In this discussion, we explore ways that Stripe — arguably the best American fintech company full-stop, although who would want to mess with Square — could be entering the crypto space. We consider approaches similar to the payment onramps, then discuss the underlying market structure powering those experiences, and highlight more generally the role of gateways relative to protocols. We touch on the role of custodians, banks, and wallets, as well as Square’s attempt, the tbDEX, where KYC/AML comes down to forms of opt-in identity. Finally, we address questions about Circle and USDC, and how stablecoins differ from the rails on which they travel.

Read MoreWe anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

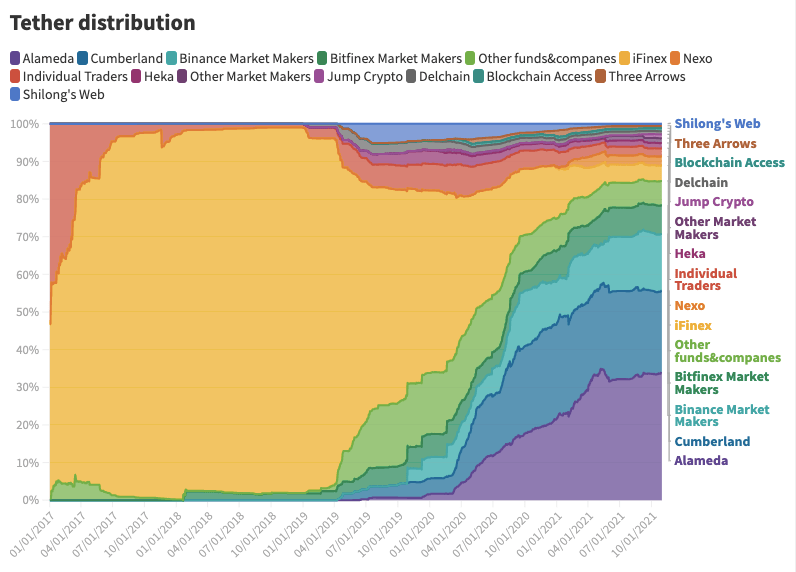

Read MoreWe look at a recent report from Protos that traces the issuance of USDT to the institutional players in the centralized crypto capital markets. The data reveals the market share of players like Alameda, Cumberland, Jump, and others in powering trading in exchanges. We try to contextualize this market structure with what exists both in (1) investment banking and (2) decentralized finance. The analogies are helpful to de-sensationalize the information and calculate some rough economics.

