.

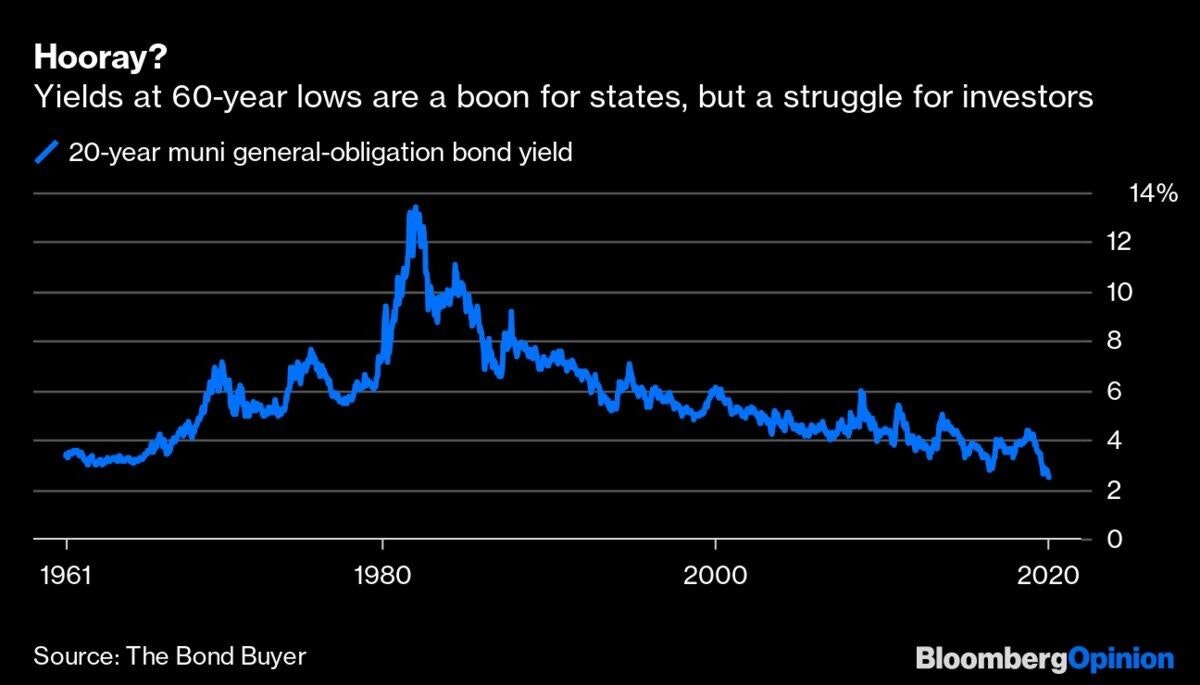

Read MoreI reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

Read MoreI discuss Citi's roboadvisor launch and why it took the firm 12 years to get to the party. We break down the difference between financial services ingredients and the organizations that combine those ingredients to manufacture and distribute financial products. We also look at how that consumer prerogative is defining the asset management industry, and the consolidation towards monolithic passive indexing providers. Last, we talk about how people prefer mass produced Twinkies to expensive artisanal desserts. Yummy!

