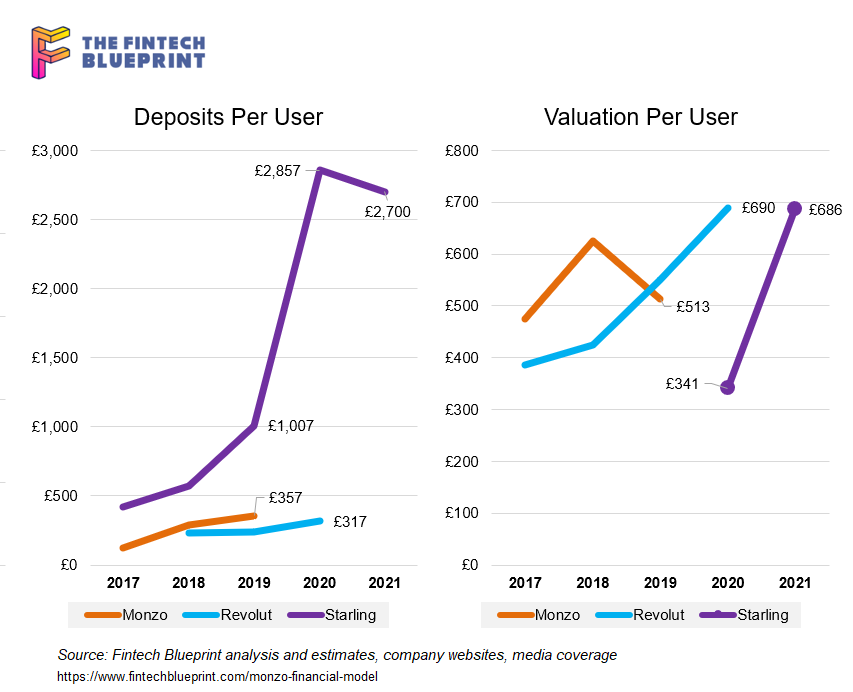

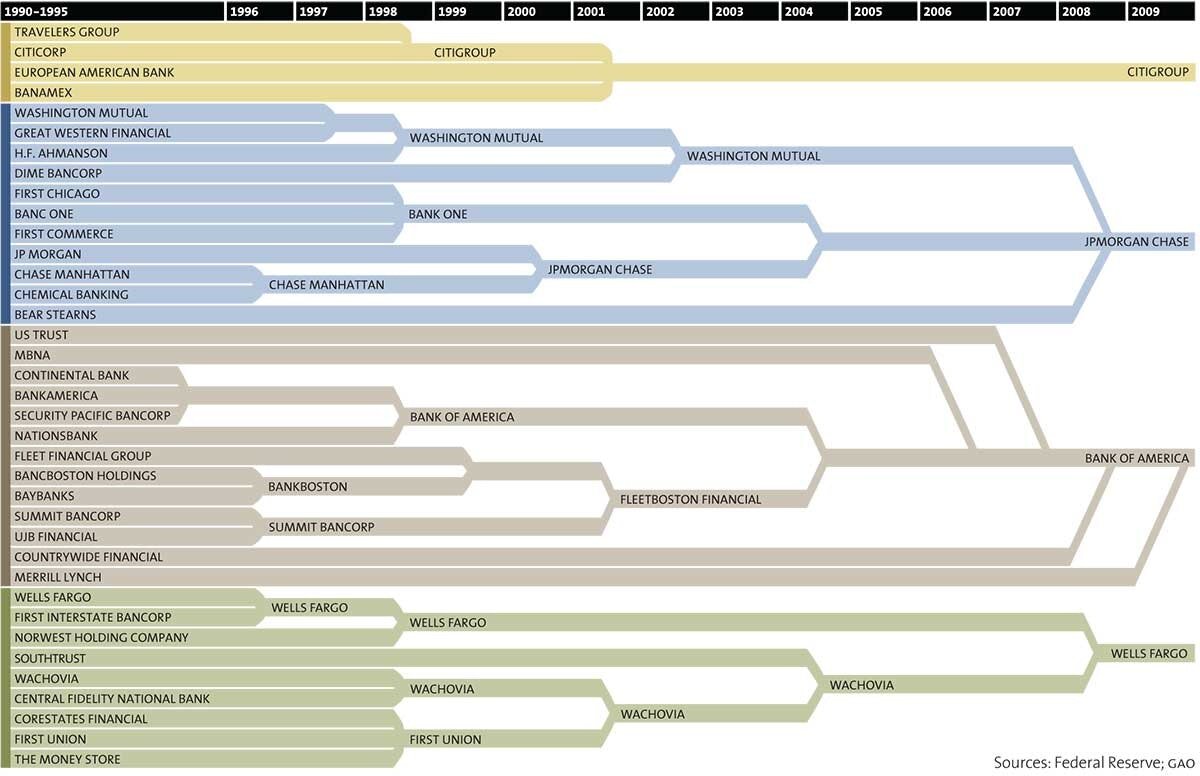