Read MoreWe discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

Read MoreIn this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

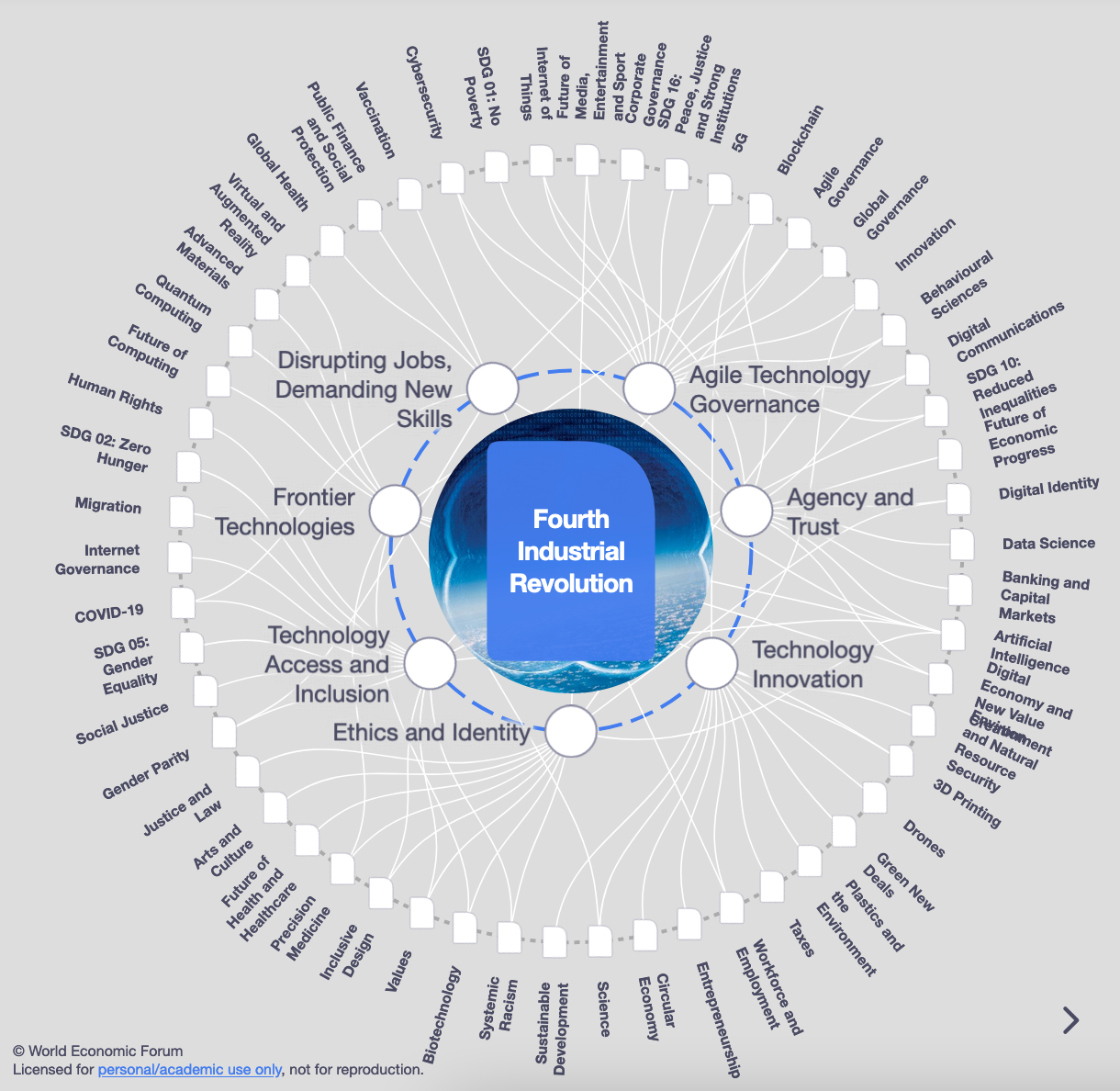

Read MoreIn this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

Read MoreThis week, we cover these ideas:

The nature of digital identity, and the difference between a representation at some moment of time vs. a record of your being

The launch of the DeFi Passport by Arcx and how it can be useful for underwriting

The European Digital Wallet, and the implication of such a development for CBDCs and government services

China’s CBDC, Sweden’s BankID, and other existential crises

If you want to go deeper on this topic, we strongly recommend our conversation with Michael Cena of the Ceramic Network here. Whereas Michael started working on the identity problem by trying to add labels to people, where he ended up is creating a protocol that tracks historic software activity and interactions between actors. In thinking about the Ship of Theseus, this is the solution that says — your identity is your journey through the river of time itself, and not any particular stop you make along the way.

