Is Plaid cheap at $5.3 billion for $500 billion Visa? +20 key Fintech developments

Hi Fintech futurists --

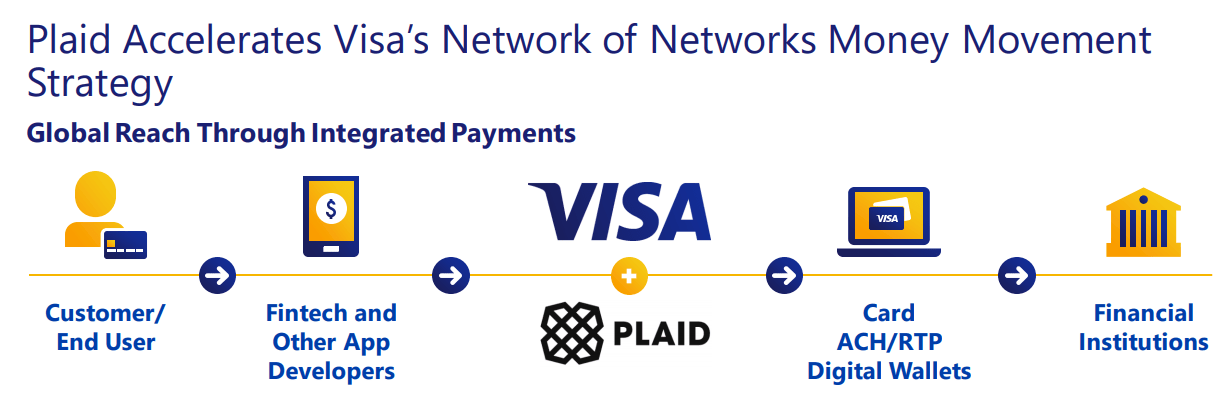

In the long take this week, I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

Long Take

Most of you have heard by now of the $5 billion monumental deal in Fintech between Visa and Plaid. Unlike the Fiserv and First Data deals last year, this is a much more forward-looking bet that requires a large incumbent (Visa) to buy into the story of one of the more expensive Fintech plays out there (Plaid). And yet, it is possible for this to soon become a real market comparable and reference transaction for years to come. Just as the Mint.com $170 million exit to Intuit became mana for entrepreneurs in 2009, a $5.3 billion exit will have similar repercussions for the decade to come. So let's get the basics out of the way.