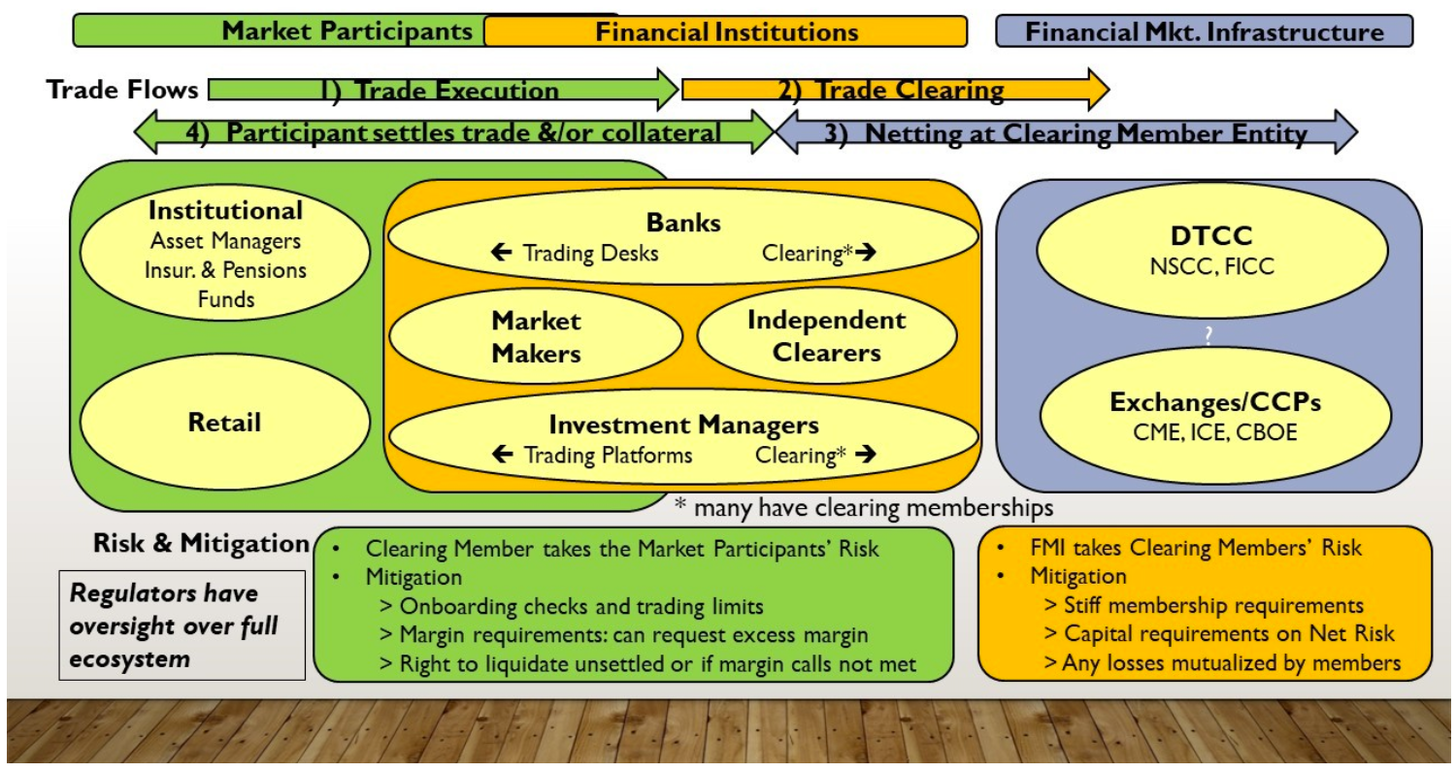

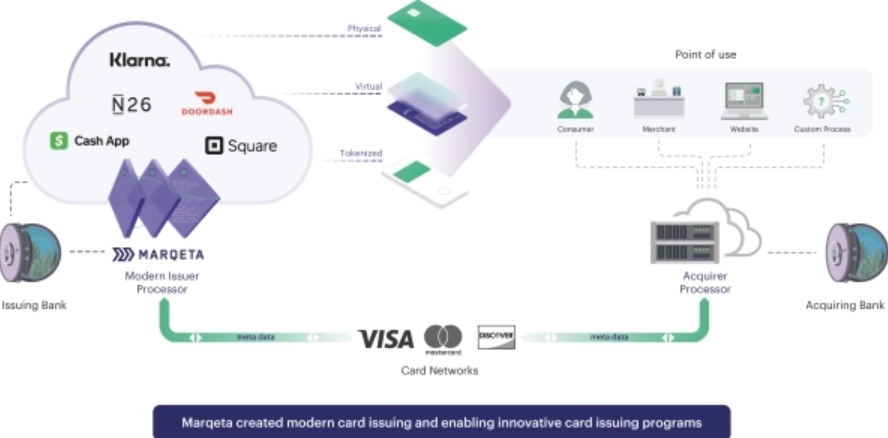

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

