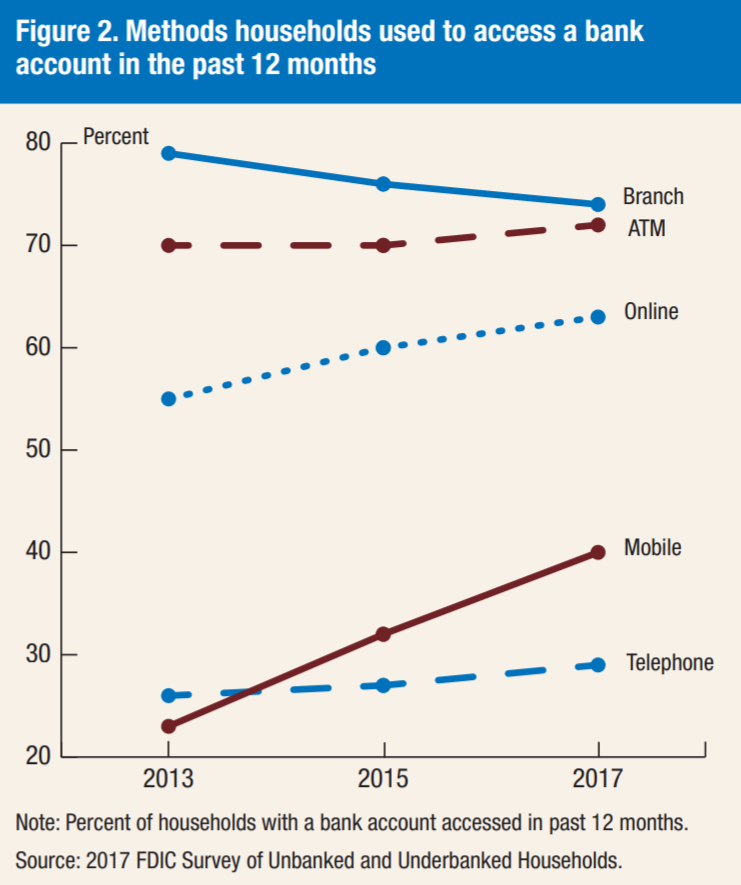

Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

Read MoreIn the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

Read MoreWhy are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.

Read MoreWe look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

Read MoreI look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

Read MoreWell this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

Read MoreChlöe Swarbrick, a 25-year old climate MP was presenting her climate change case to the New Zealand parliament, and was heckled by an older audience member. Without missing a beat, she acknowledged and dismissed the challenger with a pithy “Ok, Boomer.”

The recording has since gone viral, inspiring everything from merchandise to Vogue articles. While the incident isn’t the source of the phrase “Ok, Boomer”, today it is the most well known manifestation. So what does the phrase mean? If you are inclined to more colorful language, see Urban Dictionary. But the meaning is obvious on its face — Gen Z is dismissing utterly and without consideration the judgment and protestations of society's elders on multi generational issues like economics, climate change, and social norms.

