This week, we look at:

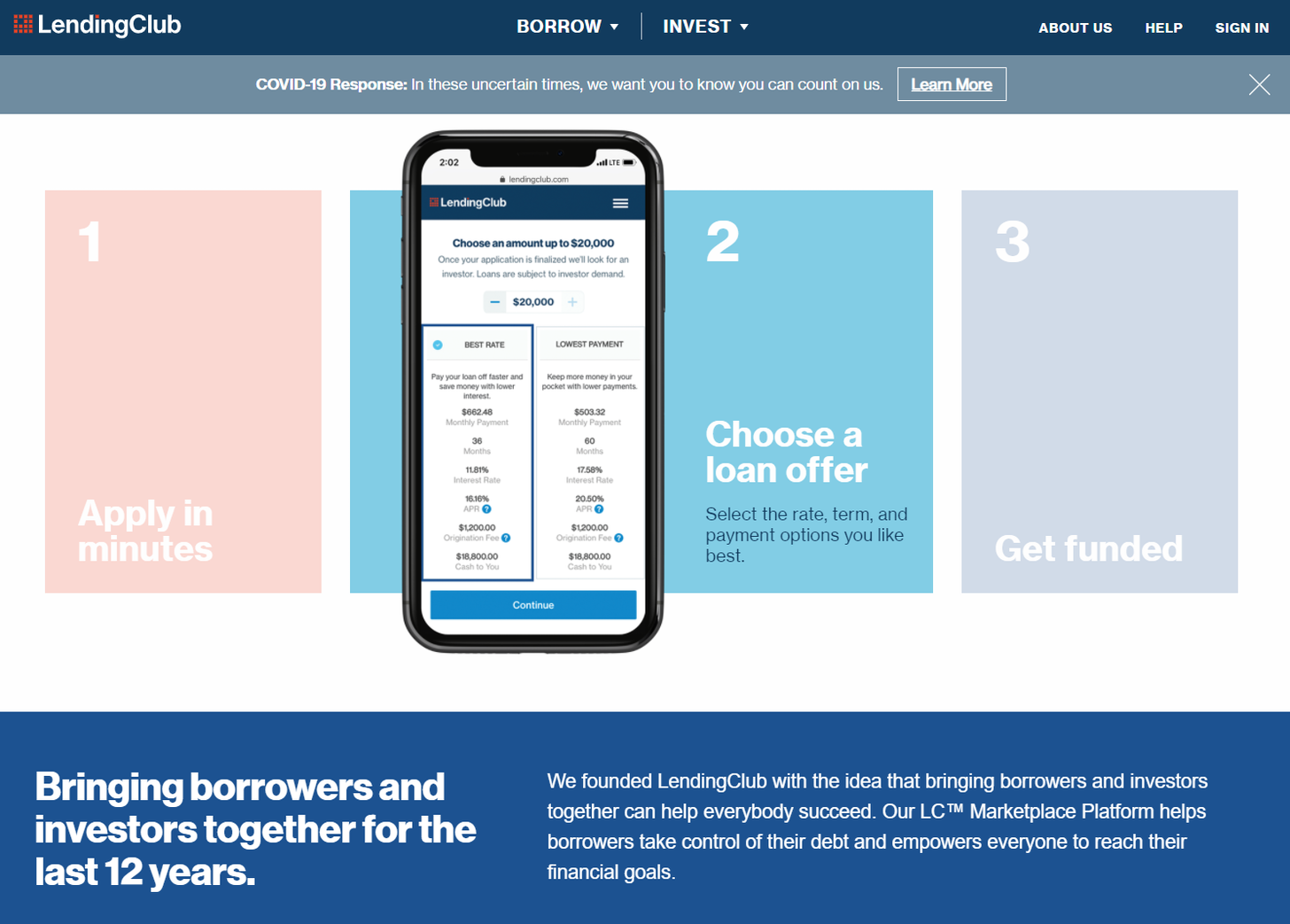

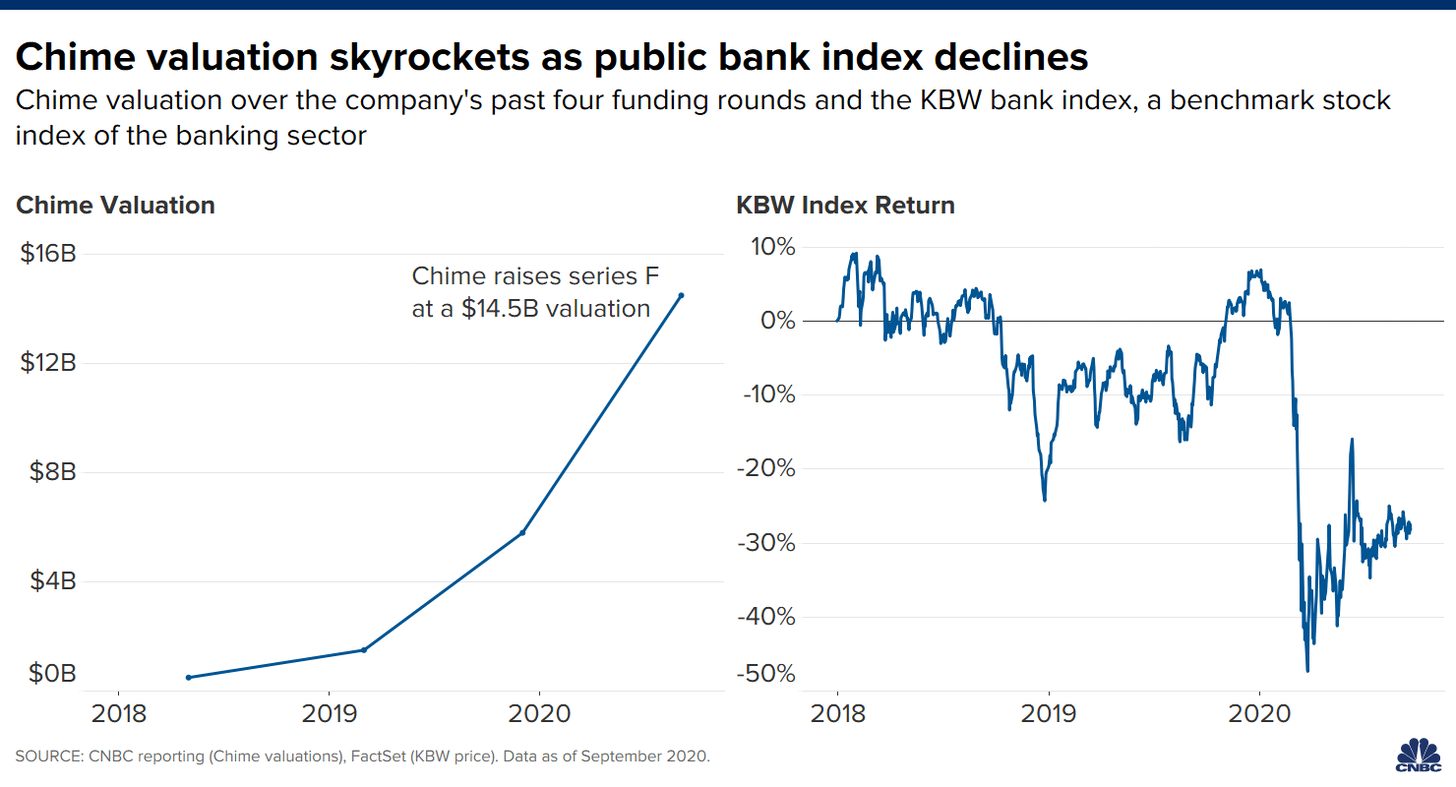