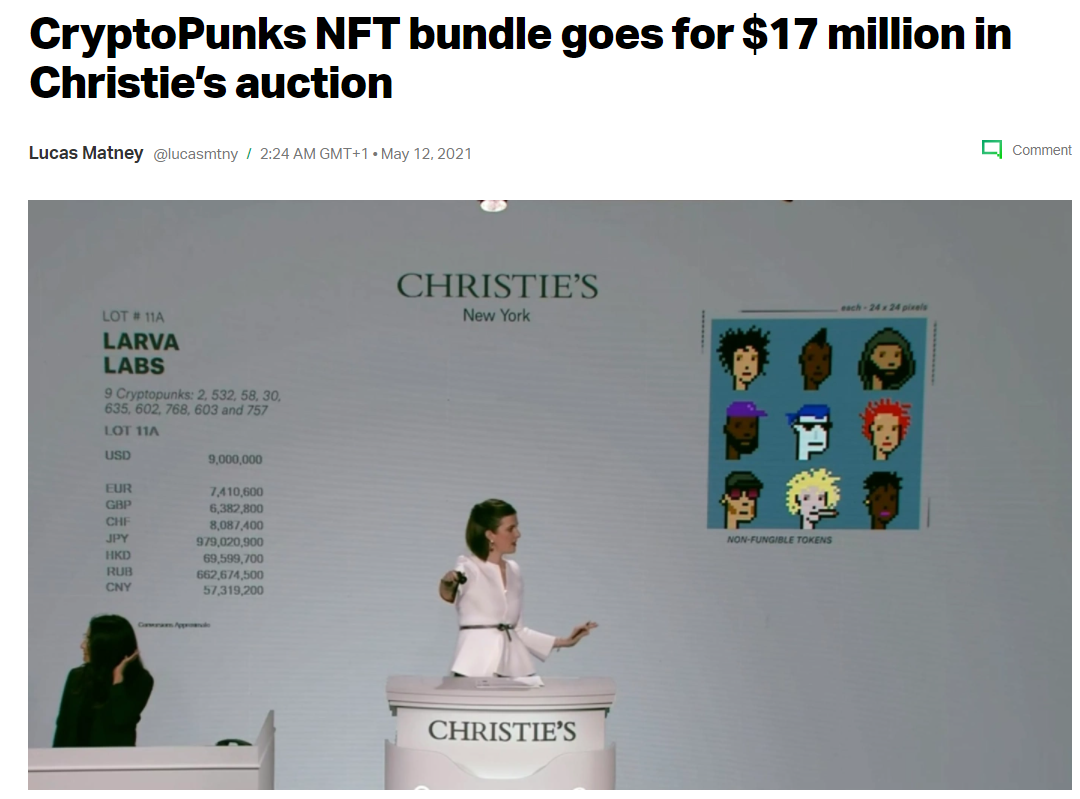

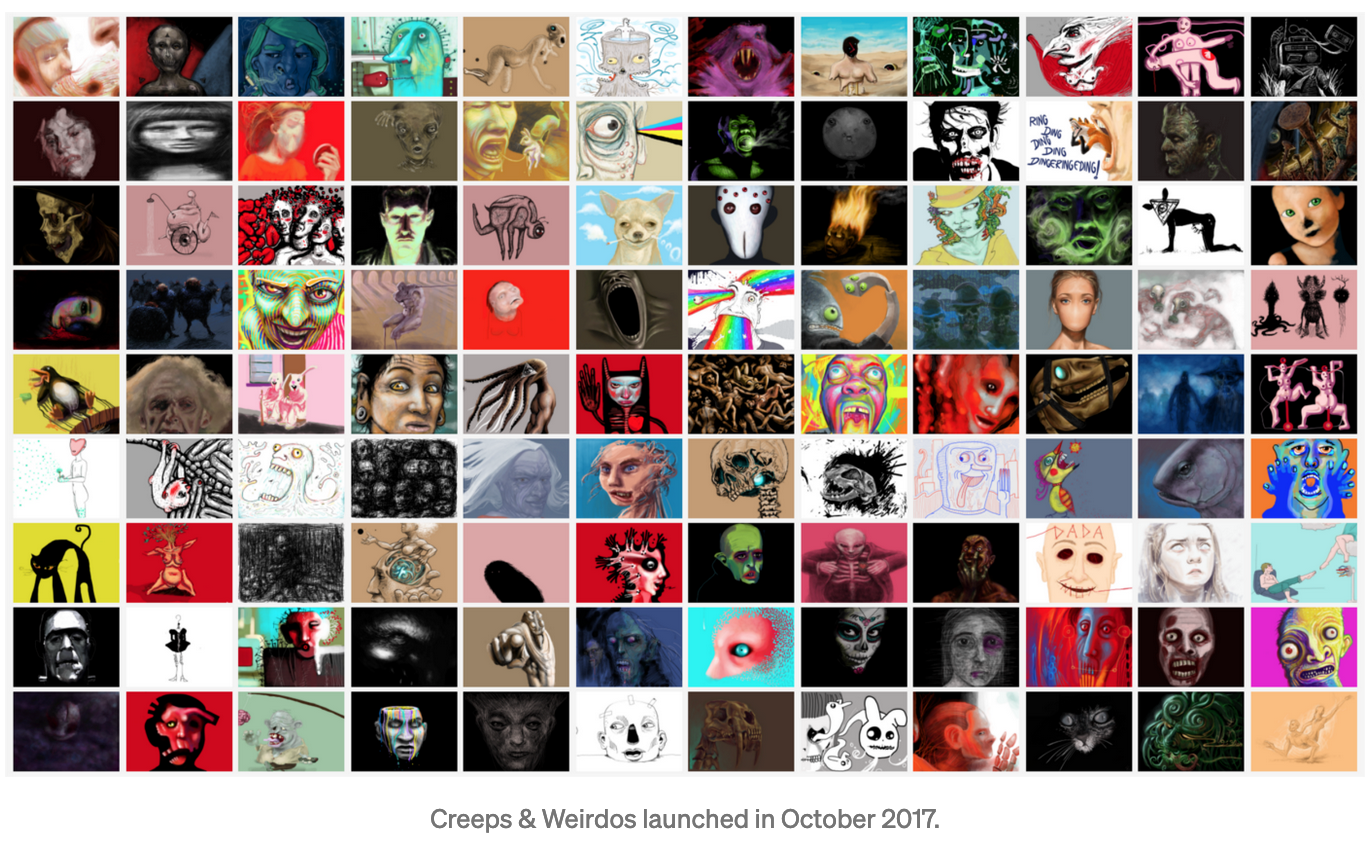

