In this conversation, we talk with Mike Belshe, CEO of BitGo and expert technologist about custody, prime brokerage, and the evolution of the institutional digital asset industry.

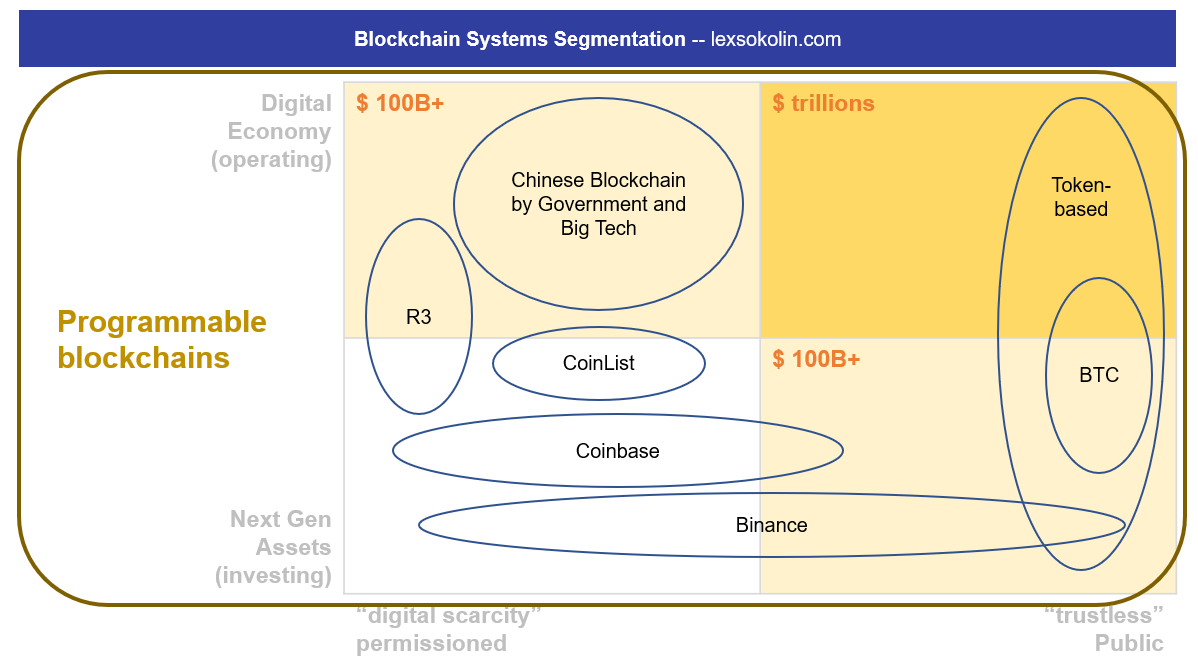

I often mention that crypto is still all about capital markets trading (i.e., manufacturing) and not about wealth management (i.e., distribution). This conversation touches on where we are in the maturity of market infrastructure, the role of fiduciaries, and the path forward. If you are sitting in a RIA, investment fund, or other asset manager, pay attention!

Read More