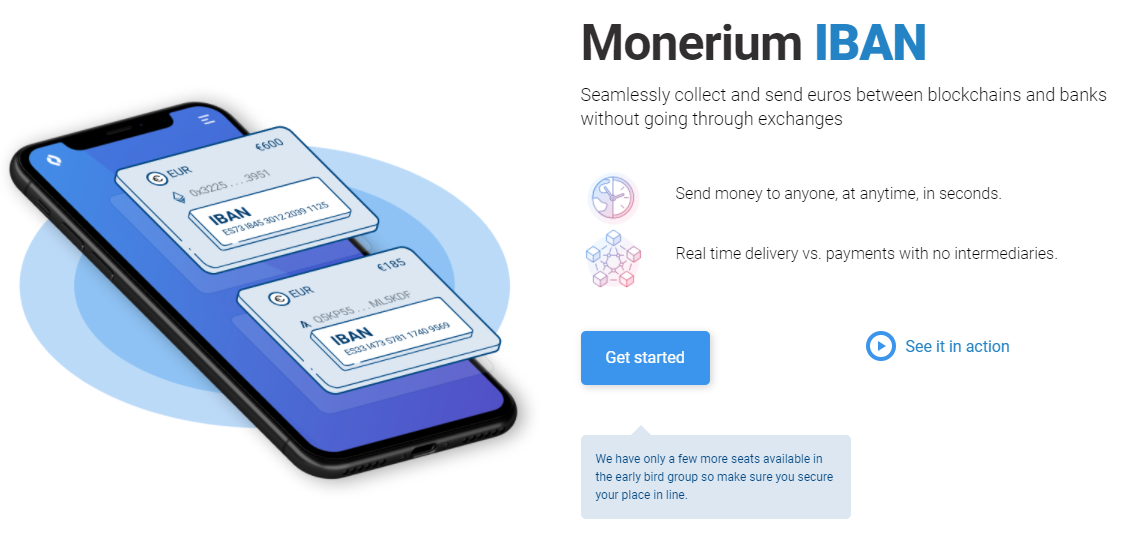

Read MoreIn this conversation, we talk with Jon Helgi Egilsson about his incredible journey to becoming Chairman and a co-founder of Monerium.

Jon is a former chairman and vice-chairman of the supervisory board of the Icelandic Central Bank, a former adjunct professor in financial engineering and MBA lecturer at Reykjavik University, a visiting scholar at Columbia University, and co-founder of four software companies. Additionally, we explore the various concepts of digital money in the framework creating a competitive yet unified environment between fiat money, banking based on fractional-reserve, and the token economy.

Read MoreThis week, we look at:

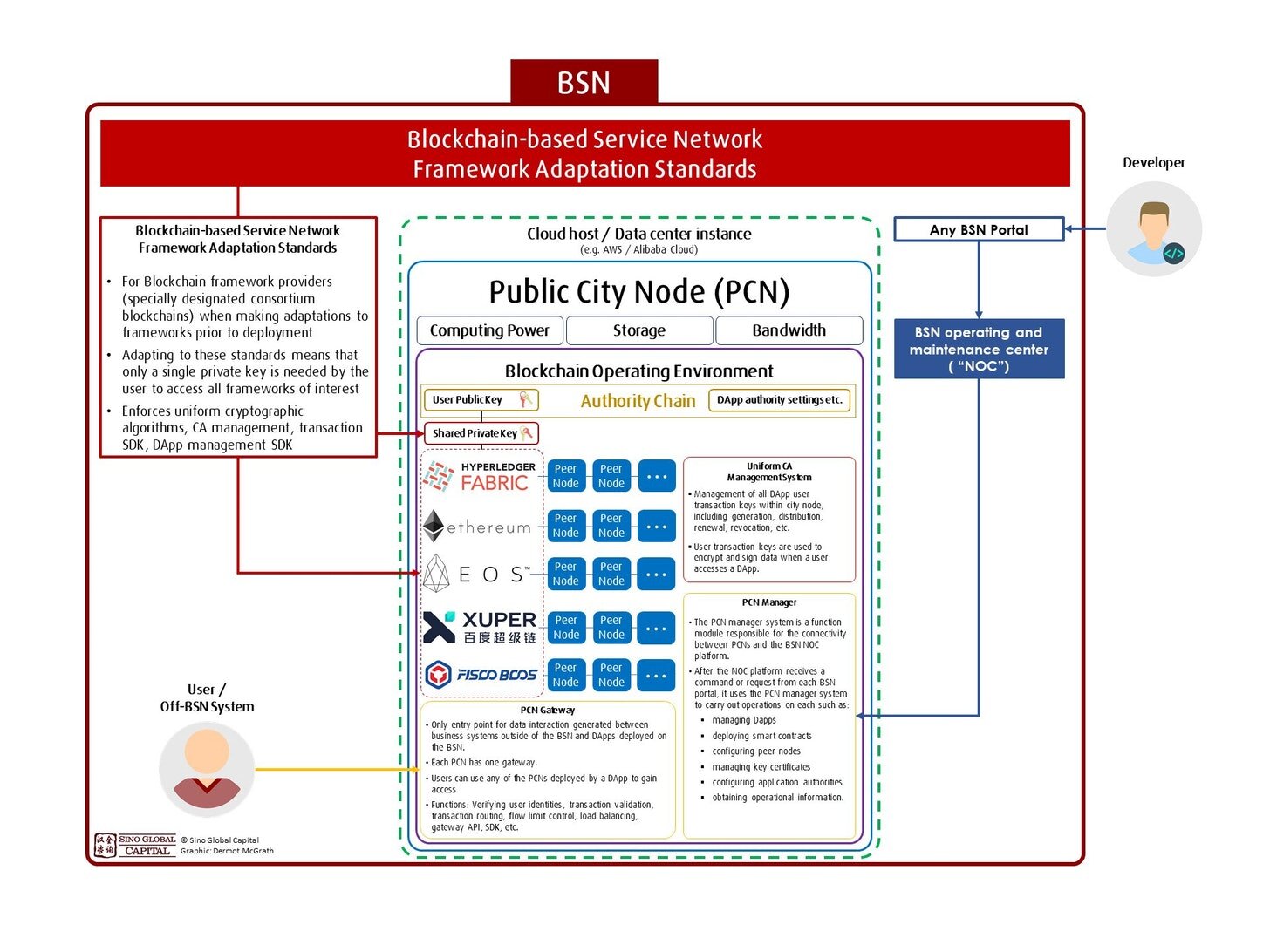

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

Footnote: Stripe worth $95 billion, closing $600 million investment

This week, we look at:

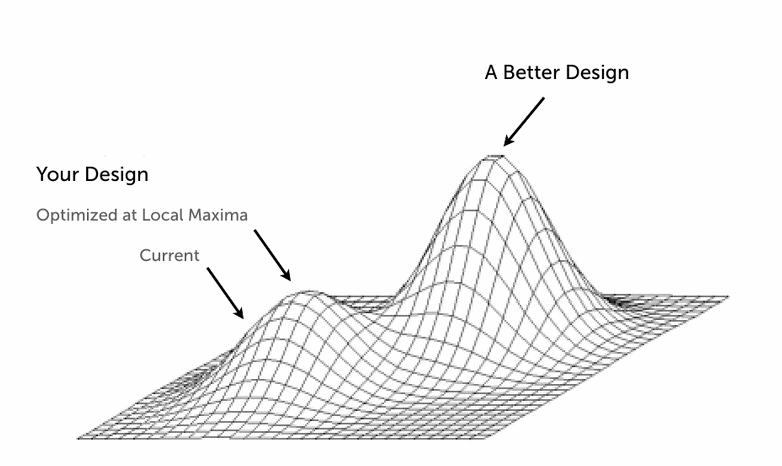

The nature of innovation hubs, and how close groups of actors within a particular environment can be massively, fundamentally productive. Take for example the 30 million years of the Cambrian explosion.