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

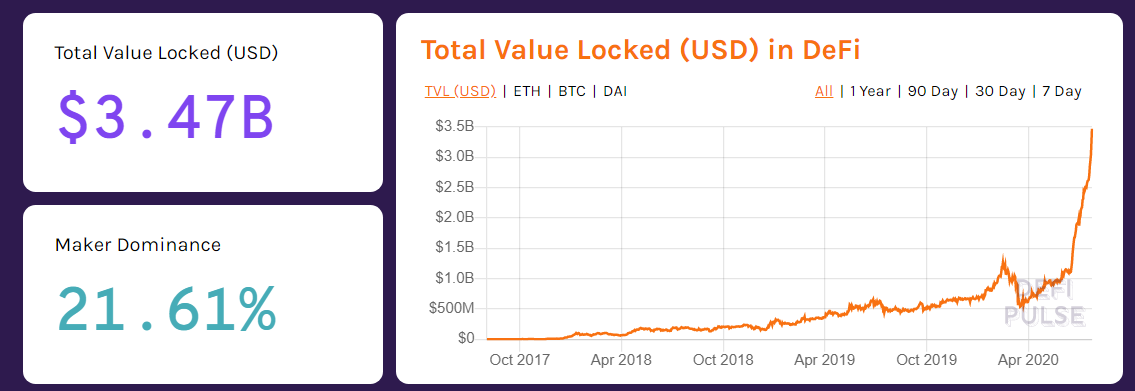