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

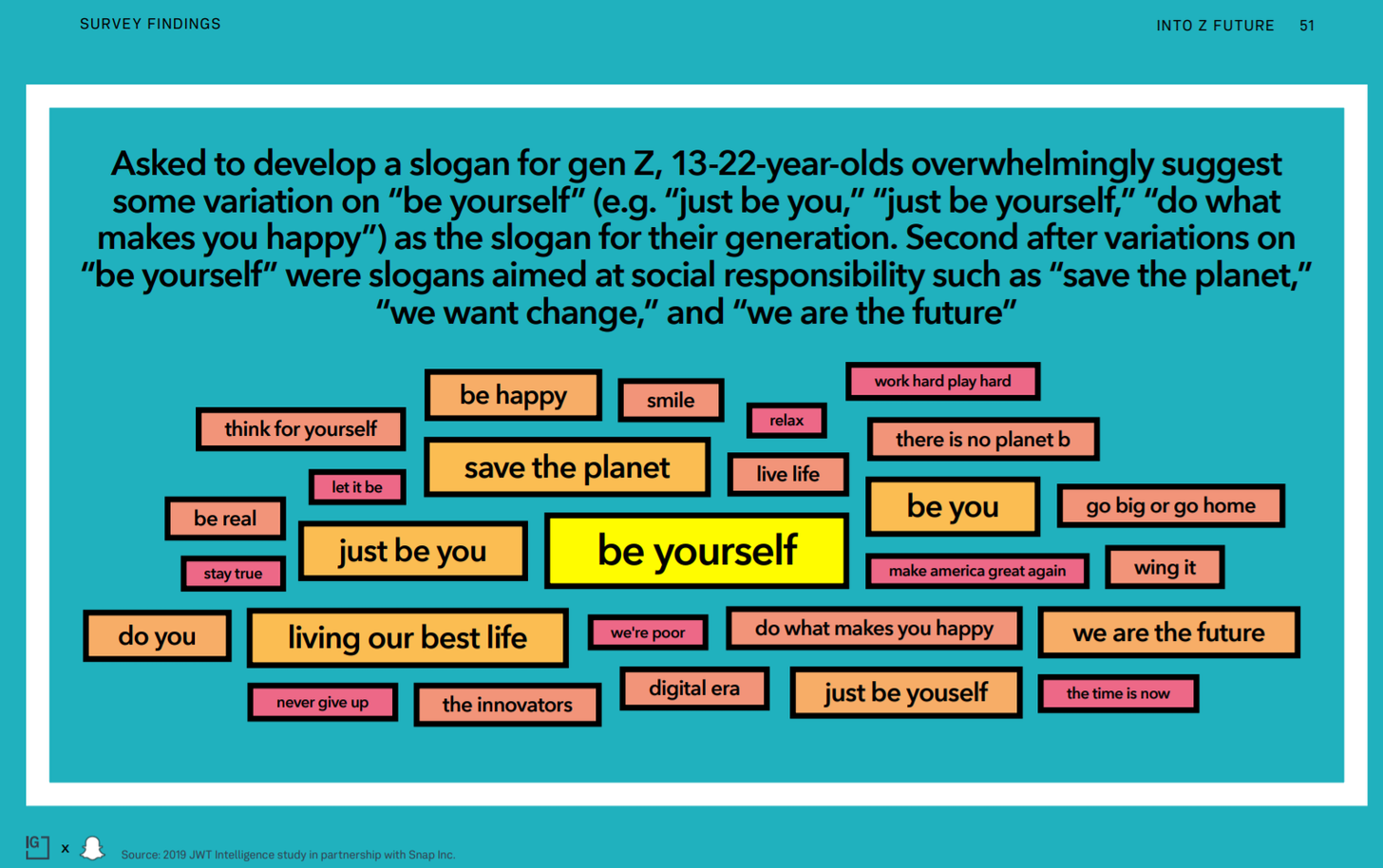