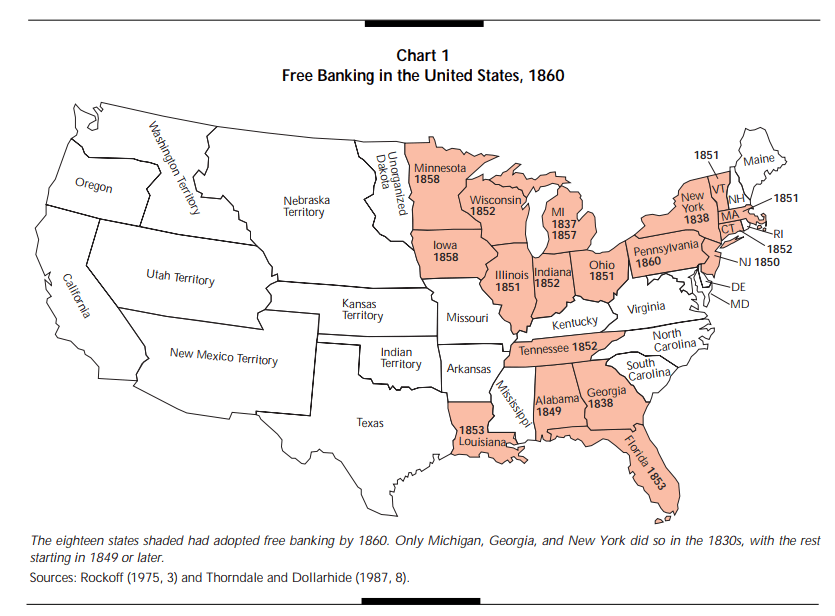

The difficulty of experimenting with banking and money frameworks, the limits of traditional econometrics, and an overview of “free banking” in the 1840s.

How evolutionary theory can help us think about selection of economic models, and the hyper-competition and hyper-mutation that we see in crypto. DeFi protocols, like BadgerDAO and ArcX among hundreds of others, are experiments in designing different monetary policies and banking regime experiments in real time.

We have never before had such acceleration in the design space of the economic machine, subject to evolutionary pressures, built by a closely-wound nexus of developers. It is a fortune for the curious.

Read MoreThis week, we look at:

How banks and financial advisors have failed to deliver on $1 trillion in capital appreciation for their clients over the last 12 years

The role of bank regulators in the United States, and the tensions between state and federal agencies

How the OCC is laying the groundwork for national banks to custody crypto assets, bank stablecoin reserves, run blockchain nodes, and use crypto payment networks

And instead of financial advisors or other CFAs guiding the retail market in good decision making, a newsfeed of *what’s popular* has driven Apple, Google, Tesla and the other John Galt hallucinations to the stratosphere. Don’t get us wrong. We love the robot as much as the next Fintech commentator. But it is clear to us that “the masses” are not being “advised”. And that the capital appreciation that matters — cementing the next trillion dollar networks for global future generations in work yet to emerge — is misunderstood and misrepresented by most financial professionals to their clients.

Read MoreThis week, we look at:

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless -- the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.

Read MoreThis week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

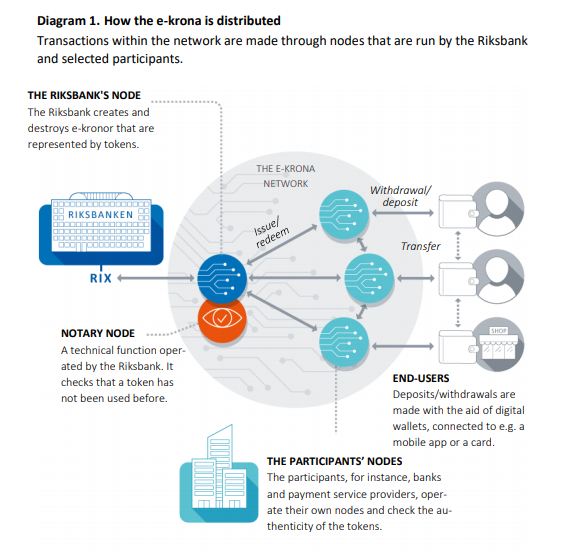

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

Read MoreThis week, we look at:

How the music industry needed The Pirate Bay and Napster

Why J.P.Morgan is paying $1B in fines for allegedly manipulating the precious metals market

Whether DeFi is flirting with self-dealing and veering towards apathy

Why QAnon and 8chan are a bad example for global governance

And how the European Commission’s proposed crypto-market rules are highly productive for blockchain-based capital markets infrastructure