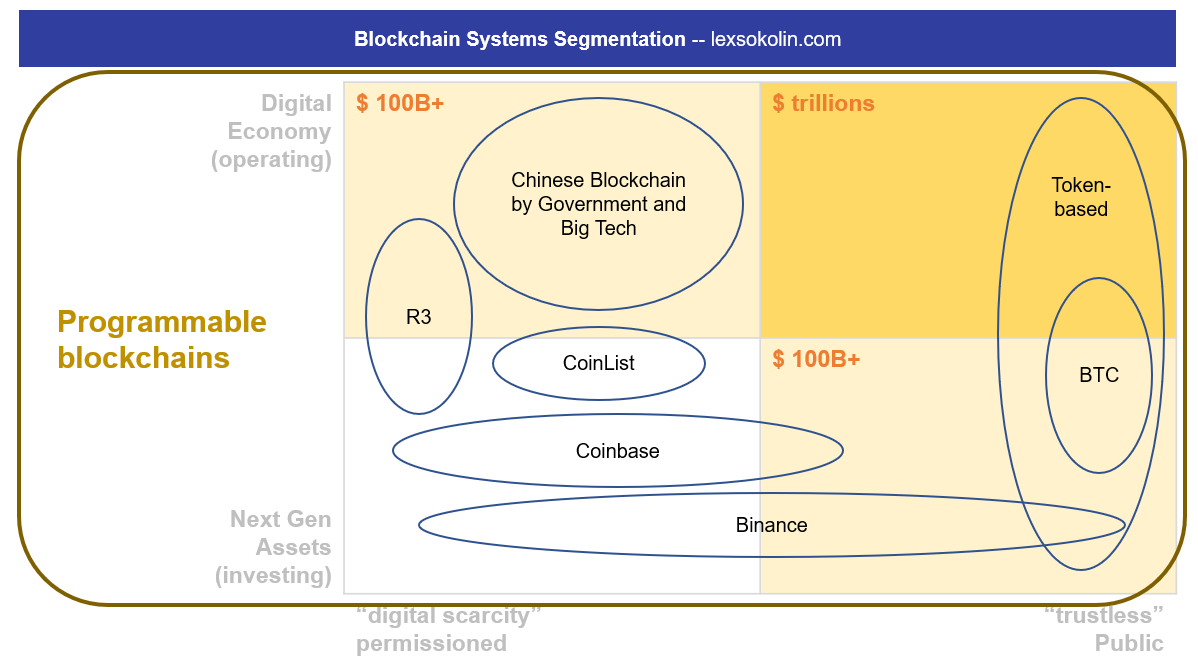

Read MoreLook at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.