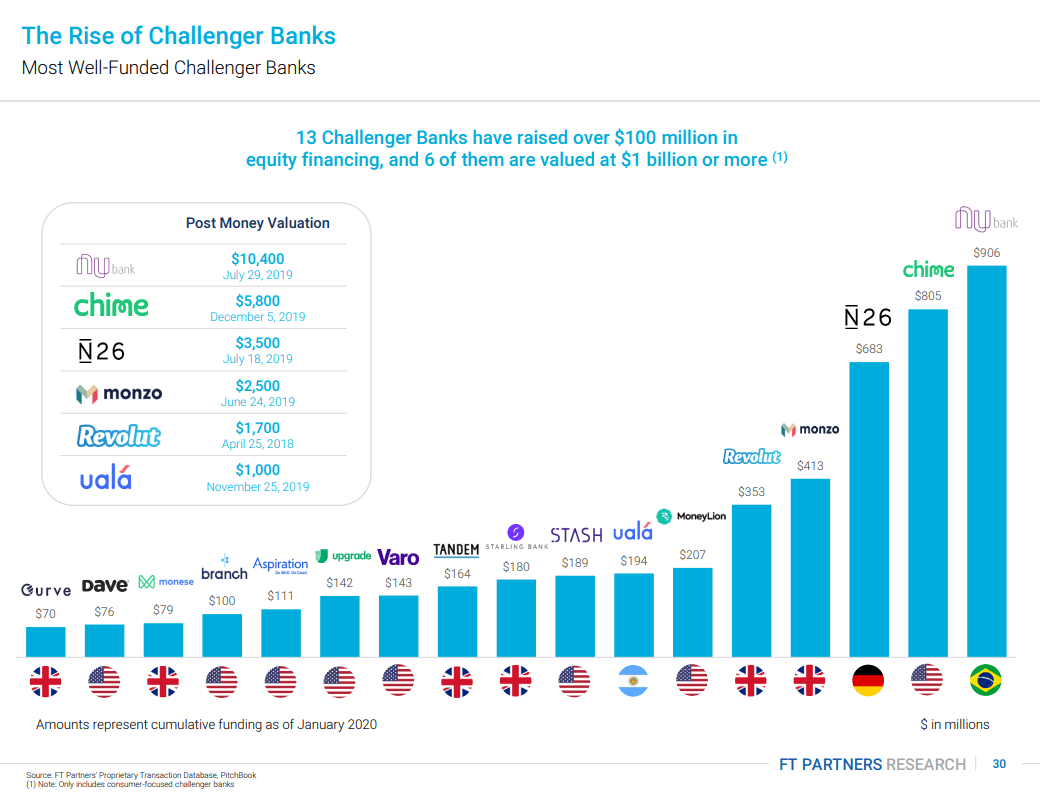

Plaid was founded in 2013, has revenue of $100 to 200 million, and about 400 employees. That's about $12 million of total enterprise value per employee! The firm also powers 200 million connected accounts -- give or take -- for a $25 value per account. I've written before about the $1,000 per-account values of the challenger banks, and the lead-generation value of companies like Credit Karma or Lending Tree. Just note the number of users and the valuations of the companies below, and you start to get a sense for what kind of user footprint a company like Plaid provides infrastructure (more in the FT Partners report).

Visa is looking to pay $5 billion in cash, plus $400 million in employee retention and performance in the form of RSUs. That is about 2x on their most recent private valuation (hats off to Mary Meeker). Given Uber, AirBnB, WeWork and other Silicon Valley unicorn bets are losing their shine, it is still somewhat surprising that Plaid's narrative has persuaded Visa. So what can we learn? Why is this company selling for 25-50x revenue, and not 5-10x as the Yodlee/Envestnet acquisition for essentially the same bet? What is the real product, and product strategy? Who are the customers? And most importantly, what motivates the acquirer?

Plaid provides use cases built on data aggregation, delivered through APIs. It sees nearly every bank and investment account in the US, and being the leader in the industry gives you 80% of that industry's value (i.e., it is good to be the best Justin Bieber, not the 53rd version of Justin Bieber). Plaid also used venture funding to design its revenue growth to look correct to an investor. It raised around $300 million, and spent it to generate several hundred millions of revenue back. Not to say that this is easy to do -- quite the opposite. But spending your war-chest on user acquisition in the correct way is pivotal. There are no years that are failing to perform on a revenue growth basis, which creates the impression that the team is executing on an exponential opporunity.

Second -- unlike Yodlee, Plaid leans into authentication and payments use cases. If you sign up for an account on a FinTech app, you likely link your bank accounts with Plaid. The company did not invent the tech, nor build the full stack originally — in fact they were 13 years late to the theme. Now, they also have personal finance management data, especially after acquiring Quovo. But the display of PFM information is absolutely secondary to the use-case of onboarding clients for Fintech customers. It's nice to be able to show your customers their networth statement, but your customers won't pay for this while costing you money. It's much better to use data aggregation to generate revenue through onboarding customers. This is a core takeaway. Attach yourself to the growth of others, and take a small piece.

Further, payments and lending are the most revenue-generating and optically venture-backable asset classes. It is easier to give people money than to take it from them. Thus lending can balloon to millions of retail customers lining up for free services -- with an unidentified default event several years out. It is harder to build a business where you get people to give you money to manage or bank. It is even harder to sell a venture story around a large institutional finance business, where you only have a few chunky customers that trust you.

Given that Plaid aggregates consumers across payments, lending, banking and wealth, it was able to ride the wave of FinTech venture finding as a derivative. You likely have heard that the biggest beneficiaries of venture capital investment generally are Google and Facebook, where most young start-ups go to spend advertising dollars. For Fintech, the same can be said for the onramps into growing disruptors. This is also why companies like ComplyAdvantage …