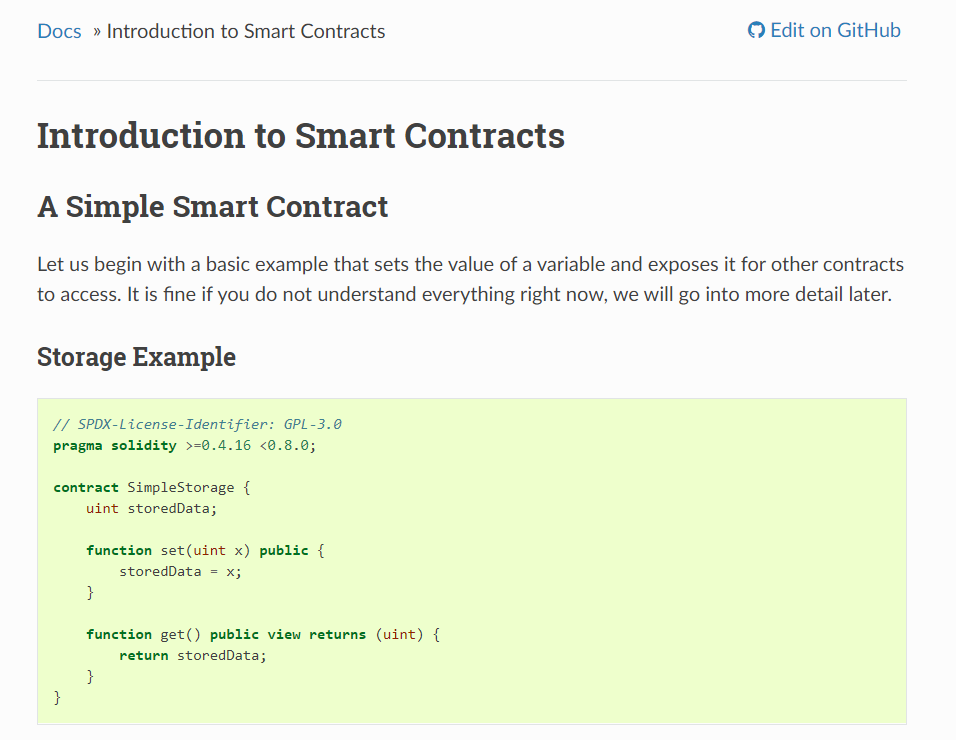

In this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.

Read MoreWhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

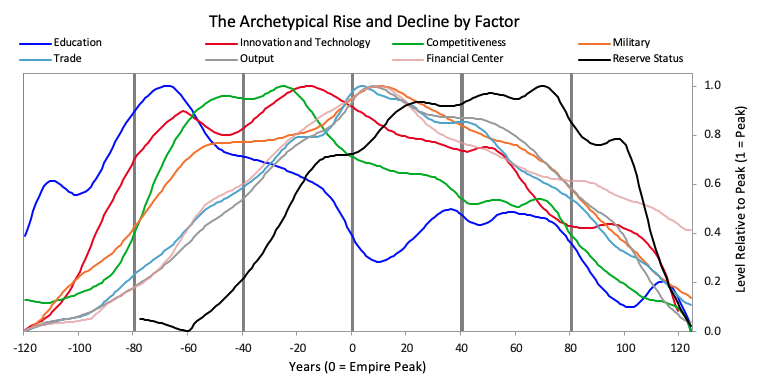

Read MoreThis week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

Read MoreA digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.

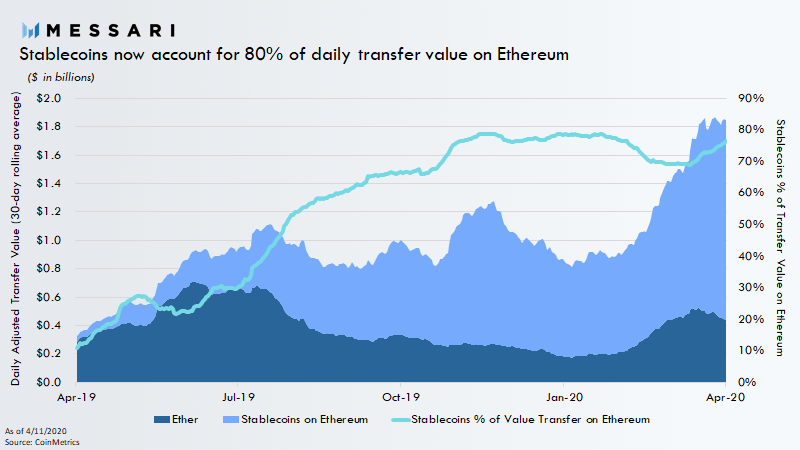

Read MoreThis week, we look at cash -- blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

Read More