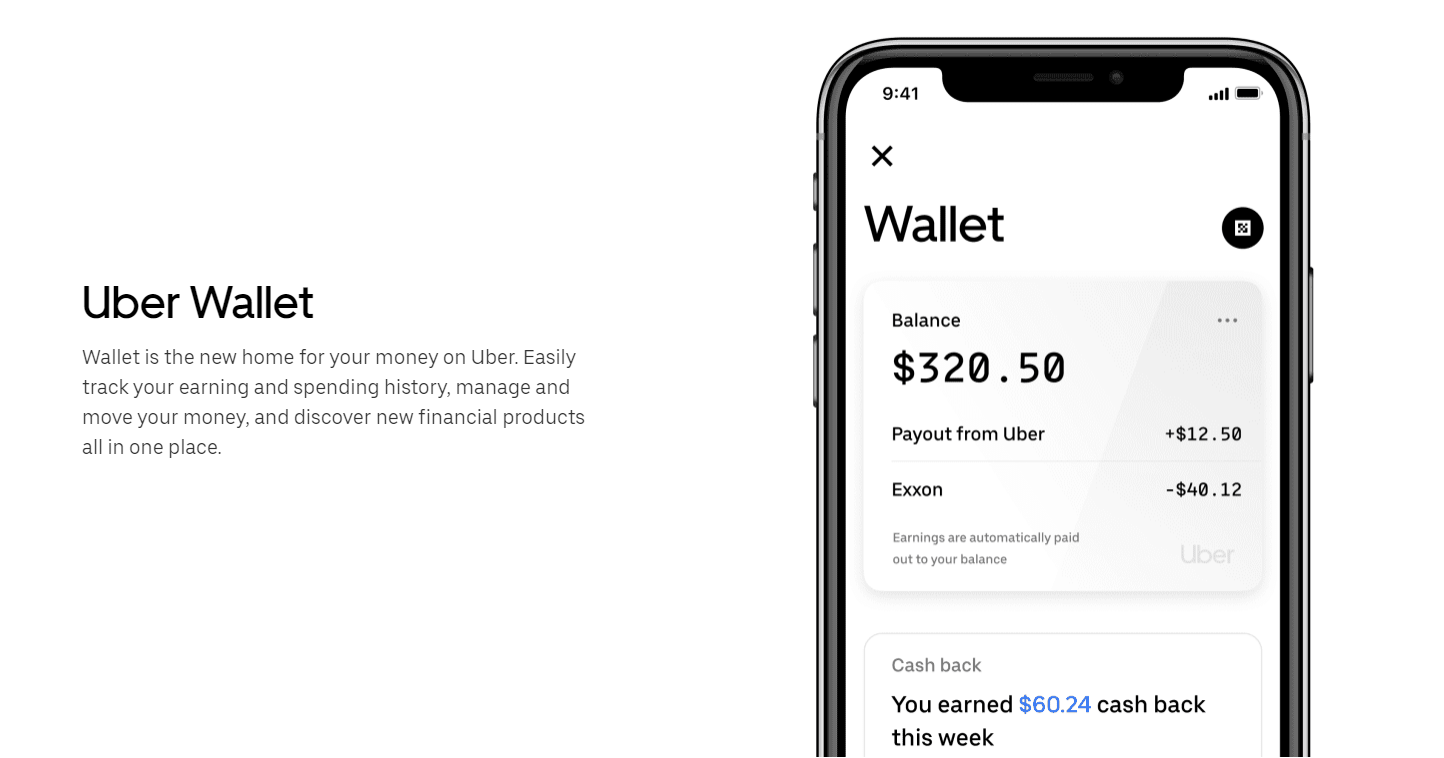

Read MoreUber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

Read MoreI look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

Read MoreLet’s look at the recent Fortnite blackout and compare it to neobank Chime's embarassing down time, as well as explore the business model implication of what it means to be the social square where people hang out. Does Finance have such an equivalent? Maybe it is Venmo, crypto Twitter, or the credit unions. We also look at statistics behind influencer marketing, and how influencers have usurped the position of music labels. Perhaps banks should get ahead of this game too.

Read MoreI look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

Read MoreWe are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

Read MoreFeelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

Read MoreI've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

Read MoreAssurance came on my radar courtesy of Financial Technology Partners, which was the investment banker on Assurance's $3.5 billion sale to Prudential. Notably, the company is just 3 years old -- which comes out to a cool billion of enterprise value per year, likely a record comparable to the very few Ant Financials. Depending on the details, this is about $25 million of value per employee. So what does the company do? Simple, really. It is a destination website licensed to sell all types of insurance product (e.g., life, health, auto), with a clean onboarding questionnaire like any other roboadvisor, which then matches against policies on offer from third parties. AI and data science are used as the recommendation engine. It is a Kayak or Money Supermarket of insurance, simply designed, cleverly wired, with killer founders.