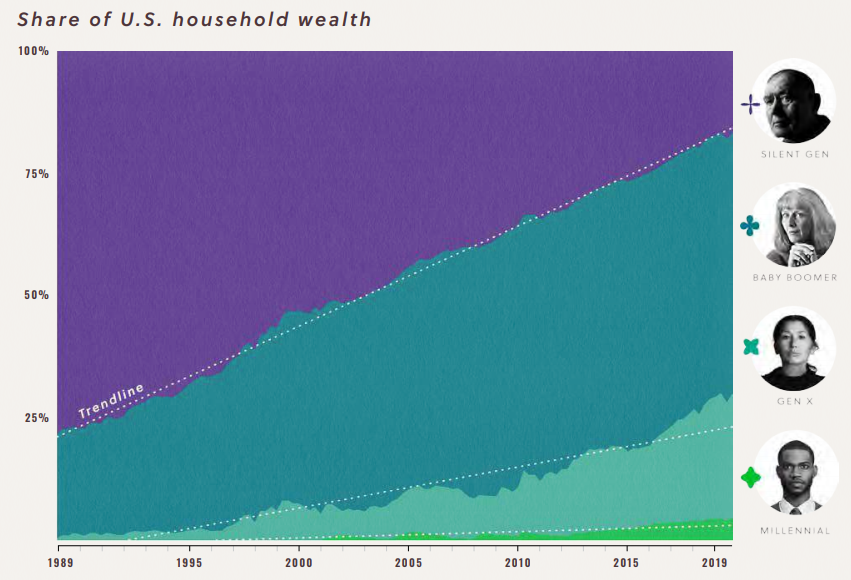

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.

Read More