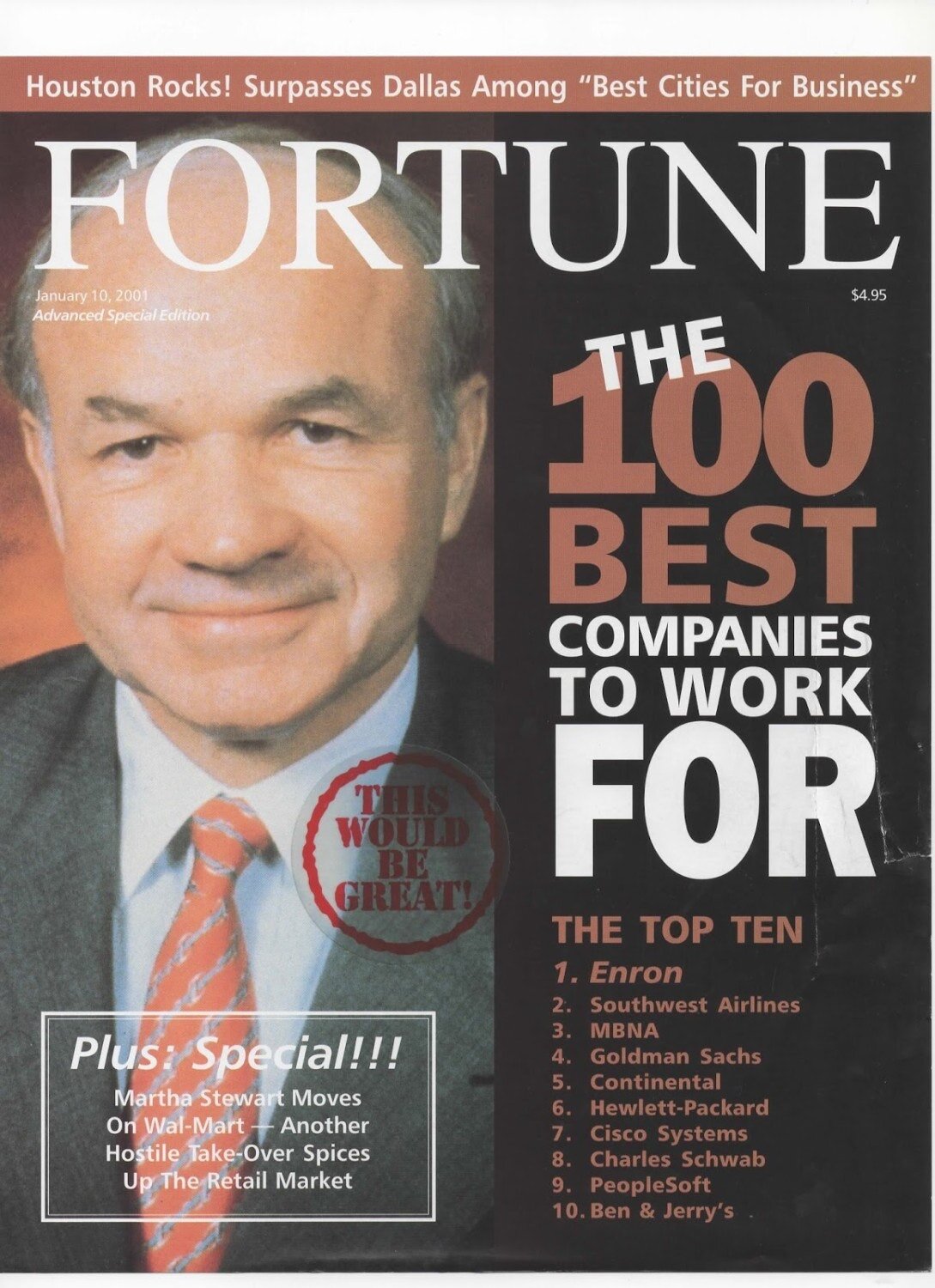

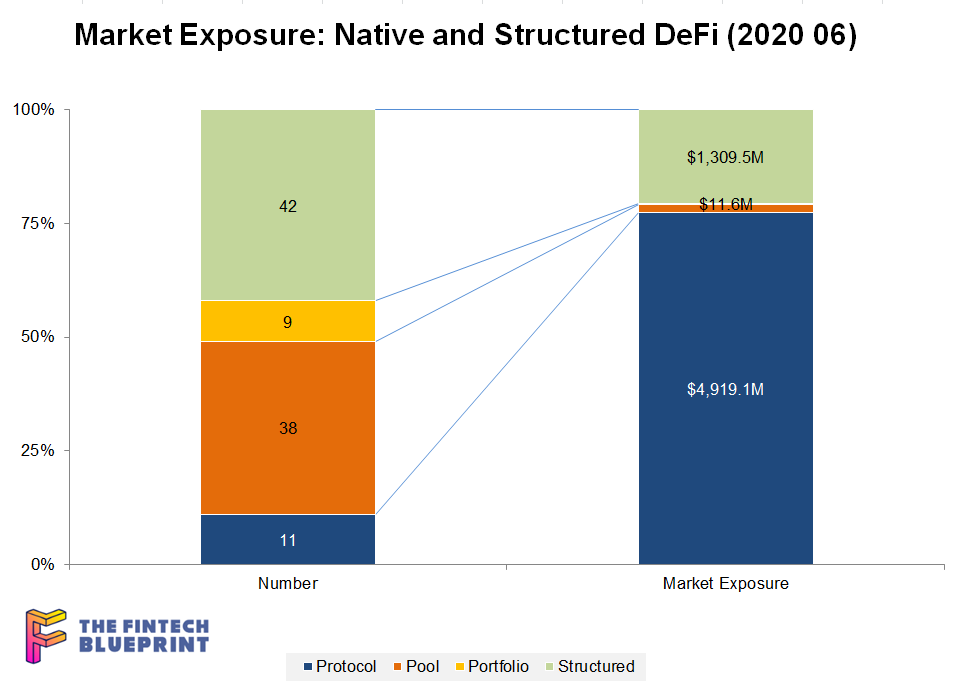