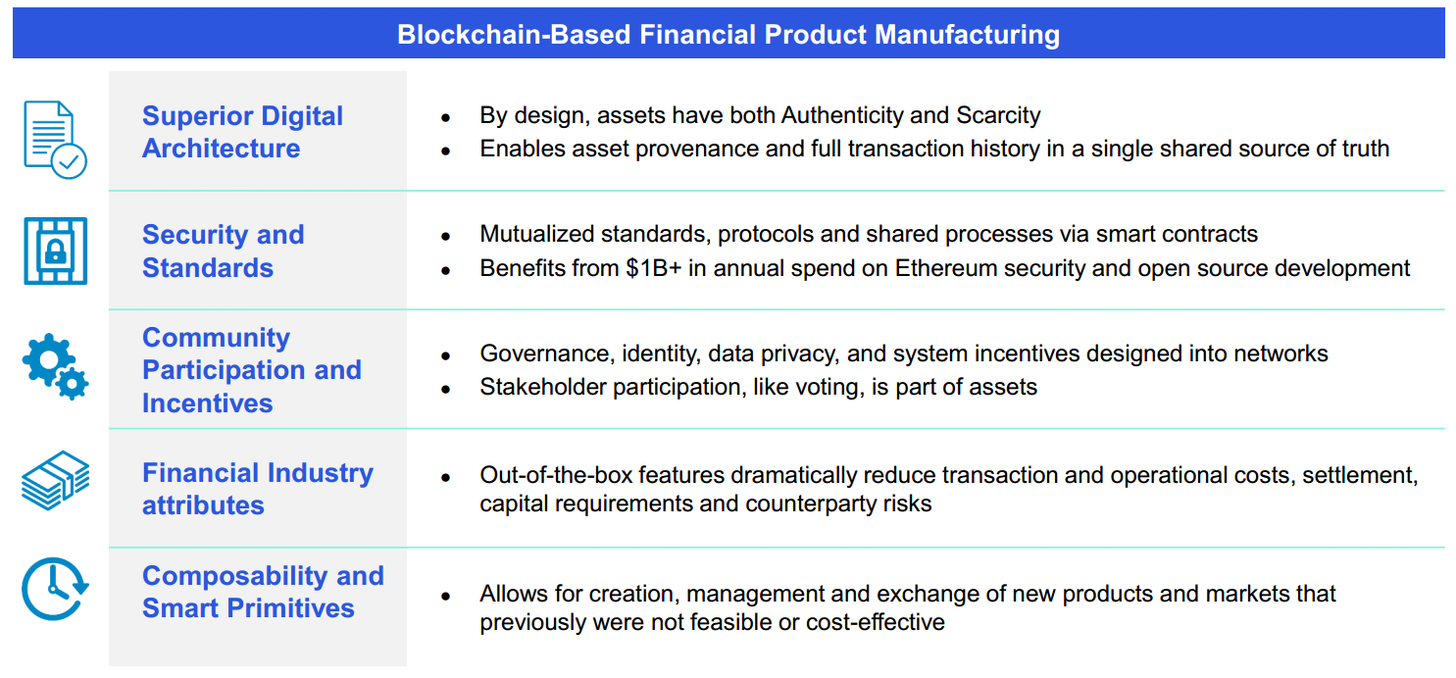

Read MoreBut nothing feels fundamentally different. Yes, we have some new brands that live on our phones. But when sliced across deposits, volume, or assets under management, the public companies still do the lion's share of the financial work. With open banking, incumbents are likely to win even more, powering Apple's credit card for example. The core reason for this, I think, is that Fintech has democratized access to existing financial products. It has not really changed how those products are manufactured. Only by transforming how things are made and the value chains to deliver them can you build the Google, Netflix, Spotify, or Uber of the next generation.

Read MoreFrom a financial incumbent point of view, if you are going to mutualize infrastructure, you need to actually mutualize the infrastructure. This means solving the game theory problem of accidentally giving away the value of your back office systems to your biggest, best-funded bank competitor -- not a competitive equilibrium. To that end, technology companies are a natural place for maintaining crypto systems. However, note that public chains today already have the benefit of billions of dollars in cyber-security spending (i.e., mining) and the dedicated engineering of thousands of open source developers. By choosing to use a public chain, you get this out of the box. With a proprieraty solution, even if the end-results are open-sourced, community is impossible to replicate. Maybe this is why IBM bought Red Hat for $34 billion, and Microsoft bought GitHub for $7 billion.

Read MoreHow do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

Read MoreI've got a gentle, data-backed story this week inspired by a great distinction made in this Techonomy article by the Chief Digital Officer at Schneider Electric. The thesis tracks three key lessons from attempting to bring large companies into the 21st century: (1) transform the core of your business instead of fumbling around at the edges, (2) digitize your processes and separately figure out a distinct digital model, and (3) catalyze a digital ecosystem from the new model. You can think about the distinction as either taking the existing business and slowly swapping out parts from human to machine (e.g., like RoboCop), or building the robot from scratch utilizing the latest platforms, markets, and artificial intelligence (e.g., like Terminator).

Read More