Read MoreI examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

Read MoreI dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

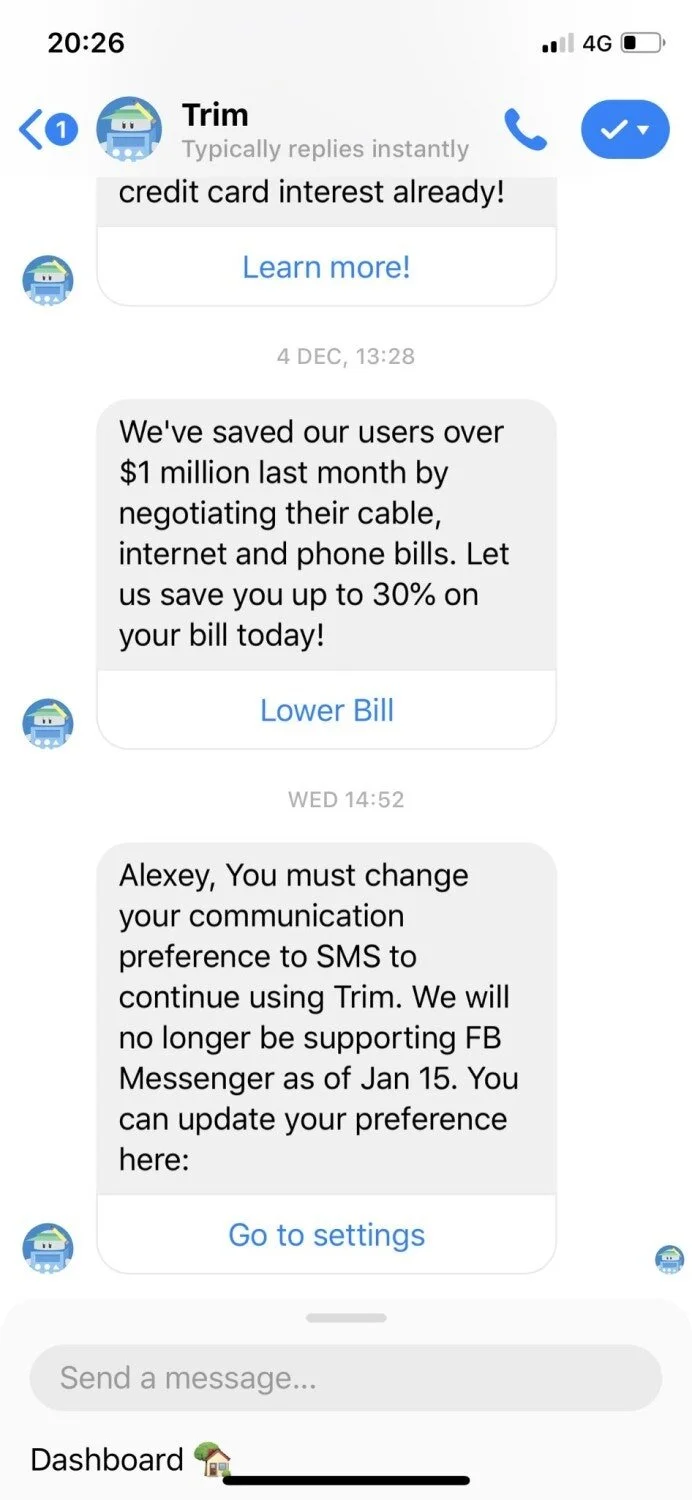

Read MoreIn the long take this week, I try out a contrarian point of view on personal finance chatbots. Trim, a savings chatbot, just withdrew support from Facebook Messenger. While lots of other chatbots are still invested in conversational banking, what could we take away from the counterfactual of chatbots failing to get B2C traction? What is the impact on the rest of the platform wars waged by Amazon, Google, and Tesla for connected homes, cars, and the Internet of Things?

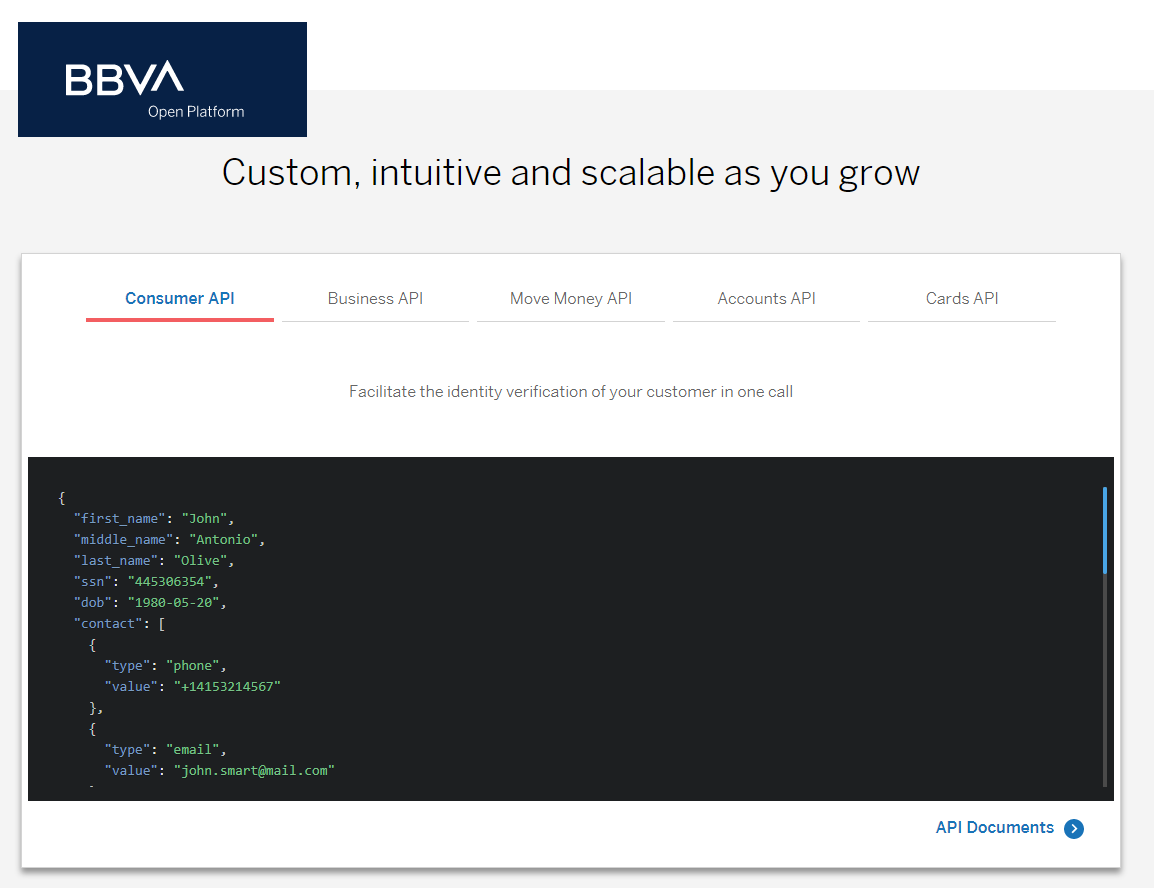

Read MoreAnyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

Read More