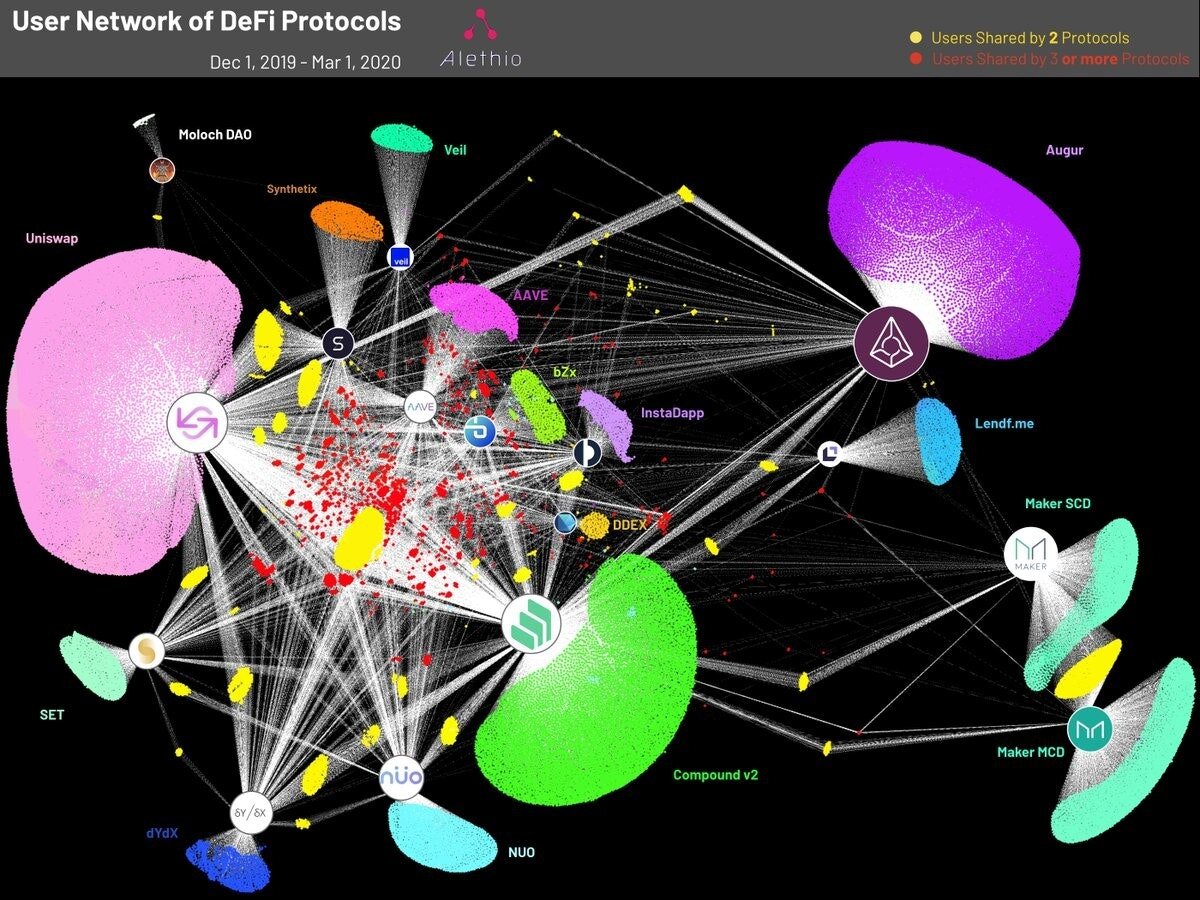

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma